Sentiment analysis plays a crucial role in forex trading, offering insights into the collective mood or attitude of market participants toward a specific currency pair.

Unlike technical or fundamental analysis, which relies on historical data and economic indicators, sentiment analysis focuses on the psychology and emotions driving market decisions.

Understanding how trader sentiment affects forex markets can help traders anticipate price movements and identify potential trading opportunities.

What is Sentiment Analysis?

Sentiment analysis in forex trading involves gauging the overall market mood to predict future price action. This analysis can be quantitative, such as using sentiment indicators and indices, or qualitative, involving the interpretation of news headlines, social media trends, and trader forums.

Key sentiment indicators include:

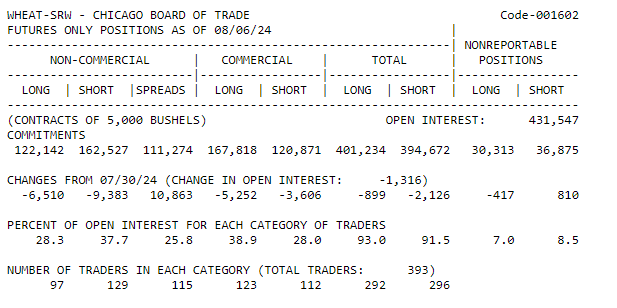

Commitment of Traders (COT) Report

Published by the Commodity Futures Trading Commission (CFTC), the COT report provides a weekly snapshot of trader positioning in the futures market. By analyzing the positions of different types of traders—such as commercial hedgers and speculators—traders can infer market sentiment for various currency pairs.

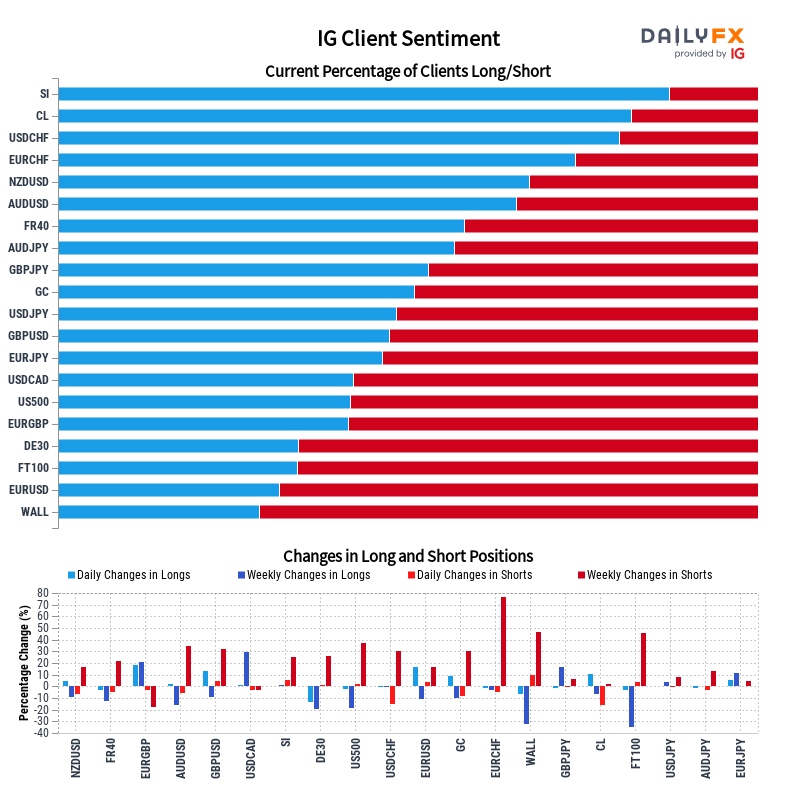

Sentiment Indices

Tools like the IG Client Sentiment Index or the DailyFX Sentiment Report track the ratio of long to short positions in a currency pair. A high percentage of traders being long or short on a currency can indicate potential reversals, as the market tends to move in the opposite direction when sentiment reaches extreme levels.

Social Media and News Sentiment

Advances in artificial intelligence and machine learning have made it possible to analyze vast amounts of text data from news outlets, blogs, and social media. Tools like Twitter sentiment analysis can give traders an idea of the prevailing market mood and whether it is bullish, bearish, or neutral.

How Sentiment Affects Forex Markets

Contrarian Trading Strategy

One of the most common uses of sentiment analysis is in contrarian trading strategies. The idea is that when the majority of traders are bullish or bearish on a currency, the market may be overextended in that direction. A contrarian trader might take the opposite position, betting on a market correction.

Example: If sentiment data shows that 80% of traders are long on the EUR/USD, a contrarian trader might look for technical signs of a reversal and consider shorting the pair.

Reinforcement of Trends

In some cases, sentiment aligns with strong market trends, reinforcing price movements. When positive sentiment is backed by solid economic fundamentals, trends can persist, leading to extended price runs.

Example: During a strong economic recovery, positive sentiment towards the U.S. dollar might align with rising interest rates and GDP growth, pushing the dollar higher against other currencies.

Market Psychology and Herd Behavior

Sentiment analysis taps into market psychology, where emotions like fear, greed, and euphoria can drive market behavior. Herd behavior occurs when traders collectively move in the same direction, often leading to rapid price swings or bubbles.

Example: In times of economic uncertainty, fear can drive traders to flock to safe-haven currencies like the Japanese yen or Swiss franc, causing sudden appreciation in these currencies even if the underlying fundamentals don’t justify such moves.

Sentiment Shifts and Volatility

Sudden shifts in market sentiment can lead to increased volatility, as traders react to new information or changes in market conditions. These shifts are often triggered by unexpected news events, central bank announcements, or geopolitical developments.

Example: A surprise interest rate hike by the Federal Reserve might shift sentiment rapidly from bullish to bearish on emerging market currencies, leading to sharp declines as traders reassess their positions.

Conclusion

Sentiment analysis is a powerful tool in forex trading, providing unique insights into the emotions and psychology driving market movements. By understanding trader sentiment, forex traders can anticipate potential reversals, identify trends, and navigate market volatility more effectively. While sentiment analysis should not be used in isolation, it can be a valuable complement to technical and fundamental analysis, helping traders to make more informed decisions in the dynamic world of forex trading.