In forex trading, understanding economic indicators is crucial for making informed decisions. One such important indicator is the Producer Price Index (PPI) data, which can provide insights into inflation trends and future economic activity.

Forex traders often analyze PPI data to anticipate currency movements, as it serves as an early warning sign of inflationary pressures in an economy.

This guide will explain what the Producer Price Index is, how it relates to inflation, and how traders can use PPI data in forex trading to their advantage.

What is the Producer Price Index (PPI)?

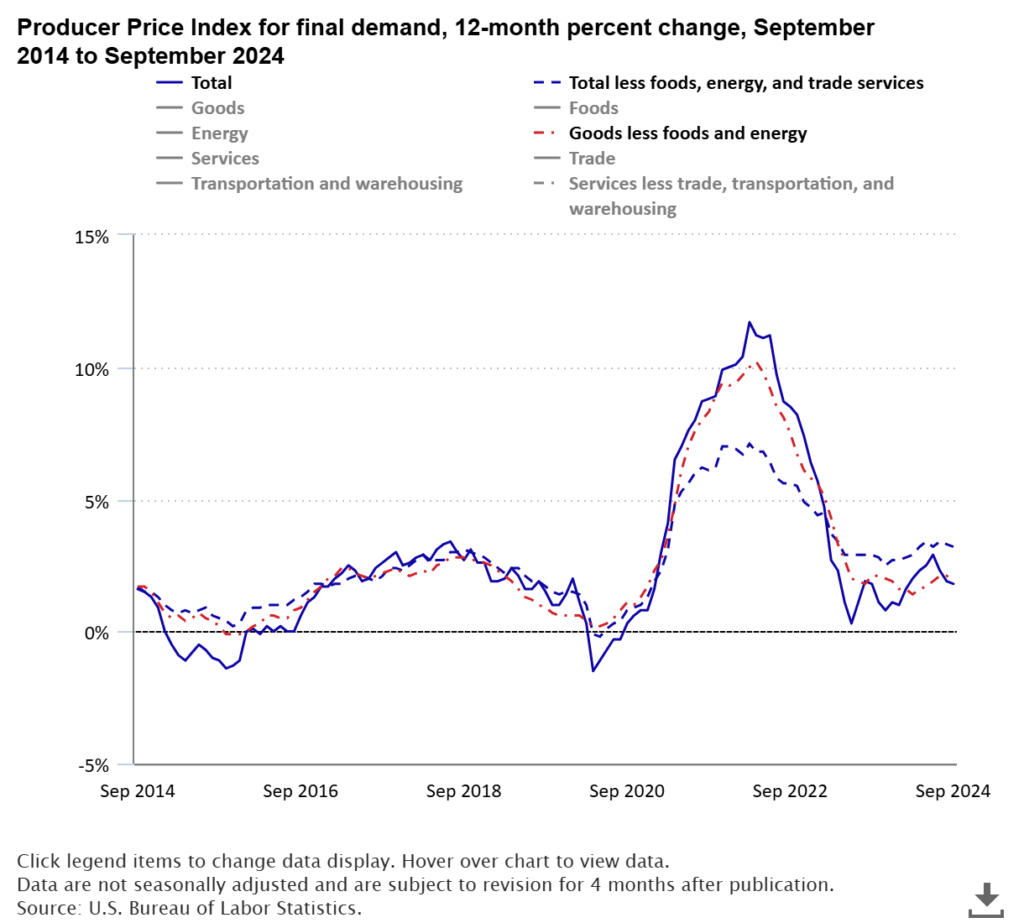

The Producer Price Index (PPI) is a measure of the average change in selling prices received by domestic producers for their goods and services over time. Essentially, it tracks price changes at various stages of production—covering raw materials, intermediate goods, and finished products. The PPI is often referred to as a leading indicator of inflation because rising production costs can lead to higher prices for consumers down the line.

In the United States, the Bureau of Labor Statistics (BLS) releases the PPI monthly, breaking it down by industry, commodity, and stage of production. Other countries, such as the UK and Japan, also publish PPI reports, making it a widely used indicator for global forex traders.

How PPI Relates to Inflation

Understanding the relationship between PPI data in forex trading and inflation is essential. Since PPI measures the prices that producers receive, it often provides early clues about future inflation trends. When production costs rise, businesses may pass those costs on to consumers, leading to higher consumer prices. As a result, a high or rising PPI can signal potential increases in the Consumer Price Index (CPI), which central banks closely monitor to gauge inflation.

Here’s how the Producer Price Index and inflation are linked:

- Cost-Push Inflation: When PPI data shows that production costs are rising, it can indicate cost-push inflation. This type of inflation occurs when increased costs for raw materials and labor force companies to raise their prices to maintain profit margins.

- Monetary Policy Implications: Central banks monitor inflation trends to make monetary policy decisions. If the PPI suggests inflationary pressures, central banks may consider raising interest rates to control inflation, which can strengthen the currency. Conversely, if PPI data points to decreasing prices, central banks may lean toward lower rates to stimulate the economy, potentially weakening the currency.

How Forex Traders Use PPI Data

PPI data in forex trading can serve as a valuable tool for predicting currency movements. Here are a few ways forex traders can interpret and use PPI data effectively:

Analyzing Trends:

Forex traders often look for trends in PPI data. A consistent increase in the PPI over several months can signal rising inflationary pressures, which might lead to an interest rate hike. Conversely, a declining PPI trend could suggest slowing inflation or even deflation, which might prompt a central bank to cut interest rates.

For example, if the US PPI shows consistent increases, forex traders might anticipate a rate hike from the Federal Reserve, potentially making the US dollar (USD) more attractive against other currencies, such as the euro (EUR) or Japanese yen (JPY).

Comparing with CPI:

While both the PPI and CPI measure inflation, they do so at different stages in the production and consumption process. Forex traders often compare PPI with CPI to gain a complete picture of inflation. If the PPI rises but the CPI remains stable, it might suggest that producers are absorbing costs instead of passing them on to consumers.

If both PPI and CPI show rising inflation, this can confirm inflationary pressures across the economy, signaling that a central bank is likely to take action. For instance, rising PPI and CPI in the Eurozone could lead traders to expect the European Central Bank to raise interest rates, potentially strengthening the euro.

Watching for Economic Surprises:

Economic surprises can significantly impact forex markets, especially when actual PPI data deviates from analysts’ expectations. A higher-than-expected PPI reading can cause immediate currency appreciation, as traders anticipate tighter monetary policy. Similarly, a lower-than-expected PPI may lead to currency depreciation.

Traders should pay attention to consensus forecasts for PPI data and compare them with the actual numbers released. For example, if the UK’s PPI is expected to rise by 0.3% but instead shows a 0.7% increase, traders might anticipate that the Bank of England could react to inflationary pressures, potentially making the British pound (GBP) more appealing in the forex markets.

Pairing PPI Data with Other Economic Indicators:

PPI data is often analyzed alongside other key economic indicators, such as GDP growth, employment data, and retail sales. Forex traders can use these indicators in combination with PPI data to make more informed trading decisions.

For example, if PPI and GDP growth in Canada are both trending upwards, it could suggest a strong economy with potential inflationary pressures, which might lead the Bank of Canada to raise interest rates. In such cases, traders might look to buy the Canadian dollar (CAD) against other currencies, expecting it to appreciate.

Practical Example: Trading Forex with PPI Data

Let’s go through a practical example of using PPI data in forex trading.

Suppose the United States is scheduled to release its monthly PPI report. Analysts expect the PPI to increase by 0.2%, but the actual data reveals a surprising 0.6% increase. This sharp rise suggests that inflationary pressures are building up at the production level, potentially leading to higher consumer prices in the future.

Forex traders might react by buying the US dollar (USD), expecting the Federal Reserve to raise interest rates in response to rising inflation. As a result, USD pairs such as EUR/USD and GBP/USD could decline as the dollar strengthens relative to the euro and pound.

In this scenario, traders who anticipated a stronger PPI release and positioned themselves accordingly would benefit from the immediate currency movement following the data release.

Key Takeaways for Forex Traders

Using PPI data in forex trading offers several advantages:

- Early Inflation Signals: PPI acts as an early indicator of inflation, allowing traders to anticipate future changes in the CPI and central bank actions.

- Monetary Policy Predictions: By understanding PPI trends, forex traders can gain insight into potential interest rate changes, helping them make more informed trading decisions.

- Market Sentiment and Volatility: PPI releases can create significant market movements, offering opportunities for short-term trades based on economic surprises.

Conclusion

Understanding and utilizing PPI data in forex trading can give traders a valuable edge. By analyzing trends, comparing with CPI data, watching for surprises, and pairing PPI with other indicators, traders can gain deeper insights into economic conditions and inflation trends. This knowledge helps forex traders anticipate central bank actions and make more informed trading decisions. As with any economic indicator, however, it’s essential to use PPI in conjunction with other data and stay aware of broader market conditions.