The forex market is one of the most dynamic financial markets in the world that operates 24 hours a day, five days a week. But this constant activity isn’t random — it’s driven by major financial centers opening and closing across different time zones.

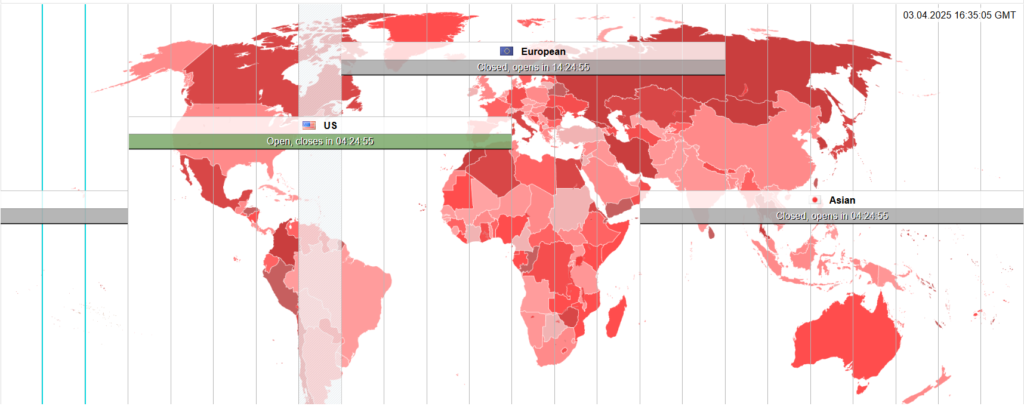

These trading periods are known as market sessions, and they are key to understanding forex price movement, liquidity, and volatility. The four major sessions — London, New York, Tokyo, and Sydney — each play a distinct role in shaping the forex landscape.

In this lesson, we’ll break down each session, show you when and how to trade them, and explain why session overlaps can be goldmines for savvy traders.

What Are Forex Market Sessions?

Forex is a decentralized market, meaning there’s no central exchange. Instead, trading happens electronically over-the-counter (OTC), and as one major financial center closes, another opens.

The forex market is typically divided into four main trading sessions:

- Sydney (Australia)

- Tokyo (Asia)

- London (Europe)

- New York (North America)

Each session has its own rhythm, with specific hours, dominant currency pairs, and levels of activity.

London Session: The Powerhouse of Forex

The London session is the busiest and most liquid session of all. It overlaps with both the Asian and U.S. markets, which is why many traders consider it the heart of the forex trading day.

Timing:

- Summer: 7:00 AM – 4:00 PM GMT

- Winter: 8:00 AM – 5:00 PM GMT

Liquidity & Volatility:

This session contributes to around 35–43% of global forex transactions, with high trading volume due to the presence of large institutions and banks in financial hubs like London, Frankfurt, and Zurich.

Expect increased volatility and tighter spreads — ideal conditions for day traders and scalpers.

Best Currency Pairs:

- EUR/USD

- GBP/USD

- USD/CHF

Trading Tips:

Focus on the London–New York overlap (1 PM – 5 PM GMT) for the most action. Breakout and trend-following strategies work well due to the high volatility.

New York Session: The Dollar-Driven Giant

As London winds down, New York steps in — and since the U.S. dollar is involved in roughly 85% of forex trades, this session carries a heavy punch.

Timing:

- Summer: 1:00 PM – 10:00 PM GMT

- Winter: 8:00 AM – 5:00 PM EST

Liquidity & Volatility:

Early hours see high liquidity thanks to the London overlap, but things slow down after Europe closes. U.S. economic reports like Non-Farm Payrolls, CPI, and Fed rate decisions drive major moves.

Best Currency Pairs:

- EUR/USD

- GBP/USD

- USD/JPY

Trading Tips:

Trade during the first half of the session (especially 1 PM – 4 PM GMT) for maximum volatility. Be cautious post-lunch hours in the U.S. as the market tends to quiet down.

Tokyo Session: The Quiet Strategist

The Tokyo session kicks off the Asian trading day. While generally calmer than London or New York, it offers strategic opportunities — especially for traders who prefer range-bound conditions.

Timing:

- Summer: 12:00 AM – 9:00 AM GMT

- Winter: slight variation based on DST

Liquidity & Volatility:

Liquidity is lower and moves are more contained. It’s a great session for identifying support/resistance levels and for using mean-reversion or range-trading strategies.

Best Currency Pairs:

- USD/JPY

- AUD/JPY

- EUR/JPY

Trading Tips:

Focus on JPY crosses, and use tighter stop-losses. Watch for momentum building as the London session opens and Asian liquidity starts to fade.

Sydney Session: The Market’s Opening Bell

The Sydney session officially opens the forex trading week on Monday morning in Australia. It’s the calmest session but still vital for understanding early market sentiment.

Timing:

- Summer: 10:00 PM – 7:00 AM GMT

- Winter: timing shifts slightly

Liquidity & Volatility:

Liquidity is thin, making it harder to get tight spreads. However, this session is useful for preparing trades or monitoring how markets react to weekend news.

Best Currency Pairs:

- AUD/USD

- NZD/USD

- AUD/JPY

Trading Tips:

Great for long-term analysis and placing swing trades. Use this session to set pending orders or watch price reactions before the Tokyo session kicks in.

Forex Session Overlaps: When the Market Comes Alive

Some of the most volatile and liquid periods occur during overlaps between major sessions.

London–New York Overlap (1 PM – 5 PM GMT):

- This is the most active time in the forex market.

- Perfect for short-term strategies like scalping and breakout trading.

- Major news from the U.S. and Eurozone often causes big moves.

Tokyo–London Overlap (7 AM – 8 AM GMT):

- A brief but meaningful window where Asian traders close positions and European traders step in.

- Good time to trade JPY pairs and observe potential reversals.

Choosing the Right Session for Your Strategy

Every trader has a different style and schedule. Choosing the session that suits your personality and goals can improve your consistency.

| Strategy Type | Best Session |

|---|---|

| Scalping/Day Trading | London, New York |

| Range Trading | Tokyo, Sydney |

| News Trading | New York |

| Swing/Position Trading | Any (depending on entry setup) |

Consider your time zone and availability, and always monitor session-specific volatility and liquidity to avoid being caught off guard.

Conclusion

The forex market is a 24-hour opportunity machine — but not all hours are created equal. Each session offers different levels of liquidity, volatility, and trading potential. By understanding the characteristics of the London, New York, Tokyo, and Sydney sessions — and the overlaps between them — you’ll be better equipped to:

- Time your entries and exits

- Choose the right pairs

- Match your strategy with the market’s behavior

Whether you’re a night owl, an early bird, or a mid-day momentum hunter, there’s a forex session out there that fits your rhythm. Master the clock, and you’ll start trading smarter.