In the ever-evolving world of forex trading, few indicators hold as much sway over currency values as interest rates. Whether central banks are raising or slashing them, interest rate decisions ripple across the currency markets like a stone thrown into a still pond.

But why do these shifts wield such influence? This lesson will explore the economic mechanisms behind rate hikes and cuts—and why every forex trader should pay close attention.

Why Interest Rates Matter in Forex

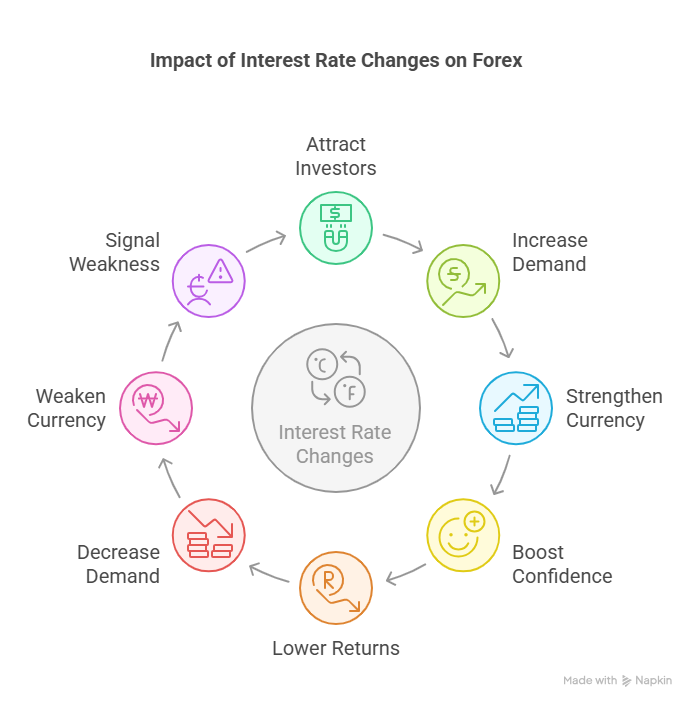

Interest rates act as a magnet for global capital. When a central bank alters its benchmark rate, it changes the risk-reward landscape for investors worldwide. A higher rate often means better returns on investments denominated in that currency, while a cut typically indicates softer returns and potential economic concern.

But the implications run deeper than just yield. Interest rates are tied to inflation, capital flows, consumer confidence, and even geopolitical sentiment. Understanding their role is crucial for any trader seeking to forecast market direction accurately.

How Interest Rate Hikes Move the Forex Market

1. Attractiveness to Investors

When a central bank hikes interest rates, it boosts returns on savings accounts, government bonds, and other fixed-income investments. This shift draws in foreign capital looking for higher yields. In essence, the currency becomes more rewarding to hold, increasing demand and pushing its value higher.

For instance, if the Federal Reserve raises interest rates while the European Central Bank stands pat, investors may shift capital from euros to dollars—strengthening the USD against the EUR.

2. Reduced Supply and Increased Demand

As foreign investors purchase assets denominated in the higher-yielding currency, they first need to acquire that currency. This increase in demand tightens supply in forex markets, adding upward pressure to the currency’s price.

3. Inflation Control and Economic Confidence

Rate hikes are often interpreted as a sign that the central bank is confident in the strength of the economy and is proactively working to manage inflation. This fosters optimism among investors and can lead to a sustained appreciation of the currency.

4. Market Sentiment and Expectations

Perhaps most importantly, forex markets are driven not only by actual rate changes but by expectations. If traders anticipate a hike, the currency may appreciate before the announcement. On the other hand, a surprise hike—one not priced into the market—can cause dramatic intraday moves as traders scramble to reposition.

How Interest Rate Cuts Move the Forex Market

1. Lower Returns and Capital Outflows

Cutting interest rates lowers the yield on investments denominated in that currency, making them less attractive to international investors. This shift can lead to capital outflows as investors seek better returns elsewhere, weakening demand for the currency and causing it to depreciate.

For example, if the Reserve Bank of New Zealand unexpectedly slashes rates, the NZD may plummet as global capital seeks higher returns in other markets.

2. Increased Money Supply and Liquidity

Lower interest rates encourage borrowing and increase liquidity in the economy. While this can stimulate economic growth, it also expands the supply of the currency. An increased money supply typically reduces the value of the currency, especially if it’s not matched by growth in economic output.

3. Signaling Economic Weakness

Rate cuts often signal that a central bank is concerned about economic stagnation or deflation. This can undermine investor confidence, leading to reduced demand for the currency and further weakening its value.

4. Volatility from Market Reactions

As with hikes, market reactions to rate cuts are heavily driven by expectations. A surprise cut or dovish forward guidance can cause a wave of volatility, with traders quickly exiting long positions or shorting the currency.

Other Key Factors that Shape the Impact of Rate Decisions

1. Interest Rate Differentials

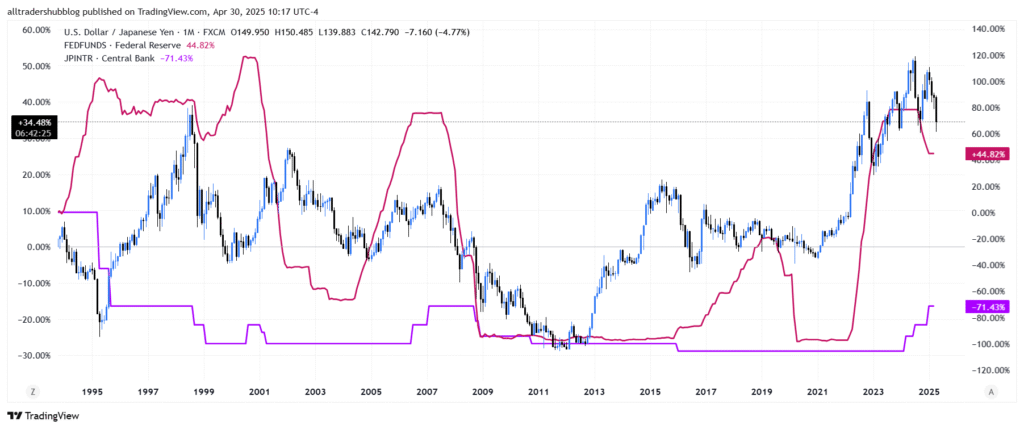

Forex is inherently a relative market—one currency is always traded against another. What matters most is the difference in interest rates between two countries. If the U.S. raises rates while Japan holds steady, USD/JPY is likely to rise as capital flows toward the higher-yielding U.S. dollar.

2. Inflation Expectations

Interest rate changes are often responses to inflation pressures. High inflation may trigger hikes, which support the currency, while low or falling inflation may lead to cuts and a weaker currency. Traders who anticipate how inflation trends influence future rate decisions can position themselves ahead of the market.

3. Broader Economic Fundamentals

While rates are critical, they don’t operate in isolation. GDP growth, employment data, trade balances, and fiscal policy all shape how markets interpret rate decisions. A rate hike amid economic weakness may not strengthen a currency if traders believe it’s a policy mistake.

4. Market Sentiment and Political Stability

Finally, the reaction to rate decisions is often filtered through the lens of investor sentiment and political context. A rate hike in a politically unstable country may not attract capital if investors fear currency controls or economic mismanagement. Central bank credibility plays a massive role in how rate changes are received.

Examples of Interest Rate Impact in Forex

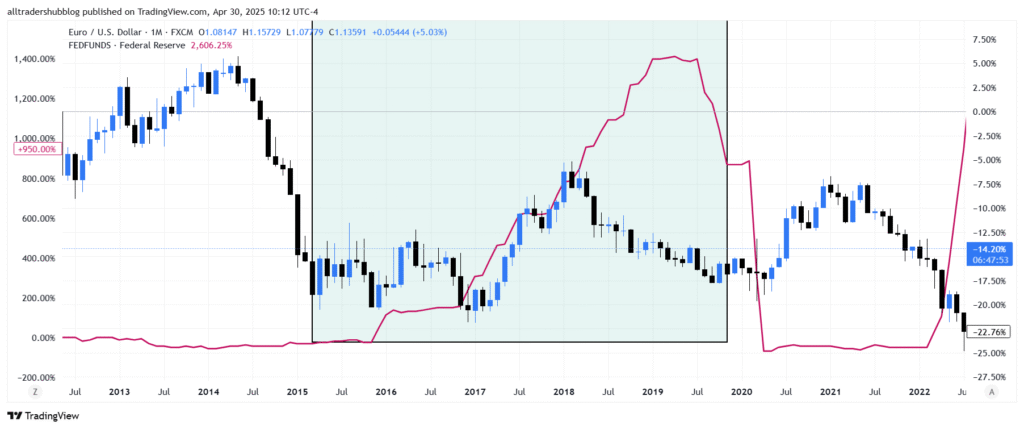

1. EUR/USD and Divergent Monetary Policies

The euro and U.S. dollar are frequently influenced by opposing interest rate policies. If the Federal Reserve hikes rates while the European Central Bank cuts or holds, the USD tends to strengthen sharply against the EUR. This was especially evident during the 2015–2016 divergence, when U.S. rate hikes sent the dollar soaring.

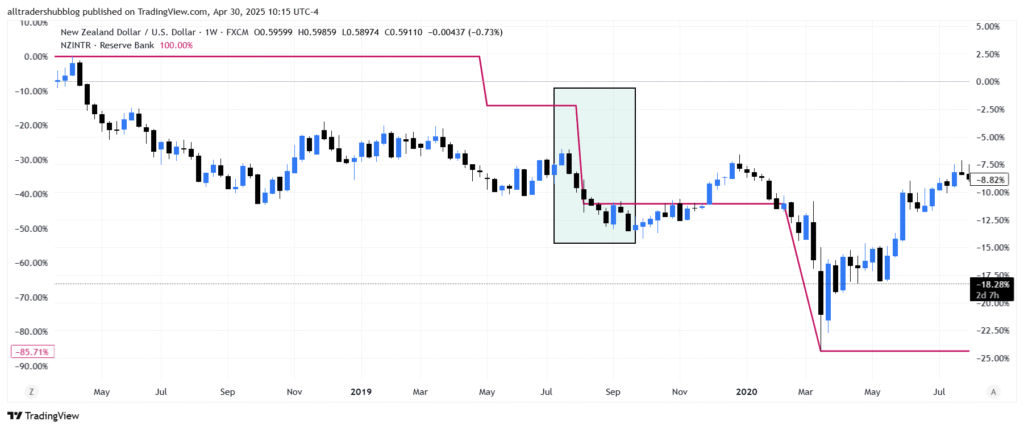

2. NZD/USD and Surprise Rate Cuts

In August 2019, the Reserve Bank of New Zealand shocked markets with a 50-basis-point rate cut—larger than expected. The NZD/USD dropped over 1% in a single day as traders reacted to the unexpected dovish stance. This highlights how surprises—not just decisions—drive volatility.

3. USD/JPY and BoJ Rate Shifts

The Japanese yen often behaves as a “safe haven,” but it also responds to interest rate differentials. If the Bank of Japan raises rates while the Fed pauses or cuts, the yen tends to appreciate, reflecting a narrowing yield gap and increased capital attraction to Japan.

Key Takeaways for Forex Traders

- Rate Hikes = Stronger Currency: They signal economic strength, attract foreign capital, and reduce currency supply.

- Rate Cuts = Weaker Currency: They imply economic weakness, reduce investment yields, and increase money supply.

- Expectations Matter: Markets often move in anticipation of rate changes, not just after.

- Relative Rates Rule: The difference between two countries’ rates (not just one) drives currency pairs.

- Fundamentals Still Count: Growth, inflation, trade, and politics all influence how rate changes are interpreted.

Conclusion

Interest rates are more than a policy lever—they’re a direct line into the health, outlook, and attractiveness of a currency. Understanding how and why hikes and cuts move the market gives forex traders a powerful edge. While technicals provide the “what,” interest rates often explain the “why.”

In a market where capital is constantly seeking the highest return with the lowest risk, interest rate decisions are the compass guiding global money flows. Keep your eyes on the central banks—because in forex, they don’t just move rates. They move everything.