In forex, currency movements can feel chaotic—one moment, the dollar surges; the next, it slips. While headlines and news flashes offer momentary clues, the real insights often lie hidden in financial market structures—one of the most powerful being the yield curve.

You might have heard traders or economists mention the yield curve in passing, often with tones of reverence or alarm. But what exactly is the yield curve, and how can it help predict the strength of a currency? This lesson unpacks the intricate relationship between bond markets, the yield curve, and foreign exchange dynamics to answer that question.

What Is the Yield Curve?

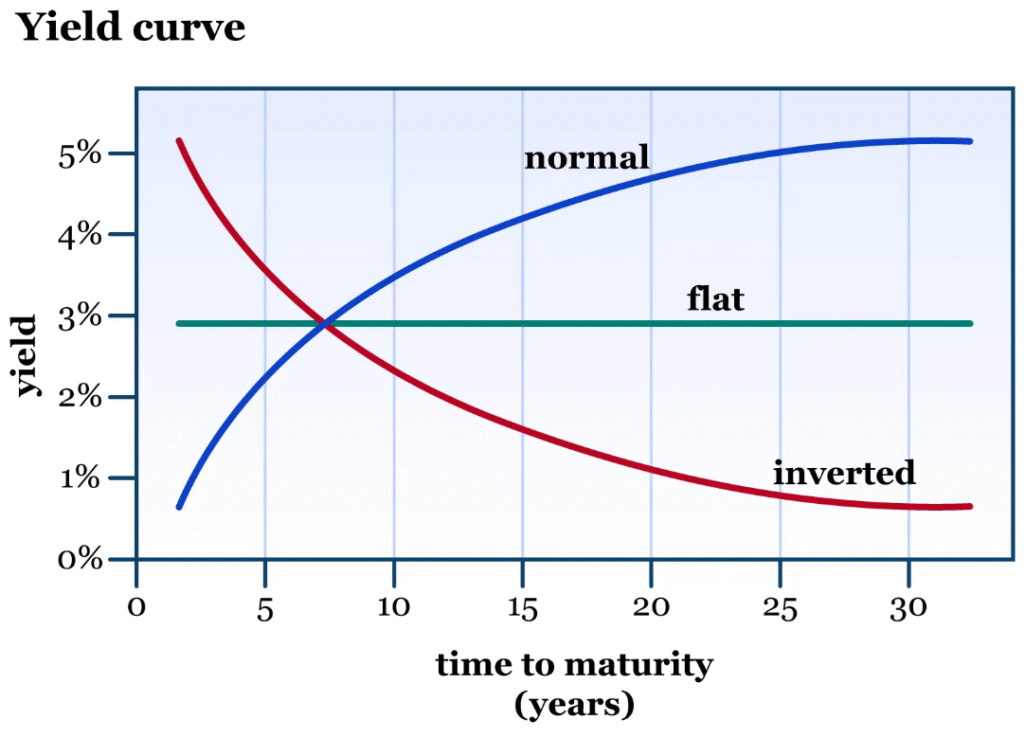

At its core, the yield curve is a graph that plots the interest rates (or yields) of bonds with equal credit quality but different maturities—typically government bonds. For example, it shows how U.S. Treasury yields differ for 2-year, 5-year, 10-year, and 30-year bonds.

The shape of the yield curve isn’t just a chart pattern—it reflects collective market beliefs about the future of the economy. There are three main forms:

- Normal Yield Curve: This upward-sloping shape suggests that longer-term bonds offer higher yields than short-term ones. It implies expectations of future economic growth and moderate inflation.

- Inverted Yield Curve: A downward slope indicates that short-term yields are higher than long-term ones—often a warning sign of recession.

- Flat Yield Curve: Little difference between short- and long-term yields, signaling economic uncertainty or transition.

The yield curve isn’t just an economic barometer; it’s a lens into investor psychology, inflation expectations, and future interest rates—all of which feed into currency valuations.

How the Yield Curve Predicts Currency Strength

Now that we’ve defined the yield curve, let’s explore how its fluctuations can signal changes in a currency’s strength or weakness. Several interrelated mechanisms drive this predictive power:

1. Interest Rate Expectations and Capital Flows

Currencies often move in anticipation of where interest rates are heading. The yield curve essentially compresses the bond market’s collective forecast into one curve.

- Steepening Curve: When long-term yields rise faster than short-term ones, it usually signals that investors expect stronger growth and inflation. This can lead to capital inflows from abroad, as higher yields offer better returns on investments like government bonds. To buy these bonds, foreign investors need the local currency—driving currency appreciation.

- Flattening or Inverting Curve: When yields flatten or the curve inverts, it often reflects a pessimistic view—recession fears, slowing growth, or expected rate cuts. Lower expected returns deter foreign capital, which can lead to currency depreciation.

In essence, the yield curve offers clues about where interest rates (and thus currency values) are headed.

2. Uncovered Interest Parity and Excess Returns

Classical economic theory says that Uncovered Interest Parity (UIP) should hold: if a country has higher interest rates, its currency should depreciate proportionally to offset the advantage. But reality often disagrees.

Empirical research—such as that in the BIS Working Paper 538—shows that violations of UIP are linked to yield curve shapes. Specifically, when the curve is flat or yields rise sharply, home currencies tend to appreciate beyond UIP predictions. Why?

Because the yield curve embeds forward-looking market sentiment—expectations of future inflation, central bank moves, and macroeconomic health. A bond market expecting stronger fundamentals often pushes currency strength beyond what theory predicts.

3. Risk Sentiment and Investor Confidence

Bond yields also act as a barometer of risk sentiment. When yields rise across the curve—especially long-term ones—it can indicate investor optimism about future growth and confidence in the economy. This sentiment can boost a currency, as capital chases risk-adjusted returns.

In contrast, falling yields may suggest risk aversion or a flight to safety, especially if investors are buying long-term bonds despite low returns. Such a sentiment shift typically weakens the currency, as money flows into safer, lower-yielding assets.

For forex traders, observing sudden yield curve changes can provide early warnings about shifting market moods.

4. Central Bank Policy and Inflation Expectations

The front end of the yield curve is heavily influenced by central bank policy rates. But the long end is shaped more by market expectations—particularly about inflation and future rate hikes or cuts.

- If inflation is expected to rise, long-term yields go up, steepening the curve. Markets may anticipate tighter monetary policy to fight inflation, leading to currency appreciation.

- If inflation expectations drop or growth slows, long-term yields decline, flattening the curve—often triggering currency weakness due to anticipated easing.

For forex traders and macro investors, the yield curve acts as a real-time consensus view of central bank credibility, inflation trends, and economic strength—all key to currency valuation.

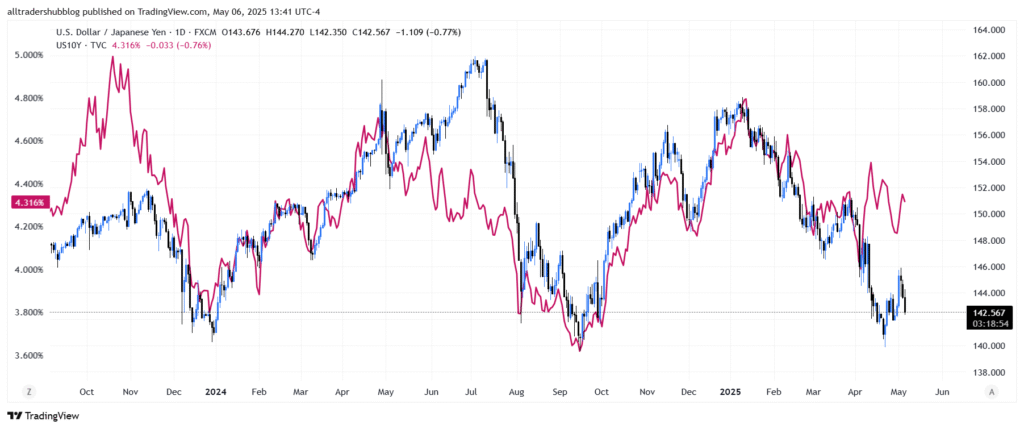

5. The 10-Year Treasury Yield and the US Dollar: A Real-World Case

A concrete example of the bond-currency relationship is the U.S. 10-year Treasury yield and the U.S. dollar.

When the 10-year yield rises, the dollar often strengthens, particularly against lower-yielding currencies like the Japanese yen or Swiss franc. This happens because:

- Investors seek higher returns in U.S. Treasuries.

- They must buy dollars to purchase these bonds.

- This inflow increases demand for the dollar, leading to appreciation.

Although the correlation isn’t perfect—other factors like geopolitics and Fed policy can interfere—the link is strong enough to be a staple in many professional trading strategies.

If you’re a forex trader watching the USD/JPY pair, you’d be wise to keep an eye on the 10-year yield—it often leads the price action.

Summary: Why the Yield Curve Matters in Forex Trading

Let’s recap why the yield curve deserves a spot on every serious trader’s radar:

- It reflects investor expectations about future growth, inflation, and monetary policy.

- A steepening curve attracts foreign capital, boosting currency strength.

- A flattening or inverted curve signals economic concerns, leading to currency weakness.

- The yield curve helps explain real-world deviations from interest rate parity theories.

- Central bank actions and inflation expectations shape the curve—and, by extension, currency markets.

- Empirical data, like the correlation between the 10-year Treasury yield and the U.S. dollar, confirm these dynamics.

For traders, understanding the yield curve isn’t just academic—it’s strategic. It bridges fixed income and forex, connecting bond traders’ expectations with currency market outcomes.

Final Thoughts: From Macro to Market Moves

In today’s interconnected financial world, ignoring the bond market is like flying blind in a storm. The yield curve, with all its bends and slopes, offers more than an economic forecast—it provides a competitive edge.

Whether you’re a long-term macro investor or a short-term forex scalper, the yield curve can sharpen your analysis and timing. After all, currencies don’t move in a vacuum—they move with capital, confidence, and interest rate expectations. And those expectations are drawn—every day—on the canvas of the yield curve.

References:

[5] BIS Working Paper 538: https://www.bis.org/publ/work538.pdf

[6] ECB Yield Curves: https://www.ecb.europa.eu/stats/financial_markets_and_interest_rates/euro_area_yield_curves/html/index.en.html

[7] Investopedia: https://www.investopedia.com/terms/y/yieldcurve.asp

[9] Blueberry Markets: https://blueberrymarkets.com/market-analysis/how-bond-yields-affect-currency-movements-in-forex/

[10] XTransfer: https://www.xtransfer.com/wiki/trade-terms/understanding-the-impact-of-yield-curves-on-global-trade

[11] Privalgo: https://www.privalgo.co.uk/bond-yields-and-currencies/