Central banks play a pivotal role in the global economy, and their policies have far-reaching effects on the forex market. Understanding how central bank policies influence currency values is crucial for any forex trader.

In this lesson, we’ll explore the mechanisms through which central banks impact forex markets and provide insights into what traders need to watch out for.

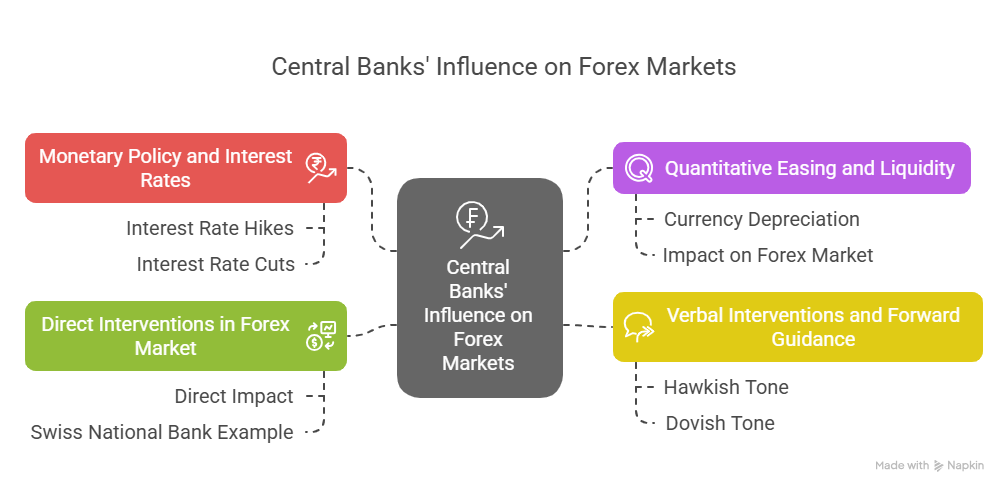

Monetary Policy and Interest Rates

One of the primary tools that central banks use to influence the economy is monetary policy, specifically through the adjustment of interest rates. When a central bank raises or lowers interest rates, it directly affects the value of the nation’s currency.

- Interest Rate Hikes: When a central bank raises interest rates, it often leads to an appreciation of the country’s currency. Higher interest rates offer better returns on investments in that currency, attracting foreign capital and increasing demand for the currency.

- Interest Rate Cuts: Conversely, when a central bank lowers interest rates, it tends to lead to currency depreciation. Lower interest rates make investments in that currency less attractive, reducing demand and causing the currency to weaken.

For instance, if the U.S. Federal Reserve (Fed) were to increase interest rates, the U.S. dollar would likely strengthen as investors flock to the higher yields.

Quantitative Easing (QE) and Liquidity

Quantitative easing is another powerful tool that central banks use to influence their economies and, by extension, the forex market. QE involves the central bank purchasing large amounts of government bonds or other financial assets to inject liquidity into the economy.

- Currency Depreciation: When a central bank engages in QE, it increases the money supply, which often leads to a depreciation of the currency. This is because the increase in money supply can dilute the currency’s value.

- Impact on Forex Market: Traders often react to QE announcements by selling off the currency, anticipating its decline in value. For example, the European Central Bank’s (ECB) QE program in recent years led to a weakening of the euro.

Verbal Interventions and Forward Guidance

Central banks also use verbal interventions and forward guidance as tools to manage market expectations. Through carefully crafted statements, central banks can signal future policy actions, which can have an immediate impact on currency values.

- Hawkish vs. Dovish Tone: A hawkish tone, indicating potential interest rate hikes or tighter monetary policy, can strengthen a currency. In contrast, a dovish tone, suggesting lower interest rates or more stimulus, can weaken a currency.

For instance, when the Bank of Japan signals its intention to keep interest rates low to combat deflation, the Japanese yen often weakens in response.

Interventions in the Forex Market

In some cases, central banks directly intervene in the forex market by buying or selling their own currency. These interventions are usually aimed at stabilizing the currency or preventing excessive appreciation or depreciation.

- Direct Impact: When a central bank buys its own currency, it increases demand, leading to an appreciation. Conversely, selling the currency increases supply, leading to depreciation.

For example, the Swiss National Bank (SNB) has intervened multiple times in the past to prevent excessive appreciation of the Swiss franc, which is seen as a safe-haven currency.

Conclusion

Central bank policies are among the most influential factors in the forex market. Whether through interest rate adjustments, quantitative easing, verbal interventions, or direct market interventions, central banks have the power to drive significant movements in currency values. For traders, keeping a close eye on central bank decisions and understanding their potential impact is essential for making informed trading decisions.