Inflation reports are key economic indicators that have a profound impact on the forex market. Central banks carefully track inflation trends to shape their monetary policies, which ultimately influence currency values.

In this article, we’ll break down how inflation data affects forex markets and share practical strategies for trading currencies based on these reports and central banks’ responses to inflation trends.

Understanding Inflation Reports

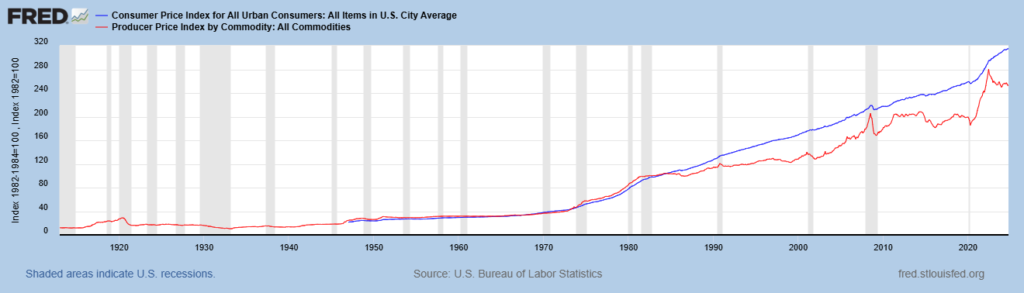

Inflation reports reveal how quickly the general price level of goods and services is rising, which directly affects the purchasing power of money. These reports often measure changes year-over-year or month-over-month through indices like the Consumer Price Index (CPI) or the Producer Price Index (PPI).

Market participants and policymakers alike pay close attention to this data, as inflation influences everything from currency strength to savings and investment decisions.

Central banks, such as the Federal Reserve or the European Central Bank, target specific inflation rates to ensure economic stability. When inflation deviates from the target, central banks may intervene by adjusting interest rates, implementing quantitative easing, or using other monetary tools to influence economic activity.

Key Inflation Measures: CPI and PPI

Central banks, such as the Federal Reserve or the European Central Bank, rely on inflation reports like the CPI and PPI to maintain price stability and foster economic growth. When inflation strays from their targets, they use various monetary tools to steer the economy back on track.

Central Bank Targets and Goals

Most central banks aim for an annual inflation rate around 2% in advanced economies. This target is not arbitrary—it plays a vital role in achieving:

- Price Stability: Predictable inflation helps households and businesses plan with confidence.

- Economic Growth: Stable prices support sustainable growth by avoiding the extremes of deflation or runaway inflation.

- Employment Growth: A balanced inflation rate promotes job creation and wage stability.

How Central Banks Respond to Inflation

When inflation exceeds the target range, central banks often tighten monetary policy to cool down the economy. They might:

- Raise Interest Rates: Higher rates make borrowing more expensive, which slows consumer spending and business investment.

- Quantitative Tightening: By reducing the money supply through selling assets or halting purchases, central banks curb liquidity.

- Forward Guidance: Clear communication about future policy helps shape market expectations and behaviors.

On the flip side, when inflation falls below target or deflation becomes a risk, central banks adopt measures to boost economic activity, including:

- Lowering Interest Rates: This makes borrowing cheaper, encouraging spending and investment.

- Quantitative Easing: Buying financial assets injects money into the economy and stimulates demand.

- Targeted Lending Programs: These initiatives direct resources to key sectors that need support.

By using these tools, central banks aim to balance inflation and keep the economy on a stable growth path.

Understanding how inflation reports and central bank actions interact is essential for forex traders looking to stay ahead of market trends and make informed decisions.

Impact of Inflation on Forex Markets

- Interest Rate Adjustments: Inflation data can lead to expectations of interest rate changes. If inflation rises above the target, central banks may increase interest rates to cool down the economy, making the currency more attractive to investors due to higher yields. Conversely, if inflation is below the target, central banks may lower interest rates, potentially weakening the currency.

- Currency Valuation: Inflation affects a currency’s purchasing power. High inflation can reduce the currency’s value relative to others, leading to depreciation. Conversely, low inflation can support a currency’s strength, leading to appreciation.

- Market Sentiment: Traders and investors closely watch inflation reports to gauge market sentiment. Higher-than-expected inflation can lead to market volatility, as traders react to potential central bank actions.

Analyzing Inflation Data for Trading

To effectively trade based on inflation reports, traders must focus on both pre-release and post-release analysis. A structured approach to analyzing inflation data helps in understanding market expectations, gauging potential reactions, and aligning trades with broader economic trends.

1. Pre-Release Analysis

Preparing for inflation data begins with a thorough pre-release analysis to understand the market’s anticipation and its implications:

- Studying Forecasted Inflation Data

Economic calendars provide consensus estimates for inflation metrics (e.g., CPI or PPI). Comparing these forecasts to prior reports offers insights into market expectations. For instance:- If forecasts suggest higher inflation, markets might anticipate tighter monetary policy, potentially strengthening the domestic currency.

- Lower-than-expected forecasts could signal dovish central bank action, weakening the currency.

- Assessing Historical Inflation Trends

Reviewing previous inflation data helps identify patterns, such as persistent inflationary pressures or seasonality effects.- Example: Persistent inflation above a central bank’s target typically strengthens the local currency, as traders price in rate hikes.

- Evaluating Macro Context

Inflation doesn’t act in isolation. Traders should consider other indicators that influence inflation or are impacted by it:- Employment Data: Strong job growth often fuels higher inflation.

- GDP Growth: Robust economic growth may signal rising demand and price pressures.

- Retail Sales and Commodity Prices: Rising consumer demand or commodity price increases can push inflation higher.

2. Post-Release Analysis

The actual release of inflation data often leads to significant market volatility. Traders must analyze the figures quickly and accurately:

- Comparing Actual Data Against Forecasts

The market’s initial reaction often depends on whether the inflation report is:- In Line with Expectations: Minimal volatility as markets have priced in the data.

- Above Forecasts (Inflation Surprise): Typically strengthens the currency due to expectations of tighter monetary policy.

- Below Forecasts: Weakens the currency, as traders anticipate dovish responses from central banks.

- Understanding Market Reactions to Surprises

An inflation surprise (positive or negative) doesn’t just affect the currency; it impacts sentiment across correlated markets, including:- Bond Yields: Rising inflation usually pushes yields higher as investors demand compensation for eroded purchasing power.

- Equities: High inflation can hurt stock markets due to fears of aggressive rate hikes.

- Commodities: Gold may react positively to high inflation as a hedge.

- Considering Inflation’s Core Components

- Traders should differentiate between headline inflation and core inflation (excluding volatile items like food and energy).

- Central banks often prioritize core inflation when making policy decisions.

- Example: A rise in headline CPI driven by temporary energy price spikes may not lead to significant monetary tightening.

3. Long-Term vs. Short-Term Impacts

Inflation’s impact on the forex market can vary depending on the time horizon:

- Short-Term Effects

- Immediate volatility occurs around the release, driven by algorithmic trading and speculators.

- Opportunities exist for scalpers and day traders during these quick price movements.

- Long-Term Trends

- Sustained inflation trends lead to adjustments in central bank policies, influencing currency values over weeks or months.

- Example: Prolonged high inflation in the U.S. during 2021-2023 led to sustained rate hikes and dollar strength.

Actionable Insights for Traders

- Monitor both headline and core inflation data for a comprehensive picture.

- Focus on deviations between actual and forecasted data to anticipate market reactions.

- Evaluate the broader economic narrative surrounding inflation, including employment, commodity prices, and fiscal policies.

- Be mindful of the time horizon: trade cautiously during short-term volatility but align longer-term positions with policy trends.

This systematic approach helps traders make informed decisions when trading inflation reports, ensuring they capitalize on opportunities while managing risks effectively.

Trading Strategies Based on Inflation Reports

Inflation reports can significantly move forex markets, creating both risks and opportunities. Traders can employ various strategies depending on their trading style, market outlook, and risk appetite. Below are four common approaches to trading inflation reports effectively.

Trading Strategies Based on Inflation Reports

Inflation reports can significantly move forex markets, creating both risks and opportunities. Traders can employ various strategies depending on their trading style, market outlook, and risk appetite. Below are four common approaches to trading inflation reports effectively.

1. Volatility-Based Trading

Inflation data releases often trigger sharp price movements due to their high impact on market expectations. Traders can capitalize on this volatility by employing short-term strategies:

- Preparing for the Data Release

- Identify the exact release time and expected impact using an economic calendar.

- Trade only highly liquid currency pairs (e.g., EUR/USD, USD/JPY) to minimize slippage during volatile periods.

- Straddle Strategy

- Place pending buy and sell orders just above and below the current market price.

- If the inflation report causes a significant move, one of the orders will trigger, capturing the breakout.

- Use tight stop losses to limit risk in case of false breakouts.

- Scalping Around the Release

- Focus on capturing small price movements in the seconds or minutes following the release.

- Prioritize speed and precision using low-latency platforms and tight spreads.

- Risk Management Tips

- Use smaller position sizes to account for unpredictable price spikes.

- Avoid holding trades just before the release to prevent getting caught in pre-release volatility.

2. Trend Following

For traders with a longer time horizon, inflation reports provide valuable insights into central bank policy direction, which can fuel sustained trends in currency pairs.

- Identifying Emerging Trends

- A report showing persistently high inflation may indicate upcoming monetary tightening (rate hikes), strengthening the currency.

- Conversely, low inflation or deflation risks suggest dovish policies (rate cuts), weakening the currency.

- Examples of Trend Following

- In the U.S., consistently high CPI readings during 2021-2023 led to a bullish USD trend as the Federal Reserve aggressively hiked rates.

- In contrast, Japan’s historically low inflation often results in a dovish Bank of Japan, creating long-term yen weakness.

- Technical Tools for Trend Confirmation

- Use moving averages (e.g., 50-day or 200-day) to identify trending markets.

- Look for breakouts above resistance or below support levels post-report.

3. Correlation-Based Trading

Inflation reports often ripple across markets, influencing correlated assets and providing additional trading opportunities.

- Bond Yields and Inflation

- Rising inflation typically drives bond yields higher, which can strengthen the currency.

- For example, when U.S. CPI data surprises to the upside, U.S. Treasury yields often rise, boosting the USD.

- Commodities and Inflation

- Inflation caused by rising commodity prices (e.g., crude oil) can impact commodity-linked currencies like CAD or AUD.

- For instance, a spike in global energy prices leading to higher inflation may strengthen the Canadian dollar due to its oil export dependence.

- Equities and Risk Sentiment

- Inflation exceeding forecasts might hurt equities, especially in high-interest-rate-sensitive sectors.

- Traders can use risk-off sentiment to trade safe-haven currencies like CHF or JPY.

4. Fundamental and Technical Fusion

Combining inflation-driven fundamental analysis with technical strategies can help traders refine their entries and exits.

- Developing a Fundamental Bias

- Use inflation data to determine the underlying direction for a currency (bullish or bearish).

- For example, persistent high inflation in the UK may signal GBP strength due to Bank of England rate hikes.

- Pairing Fundamentals with Supply and Demand Zones

- Identify key technical levels (e.g., resistance and support zones) where price is likely to react.

- Align inflation-driven biases with these zones to increase trade probabilities.

- Confirmation Indicators

- Use oscillators (e.g., RSI, Stochastic) to gauge overbought or oversold conditions before entering a trade.

- Combine with volume indicators to confirm the strength of the move following an inflation release.

Practical Application of Strategies

Example 1: Trading a Positive Inflation Surprise

- Scenario: U.S. CPI data comes in at 4.5% (forecast: 4.0%).

- Impact: USD strengthens as traders expect the Federal Reserve to hike rates.

- Strategy:

- Enter a long position on USD/JPY after confirming a breakout above resistance.

- Use Fibonacci retracement levels to find optimal entry points on pullbacks.

Example 2: Trading Correlations

- Scenario: Australia’s CPI unexpectedly falls, weakening AUD.

- Impact: Lower inflation could lead to a rate cut by the RBA.

- Strategy:

- Short AUD/USD while also monitoring gold (correlated with AUD).

- Confirm the downtrend using a moving average crossover.

Key Tips for Success

- Timing is Critical: Enter trades only after assessing market reaction to avoid whipsaws.

- Follow Central Bank Rhetoric: Inflation data is only part of the story—central bank commentary provides context for future moves.

- Backtest Strategies: Test these strategies on historical inflation data to build confidence and refine your approach.

- Adapt to Changing Conditions: Inflation trends evolve, so remain flexible in your strategy.

By aligning your trades with inflation dynamics and combining multiple strategies, you can effectively navigate both short-term volatility and long-term trends driven by inflation data.

Conclusion

Inflation reports are a vital component of forex market analysis. By understanding how inflation impacts currency values and anticipating central bank reactions, traders can develop effective strategies to capitalize on these economic events. Whether using interest rate differentials, carry trades, or event-driven approaches, staying informed about inflation trends can provide a competitive edge in the forex market.