In the dynamic world of forex trading, understanding the fundamental forces driving currency movements is essential for long-term success. One such force, often overlooked by traders, is a country’s trade balance—the difference between its exports and imports. This critical economic indicator not only reflects a nation’s economic health but also serves as a leading indicator of potential currency trends.

When a country consistently exports more than it imports, it generates a trade surplus, which can increase demand for its currency. Conversely, a persistent trade deficit can weaken a currency over time as more foreign exchange is required to fund imports. These dynamics make the trade balance a vital tool for predicting long-term forex market trends.

In this article, we will explore how trade balance data influences currency movements, why it matters in forex markets, and how traders can incorporate this information into a robust trading strategy. Whether you’re a seasoned trader or new to fundamental analysis, this guide will provide actionable insights to help you leverage trade data to gain an edge in the forex market.

What is Trade Balance and Why Does It Matter?

Understanding Trade Balance

The trade balance is an economic indicator that measures the difference between a country’s exports and imports over a specific period.

- Exports refer to goods and services sold to other countries, generating revenue and foreign exchange for the exporting nation.

- Imports are goods and services purchased from abroad, which require the use of domestic currency to buy foreign currencies.

The trade balance can result in either:

- Trade Surplus: When a country exports more than it imports, it generates a surplus, reflecting strong international demand for its goods and services.

- Trade Deficit: When a country imports more than it exports, it runs a deficit, indicating reliance on foreign goods and services.

Why Trade Balance Matters in Forex Markets

Trade balance is a key component of a country’s current account, a broader measure of international economic transactions. It has a direct influence on the supply and demand dynamics of a currency in the global market.

- Currency Demand and Trade Surpluses

- A country with a trade surplus experiences increased demand for its currency.

- Exporters receive foreign currency payments but must convert them into the domestic currency, boosting its value.

- For example, Germany’s consistent trade surplus contributes to the euro’s relative strength.

- Currency Supply and Trade Deficits

- A trade deficit can weaken a currency as it increases the need for foreign currencies to pay for imports.

- Countries with large deficits may see downward pressure on their currency over time, as seen with the U.S. dollar in certain periods despite its reserve currency status.

- Economic Health Indicator

- Trade balance reflects a nation’s competitiveness in global markets.

- A growing surplus may indicate robust industrial output, strong demand for exports, and a healthy economy, while a rising deficit may signal economic challenges or dependency on foreign goods.

Impact on Forex Trading

For forex traders, the trade balance is a fundamental signal of potential long-term currency trends:

- A widening trade surplus suggests a bullish outlook for the currency.

- A growing trade deficit may indicate a bearish trend.

While trade balance alone doesn’t dictate currency movements, it provides crucial context when combined with other macroeconomic indicators like GDP growth, interest rates, and inflation. By analyzing trade balance trends, traders can better understand the fundamental forces shaping forex markets and position themselves accordingly.

Trade Balance as a Leading Indicator for Currency Movements

How Trade Balance Influences Currency Movements

The trade balance is a reflection of the flow of goods, services, and capital between a country and the rest of the world. These flows have a direct impact on the supply and demand for currencies, making the trade balance a valuable tool for predicting long-term trends in the forex market.

- Trade Surplus and Currency Appreciation

- When a country exports more than it imports, it creates a trade surplus.

- Exporters, receiving payments in foreign currencies, must convert these earnings into the domestic currency, increasing its demand and pushing its value higher.

- For example, Japan’s trade surpluses have historically supported a strong yen, particularly during periods of global economic growth when its exports are in high demand.

- Trade Deficit and Currency Depreciation

- A trade deficit occurs when imports exceed exports.

- To pay for imports, domestic buyers must exchange their currency for foreign currencies, increasing supply and exerting downward pressure on the domestic currency’s value.

- For instance, countries with persistent trade deficits, like the United States, often experience periods of currency weakness when other fundamental factors do not counterbalance the deficit.

Why the Trade Balance is a Leading Indicator

While trade data is released after the fact, its trends often foreshadow longer-term currency movements due to the following mechanisms:

- Sustained Trends in Trade Balance

- Persistent trade surpluses or deficits create prolonged currency pressures.

- A country with a growing surplus is likely to see a stronger currency over time as the surplus reflects economic competitiveness and steady inflows of foreign capital.

- Conversely, a widening deficit suggests underlying economic vulnerabilities that can lead to currency weakness.

- Correlation with Capital Flows

- Countries with trade surpluses often experience increased foreign investment as their economic health inspires confidence.

- These capital inflows amplify the demand for the domestic currency, reinforcing the upward trend driven by trade dynamics.

- Predicting Central Bank Behavior

- Central banks closely monitor trade balances to assess economic stability.

- A persistent trade surplus may lead to tighter monetary policies to control inflation, further supporting the currency.

- Conversely, trade deficits may prompt central banks to adopt looser policies, contributing to depreciation.

Historical Examples of Trade Balance Impact

- China’s Trade Surplus and the Renminbi

- Over the past decades, China’s substantial trade surplus has supported the renminbi’s appreciation. Despite periods of government intervention, the surplus-driven demand for the currency has been a significant factor in its strength.

- The U.S. Trade Deficit and the Dollar

- The U.S. has maintained a consistent trade deficit, which theoretically pressures the dollar lower. However, the dollar’s status as the world’s reserve currency often mitigates these effects. This highlights the importance of considering trade balance in conjunction with other factors.

Time Lag in Trade Balance Effects

It’s essential to note that the impact of trade balance on currency movements often occurs with a time lag:

- The trade balance influences structural currency trends rather than short-term fluctuations.

- Factors such as global sentiment, monetary policy, or geopolitical events can temporarily overshadow the trade balance’s effects.

Analyzing Trade Balance Data

To effectively use trade balance data in forex trading, traders must understand where to find this information, how to interpret it, and what key metrics to prioritize. A systematic approach to analyzing trade balance trends can reveal valuable insights into a currency’s long-term prospects.

1. Sources of Trade Balance Data

Reliable data is essential for accurate analysis. The following are trusted sources for obtaining trade balance figures:

- National Statistics Agencies: Most countries release monthly or quarterly trade reports (e.g., the U.S. Census Bureau, Eurostat).

- Central Banks: Central banks often provide trade data in their economic bulletins or monetary policy reports.

- International Organizations: Institutions like the International Monetary Fund (IMF) and World Trade Organization (WTO) compile global trade data.

- Economic Calendars: Forex platforms and financial news websites, such as Investing.com or TradingEconomics, provide regularly updated trade balance release schedules.

2. Frequency of Data Releases

The trade data is typically released:

- Monthly: Provides regular updates, useful for spotting short-term trends or volatility.

- Quarterly: Offers a broader perspective, reducing noise from one-off events like seasonal demand changes.

- Annual Reports: Ideal for identifying long-term structural trends in a country’s trade dynamics.

3. Key Metrics to Analyze

When examining trade balance data, focus on these critical aspects:

- Absolute Values of Exports and Imports

- Track whether exports are increasing or imports are decreasing to understand which side of the balance is driving changes.

- Trade Balance as a Percentage of GDP

- Comparing trade balance to GDP offers a clearer picture of its economic significance. A surplus or deficit that constitutes a large percentage of GDP is more impactful on currency movements.

- Year-on-Year Changes

- Look at annual trends to determine whether a country’s trade position is improving or deteriorating. Consistent improvements suggest strengthening fundamentals, while a worsening balance can indicate vulnerabilities.

- Bilateral Trade Balances

- Focus on trade balances with key trading partners. For example, the U.S.-China trade deficit has long-term implications for the USD/CNY pair.

- Seasonal Adjustments

- Trade flows can be seasonal (e.g., increased imports during holidays). Adjusted data can provide a clearer view of underlying trends.

4. Identifying Trends

Rather than focusing on a single trade report, look for sustained patterns:

- Widening Surplus: Indicates growing export strength, often bullish for the domestic currency.

- Expanding Deficit: Suggests rising import dependency, potentially bearish for the domestic currency.

- Reversals: Shifts from surplus to deficit (or vice versa) may signal significant changes in economic conditions or competitiveness.

5. Trade Balance in Context

While the trade balance data is valuable, it should be analyzed alongside other macroeconomic indicators:

- Exchange Rate Trends: A strong currency may reduce export competitiveness, impacting the trade balance.

- Commodity Prices: For commodity-dependent nations, global price fluctuations significantly influence trade balances.

- Economic Growth: A booming economy may lead to higher imports, temporarily widening a deficit without indicating weakness.

6. Tools for Trade Balance Analysis

- Spreadsheets: Organize and visualize data trends over time. Use tools like Excel to calculate percentage changes and compare trade balances to other indicators.

- Economic Models: Combine trade balance data with other metrics (e.g., GDP, inflation) to predict currency movements.

- Charting Tools: Visualize trade balance trends using line charts or bar graphs to identify patterns quickly.

By analyzing the data with a structured approach, traders can uncover valuable insights into a country’s economic health and its currency’s potential direction. This foundational knowledge is essential for making informed, long-term forex trading decisions.

Incorporating Trade Data into a Forex Trading Strategy

Trade data is a powerful tool for developing a long-term forex trading strategy. When used systematically, it can help traders identify currency trends, choose the right currency pairs, and refine their market timing. Below is a step-by-step guide on how to integrate trade data into a trading strategy effectively.

1. Establishing the Fundamental Bias

The first step in leveraging trade balance data is to determine the fundamental directional bias for a currency:

- Trade Surplus = Bullish Bias: A growing trade surplus indicates strong demand for a country’s exports, leading to increased demand for its currency.

- Example: If Eurozone trade surpluses expand, the euro (EUR) may strengthen against other currencies.

- Trade Deficit = Bearish Bias: A widening trade deficit reflects greater reliance on imports, which increases the supply of the domestic currency in the forex market.

- Example: If the U.S. trade deficit grows significantly, the U.S. dollar (USD) may weaken relative to other currencies.

Focus on consistent trends in trade data rather than single data points to establish a reliable bias.

2. Pair Selection

Maximize the impact of trade balance analysis by selecting currency pairs with contrasting trade dynamics:

- Trade Surplus vs. Trade Deficit: Pair a surplus currency with a deficit currency for stronger directional trends.

- Example: If Japan has a growing trade surplus while the U.K. faces a widening deficit, the JPY/GBP pair might present a bearish opportunity for the pound.

- Trade Balance Trends in Similar Economies: Compare countries with similar economic structures to identify the stronger currency based on trade performance.

3. Combining Trade Data with Other Indicators

The data alone doesn’t capture the full picture. Use it alongside other fundamental indicators to strengthen your analysis:

- GDP Growth:

- A growing trade surplus coupled with strong GDP growth suggests a healthy economy, reinforcing a bullish currency bias.

- Conversely, a deficit combined with weak GDP growth signals potential currency weakness.

- Interest Rate Differentials:

- A trade surplus currency with high interest rates attracts more capital inflows, amplifying its strength.

- For example, Australia’s trade surplus, paired with higher rates than many developed economies, supports the AUD’s long-term strength.

- Stock Market Returns:

- Strong equity markets in surplus countries attract foreign investors, further boosting demand for the domestic currency.

4. Timing and Execution

Use trade balance data to time your entries and exits more effectively:

- Data Release Events: Trade balance reports often cause short-term volatility, presenting opportunities to enter trades aligned with long-term trends.

- Example: A significantly higher-than-expected trade surplus report may confirm a bullish trend for the currency.

- Trend Confirmation: Wait for other fundamental or technical indicators to align with the trade balance bias before entering a position.

5. Position Sizing and Risk Management

- Long-Term Trades: Trade balance trends often play out over months or even years. Consider holding positions longer to capitalize on sustained trends.

- Stop-Loss Placement: Protect against short-term volatility by placing stops at levels that account for temporary deviations from the long-term trend.

- Diversification: Avoid overexposure to a single currency by diversifying your trades across multiple pairs with favorable trade balance trends.

6. Monitoring and Adjusting Positions

Trade dynamics can change over time due to shifting economic conditions, policy changes, or external shocks:

- Regularly review updated trade data to confirm that your fundamental bias remains valid.

- Be prepared to exit or reverse positions if trade balance trends show signs of significant reversal.

Example Strategy Workflow

- Analyze Trade Balance Data: Identify countries with improving surpluses or deficits.

- Select Currency Pairs: Match surplus currencies with deficit currencies for clear directional bias.

- Combine with Other Indicators: Validate the bias using GDP growth, interest rates, and other fundamentals.

- Enter the Market: Time entries around trade balance reports or technical levels that align with the long-term trend.

- Monitor Trends: Stay updated on trade balance releases to ensure your positions remain in line with evolving data.

By incorporating trade balance data into your forex strategy, you can gain a deeper understanding of long-term currency trends. When paired with other macroeconomic indicators and sound risk management, trade balance analysis becomes a cornerstone of a robust, data-driven trading approach.

Case Study Example: Trade Balance and Currency Trends

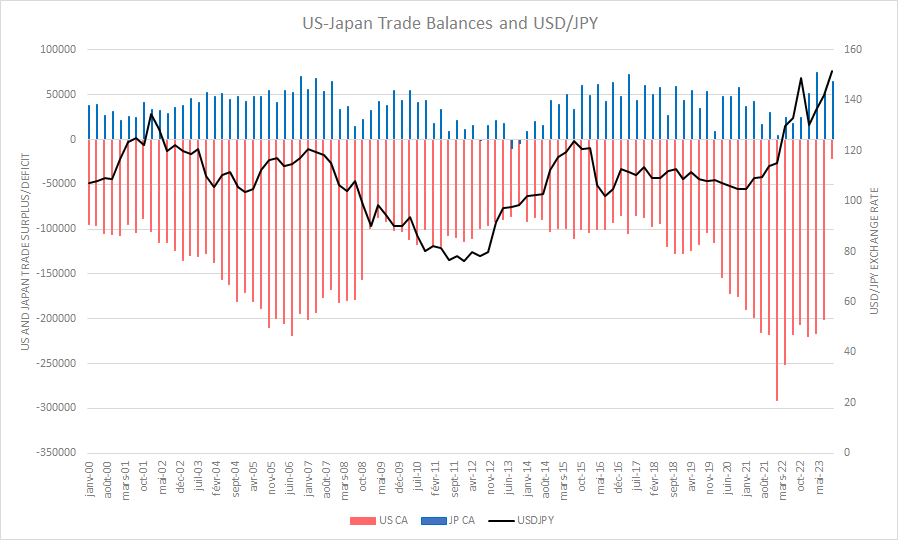

Analyzing USD/JPY Using Trade Balance Data

This case study examines the relationship between the trade balances of the United States and Japan and their impact on the USD/JPY currency pair. The goal is to demonstrate how traders can use trade balance data to identify and act on long-term currency trends.

1. Background and Trade Balance Overview

- Japan’s Trade Balance

- Historically, Japan has maintained a trade surplus due to its strong export sector, particularly in automobiles, electronics, and industrial machinery.

- A trade surplus supports the yen (JPY) because exporters convert foreign earnings into JPY, increasing its demand.

- United States Trade Balance

- The U.S. has consistently run a trade deficit, driven by high imports of consumer goods, energy, and technology products.

- A trade deficit exerts downward pressure on the dollar (USD) as more USD is exchanged for foreign currencies to pay for imports.

2. Identifying Trends

- 2015-2020:

- Japan’s trade surplus narrowed during this period due to rising energy import costs following the Fukushima disaster, which weakened the yen.

- Meanwhile, the U.S. trade deficit widened, but the dollar remained relatively strong, supported by higher interest rates.

- 2020-2023:

- Japan’s trade balance saw a resurgence as export demand recovered, particularly for high-tech components and electric vehicles.

- Simultaneously, the U.S. trade deficit deepened due to pandemic-related supply chain disruptions and increased imports, weakening the USD.

3. Applying the Data to USD/JPY

- Fundamental Bias

- From 2020 onward, Japan’s improving trade surplus suggested a bullish bias for the yen (JPY).

- The U.S.’s widening trade deficit pointed to a bearish outlook for the dollar (USD).

- Currency Pair Analysis

- Combining the two trade dynamics created a clear directional bias: USD/JPY was likely to trend lower as the yen strengthened against the dollar.

4. Combining with Other Indicators

- Interest Rate Differentials

- In 2022, the Bank of Japan maintained ultra-low interest rates, temporarily weakening the yen. However, improving trade data signaled potential long-term strength, especially if monetary policy shifted.

- GDP Growth

- Japan’s steady recovery from the pandemic, supported by strong exports, reinforced the yen’s outlook.

- Technical Analysis

- USD/JPY showed key resistance levels near 150, aligning with the fundamental expectation of a reversal.

5. Trade Execution

- Entry Point

- A trader could enter a short position on USD/JPY when Japan’s trade surplus started expanding in late-2023, confirmed by consecutive months of rising export figures.

- Position Management

- Hold the position for several months to capitalize on the sustained trend.

- Set a stop-loss above key resistance levels (e.g., 155) to protect against short-term volatility.

- Exit Point

- Exit the trade when Japan’s trade balance stabilizes or if U.S. trade deficit data shows unexpected improvement.

6. Outcome

- By mid-2024, the yen strengthened significantly against the dollar, with USD/JPY falling from 150 to 130.

- Traders who incorporated trade balance data into their strategy could have capitalized on this 20-point move while avoiding unnecessary risk during short-term fluctuations.

Key Takeaways

- Trade balance data provides valuable insights into long-term currency trends.

- Combining trade data with other fundamentals and technical analysis improves accuracy.

- Timing entries and exits around significant shifts in trade balance trends enhances profitability.

This case study highlights how a structured approach to analyzing trade balance data can help traders make informed, profitable decisions in the forex market.

Challenges and Limitations

While trade balance data is a valuable tool for predicting long-term forex trends, it is not without challenges and limitations. Understanding these can help traders use the data more effectively and avoid common pitfalls.

1. Lagging Nature of Data

- Delayed Release: Trade balance figures are typically released weeks after the end of the reporting period, making them historical rather than real-time data.

- Impact: The forex market may have already priced in the effects of the reported trade balance, reducing its immediate value for short-term trades.

- Solution: Use trade balance trends for long-term analysis rather than short-term trading.

2. Influence of External Factors

- Exchange Rate Volatility:

- Trade balance effects can be overshadowed by other market-moving events, such as central bank decisions, geopolitical crises, or unexpected economic shocks.

- Example: A widening trade surplus might not strengthen a currency if the central bank adopts a dovish monetary policy simultaneously.

- Solution: Combine trade balance data with other fundamental and technical indicators to create a holistic trading strategy.

- Global Economic Trends:

- Commodity price fluctuations, supply chain disruptions, or changes in global demand can distort the trade balance’s impact on currencies.

3. Complexity of Trade Relationships

- Bilateral vs. Multilateral Trade:

- Focusing solely on a country’s overall trade balance may overlook important nuances, such as trade relationships with key partners.

- Example: A trade deficit with one country (e.g., China) may be offset by surpluses with others, diluting the overall impact.

- Solution: Analyze bilateral trade balances alongside aggregate data to understand the specific drivers of currency movements.

- Currency Manipulation:

- Some countries actively intervene in currency markets to maintain trade competitiveness, which can distort the natural relationship between trade balance and currency trends.

4. Data Interpretation Challenges

- Seasonal Variations:

- Trade balances often exhibit seasonal patterns, such as higher imports during holidays or harvest-related export spikes. Misinterpreting these as structural trends can lead to inaccurate conclusions.

- Solution: Use seasonally adjusted trade balance data for more reliable analysis.

- One-Off Events:

- Natural disasters, political upheavals, or major policy changes can cause temporary distortions in trade data, making it harder to discern long-term trends.

- Example: Japan’s trade balance was heavily impacted by increased energy imports after the Fukushima disaster.

5. Limited Predictive Power for Short-Term Moves

- Structural Indicator:

- Trade balance trends are more suited for identifying long-term currency movements rather than short-term price action.

- Impact: Traders focusing on intraday or weekly trading may find trade data less actionable.

- Solution: Pair trade balance analysis with short-term technical indicators for intraday trades.

6. Overemphasis on Trade Balance Alone

- Not a Standalone Indicator:

- Relying solely on trade balance data can lead to oversimplified conclusions, as currency movements are influenced by a myriad of factors, including interest rates, inflation, and capital flows.

- Solution: Treat trade balance data as one component of a broader fundamental analysis framework.

7. Political and Policy Risks

- Trade Policies:

- Tariffs, trade agreements, and sanctions can rapidly alter trade dynamics, making historical trends less relevant.

- Example: The U.S.-China trade war disrupted trade balances and caused unexpected currency volatility.

- Solution: Stay informed about geopolitical developments and their potential impact on trade data.

Conclusion

Trade balance data is a vital tool for forex traders seeking to predict long-term currency trends. As a key indicator of a nation’s economic health and global competitiveness, it provides insight into the supply and demand dynamics that influence currency movements. By analyzing trade surpluses and deficits, traders can establish a fundamental bias, select optimal currency pairs, and refine their strategies to align with prevailing market trends.

However, like any single economic measure, trade balance data is not infallible. Its lagging nature, susceptibility to external influences, and limitations in short-term predictive power mean it should be used alongside other indicators such as GDP growth, interest rates, and technical analysis. Additionally, understanding the broader geopolitical and economic context is essential to avoid misinterpreting trade data.

Incorporating trade balance analysis into a forex trading strategy requires a systematic approach, careful data interpretation, and ongoing monitoring of evolving trends. When used effectively, it can provide a robust foundation for making informed trading decisions, enabling traders to capitalize on the long-term opportunities that arise in the ever-changing forex market.