Welcome to AllTradersHub!

Whether you’re a complete novice to the world of currency trading or someone looking to enhance their understanding of fundamental analysis, this guide is designed to be your comprehensive roadmap.

Forex trading, also known as foreign exchange trading, offers an exciting avenue for individuals to participate in the global financial markets. Unlike traditional stocks or commodities trading, forex trading involves the buying and selling of currency pairs, with the aim of profiting from fluctuations in exchange rates.

At the heart of successful forex trading lies fundamental analysis – a method of evaluating currencies based on economic, political, and social factors that influence their value. While technical analysis focuses on price movements and chart patterns, fundamental analysis delves deeper into the underlying forces that drive currency prices.

In this guide, I’ll cover everything you need to know to get started with forex trading and understand the role of fundamental analysis in making informed trading decisions. From mastering the basics of currency pairs and trading platforms to deciphering key economic indicators and incorporating fundamental analysis into your trading strategy, I’ve got you covered.

But beyond just theory, I’ll address the practical aspects of forex trading, including overcoming common challenges, developing a trading plan, and managing risk. Whether you’re trading for supplemental income, financial freedom, or simply to satisfy your curiosity about the financial markets, my goal is to equip you with the knowledge and tools needed to navigate the forex landscape with confidence.

So, whether you’re a curious newcomer or a seasoned trader looking to sharpen your skills, join me on this journey as we explore the fascinating world of forex trading and fundamental analysis. Let’s embark on this adventure together and unlock the potential of the currency markets.

Introduction to Forex Trading

Forex trading, also known as foreign exchange trading, is the act of buying and selling currencies with the aim of making a profit. It’s one of the largest and most liquid financial markets in the world, with trillions of dollars exchanged daily. In this chapter, we’ll cover the basics of forex trading, including what it is, how it works, and the essential elements you need to understand to get started.

What is Forex Trading?

At its core, forex trading involves the exchange of one currency for another at an agreed-upon price. Currencies are traded in pairs, with each pair representing the value of one currency relative to another. For example, the EUR/USD currency pair represents the value of the euro relative to the US dollar. When you buy a currency pair, you’re essentially buying one currency while simultaneously selling another.

Understanding Currency Pairs

Currency pairs are denoted by three-letter codes, with the first two letters representing the country and the third letter representing the currency itself. For instance, USD stands for the United States dollar, EUR for the euro, GBP for the British pound, and so on. The first currency listed in a pair is known as the base currency, while the second currency is called the quote currency. The exchange rate indicates how much of the quote currency is needed to purchase one unit of the base currency.

Basics of Trading Platforms

To participate in forex trading, you’ll need access to a trading platform, which is a software application that allows you to execute trades, monitor the markets, and analyze price movements. Trading platforms come in various forms, including web-based platforms, desktop applications, and mobile apps. They typically provide access to real-time market data, charting tools, and order management features.

Introduction to Market Participants

The forex market is decentralized, meaning it doesn’t have a central exchange like the stock market. Instead, it operates through a global network of banks, financial institutions, corporations, governments, and individual traders. Some of the key participants in the forex market include:

– Central Banks: Central banks play a crucial role in the forex market by implementing monetary policies, such as interest rate decisions and quantitative easing programs, that can impact currency valuations.

– Commercial Banks: Commercial banks facilitate currency transactions for their clients and engage in speculative trading to profit from exchange rate fluctuations.

– Hedge Funds: Hedge funds are institutional investors that trade currencies on behalf of their clients, often using sophisticated strategies to generate returns.

– Retail Traders: Individual traders like you and me participate in the forex market through online brokers, seeking to profit from short-term price movements or long-term trends.

Understanding the different participants in the forex market can help you grasp the dynamics of supply and demand that drive currency prices.

Fundamentals of Fundamental Analysis

Fundamental analysis is a method of evaluating securities by analyzing various factors that can influence their intrinsic value. In the context of forex trading, fundamental analysis involves examining economic, political, and social factors that affect the value of currencies. In this chapter, we’ll delve into the fundamentals of fundamental analysis and explore its importance in the forex market.

What is Fundamental Analysis?

Fundamental analysis is the process of studying economic indicators, geopolitical events, central bank policies, and other factors to assess the intrinsic value of a currency. Unlike technical analysis, which focuses on price movements and chart patterns, fundamental analysis looks at the underlying forces driving those price movements.

Importance of Fundamental Analysis in Forex Trading

Fundamental analysis plays a crucial role in forex trading because currency prices are heavily influenced by macroeconomic factors. Economic indicators such as interest rates, inflation rates, employment data, and GDP growth can impact the supply and demand for a currency, thereby affecting its exchange rate relative to other currencies. By understanding these fundamental drivers, traders can make more informed trading decisions and anticipate future price movements.

Key Economic Indicators for Forex Trading

Several economic indicators are closely watched by forex traders due to their potential to impact currency valuations. Some of the key economic indicators include:

– Interest Rates: Central banks use interest rates to control inflation and stimulate economic growth. Changes in interest rates can affect a currency’s yield and attractiveness to investors.

– Inflation Rates: Inflation erodes the purchasing power of a currency over time. High inflation rates can lead to currency depreciation, while low inflation rates can strengthen a currency.

– Employment Data: Employment figures, such as non-farm payroll data and unemployment rates, provide insights into the health of the labor market and overall economic activity.

– GDP (Gross Domestic Product): GDP measures the total value of goods and services produced within a country’s borders. A growing GDP indicates a healthy economy and can boost confidence in the country’s currency.

Other Influential Factors in Forex Markets

In addition to economic indicators, geopolitical events, central bank policies, trade balances, and market sentiment can also impact currency prices. Geopolitical tensions, political instability, trade disputes, and natural disasters can create uncertainty in the forex market and lead to volatility in exchange rates. Central bank interventions, such as quantitative easing or currency interventions, can also influence currency valuations.

Understanding the interplay between these factors and their impact on currency prices is essential for successful forex trading.

How to Incorporate Fundamental Analysis into Trading

Fundamental analysis provides traders with valuable insights into the underlying factors driving currency prices. In this chapter, we’ll explore how to incorporate fundamental analysis into your trading strategy and make informed trading decisions based on economic data and events.

Setting Up Your Fundamental Analysis Toolkit

Before you can start analyzing economic indicators and events, you’ll need to set up your fundamental analysis toolkit. This includes access to reliable sources of economic data, such as financial news websites, economic calendars, and government reports. You’ll also need to familiarize yourself with the key economic indicators and their significance for currency markets.

Economic Calendar and Its Importance

An economic calendar is an essential tool for forex traders, as it provides a schedule of upcoming economic events and releases. These events can include central bank meetings, interest rate decisions, inflation reports, employment data, GDP releases, and other economic indicators. By tracking the economic calendar, traders can anticipate market-moving events and plan their trading strategies accordingly.

Identifying Market Trends

Fundamental analysis can help traders identify long-term trends in currency markets by analyzing the underlying economic fundamentals. For example, a country with strong economic growth, low inflation, and rising interest rates is likely to see appreciation in its currency over time. Conversely, a country with sluggish growth, high inflation, and low interest rates may experience depreciation in its currency. By understanding these macroeconomic trends, traders can position themselves to capitalize on long-term currency movements.

Analyzing News Releases

Economic data releases and news events can have a significant impact on currency prices, causing sharp movements in the market. Traders need to stay informed about upcoming news releases and be prepared to react quickly to unexpected developments. When analyzing news releases, it’s essential to consider not only the headline numbers but also the underlying details and market sentiment. Sometimes, the market’s reaction to a news release can be influenced by factors such as expectations, revisions to previous data, and forward guidance from central banks.

Combining Fundamental Analysis with Technical Analysis

While fundamental analysis provides insights into the broader economic factors driving currency prices, technical analysis focuses on price action and chart patterns. Many traders use a combination of fundamental and technical analysis to make well-rounded trading decisions. By incorporating both approaches, traders can gain a deeper understanding of market dynamics and improve their trading accuracy.

Let’s see a real example where we compare two economies fundamentally and then we look at the technical side to show you how we do both analyses.

So let’s start with the Euro Area Macroeconomic data:

The macroeconomic data for the Eurozone presents a mixed picture of its economic health. While the unemployment rate is relatively low at 6.4%, indicating a reasonably healthy labor market, other indicators suggest potential challenges. The debt-to-GDP ratio stands at a concerning 90.9%, signaling a significant burden on government finances.

Additionally, a negative government budget balance of -3.6% implies persistent fiscal deficits. Retail sales growth is negative at -1.1%, suggesting subdued consumer spending, while real GDP growth stagnates at 0%, indicating a lack of overall economic expansion.

However, there are some positive signs, such as a modest industrial production growth rate of 1.2%. Yet, the current account deficit of -0.5% and inflation rate of 2.8% pose further economic considerations.

Policymakers in the Eurozone face the challenge of balancing these various factors to ensure sustainable economic growth and stability while addressing issues of fiscal responsibility and consumer confidence.

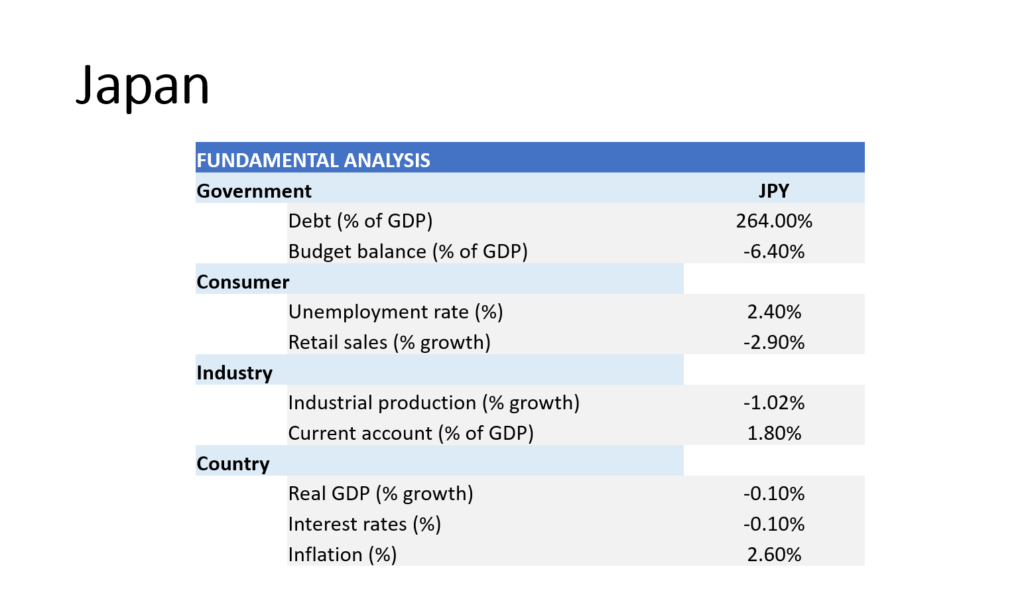

Japan Macroeconomic data:

The macroeconomic data for Japan paints a challenging economic landscape with several notable indicators. The country faces a staggering debt-to-GDP ratio of 264% and a significant government budget deficit of -6.4%, highlighting substantial fiscal pressures.

However, despite these fiscal challenges, Japan maintains a remarkably low unemployment rate of 2.4%, indicating a resilient labor market. Nevertheless, negative retail sales growth at -2.9% and a decline in industrial production by -1.02% suggest weaknesses in consumer spending and manufacturing activity, posing obstacles to economic growth.

Despite a current account surplus of 1.8%, indicating a favorable balance in international trade, real GDP growth remains stagnant at -0.1%, reflecting overall economic stagnation. With interest rates at -0.1%, the economy grapples with deflationary pressures, despite inflation hovering at 2.6%.

Japan’s macroeconomic bias appears characterized by a delicate balance between strong labor market fundamentals and persistent challenges in stimulating economic growth and managing fiscal imbalances. Addressing these challenges will likely require comprehensive policy measures aimed at fostering sustained economic expansion while ensuring fiscal sustainability.

Now, we compare the two economies to gauge whether we are fundamentally long or short the EUR/JPY pair.

To gauge the fundamental bias for the Euro area and Japan, we’ll analyze each indicator and its implications for the respective economies:

1. Debt to GDP Ratio:

– Euro Area: 90.9%

– Japan: 264%

Both economies have relatively high levels of debt compared to their GDP. Japan’s debt to GDP ratio is significantly higher, indicating a greater burden of debt on its economy.

2. Government Budget Balance:

– Euro Area: -3.6%

– Japan: -6.4%

Both economies have negative government budget balances, indicating fiscal deficits. Japan’s deficit is larger, suggesting greater government spending relative to revenue.

3. Unemployment Rate:

– Euro Area: 6.4%

– Japan: 2.4%

Japan has a lower unemployment rate compared to the Euro area, indicating a healthier labor market in Japan.

4. Retail Sales Growth:

– Euro Area: -1.1%

– Japan: -2.9%

Both economies are experiencing negative retail sales growth, suggesting subdued consumer spending.

5. Industrial Production:

– Euro Area: 1.2%

– Japan: -1.02%

The Euro area has positive industrial production growth, while Japan’s industrial production is contracting.

6. Current Account to GDP Ratio:

– Euro Area: -0.5%

– Japan: 1.8%

Japan has a positive current account to GDP ratio, indicating a surplus in its balance of trade and investment income, whereas the Euro area has a deficit.

7. Real GDP Growth:

– Euro Area: 0%

– Japan: -0.1%

Both economies are experiencing stagnant or negative real GDP growth, suggesting economic challenges.

8. Interest Rates:

– Euro Area: 4.5%

– Japan: -0.1%

The Euro area has positive interest rates, while Japan’s interest rates are negative, indicating loose monetary policy in Japan.

9. Inflation:

– Euro Area: 2.8%

– Japan: 2.6%

Both economies have moderate inflation rates, with slightly higher inflation in the Euro area.

Fundamental Bias Assessment:

Based on the provided indicators:

– Euro Area: The economy shows signs of moderate growth with positive industrial production, but challenges such as high debt levels and fiscal deficits persist. The positive interest rates indicate a less accommodative monetary policy stance.

– Japan: While the unemployment rate is low and there’s a positive current account balance, the economy faces significant challenges such as high debt levels, deflationary pressures, and negative interest rates. The contraction in industrial production and negative real GDP growth indicate economic weakness.

Overall, the Euro area appears to have a slightly more favorable fundamental bias compared to Japan, although both economies face significant challenges that warrant careful consideration in forex trading decisions. Thus, we are fundamentally long on EUR and fundamentally short on JPY.

Technically, we look at the EUR/JPY chart on the daily frame:

From the chart above, we can see that the EUR/JPY is moving upward in a nice uptrend since late December, 2023. We can use our fundamental bias to find trading opportunities and not the way around. It is important to note that fundamental data move the price and traders use technical analysis to time their entries based on their fundamental views.

Also read about The Ultimate Guide to Fundamental Analysis in Forex Trading!

Overcoming Common Challenges and Misconceptions

Forex trading can be a challenging endeavor, especially for beginners who are just starting their trading journey. In this chapter, we’ll address some of the common challenges and misconceptions in forex trading and provide practical tips on how to overcome them.

Addressing Fear and Uncertainty in Trading

Fear and uncertainty are common emotions that can impact traders’ decision-making processes. Whether it’s fear of losing money, fear of missing out on opportunities, or fear of making mistakes, these emotions can cloud judgment and lead to irrational behavior. To overcome fear and uncertainty in trading, it’s essential to develop a disciplined trading plan, stick to predefined risk management rules, and focus on the long-term goals rather than short-term fluctuations.

Common Pitfalls to Avoid

There are several common pitfalls that traders often fall into, which can hinder their success in forex trading. These pitfalls include overtrading, chasing the market, neglecting risk management, and failing to adapt to changing market conditions. By being aware of these pitfalls and taking proactive steps to avoid them, traders can improve their chances of success in the forex market.

Managing Risk in Forex Trading

Risk management is a crucial aspect of forex trading that is often overlooked by novice traders. Effective risk management involves assessing the potential risks associated with each trade, setting appropriate stop-loss levels, and managing position sizes to limit exposure. By implementing sound risk management practices, traders can protect their capital and survive in the long run, even in the face of adverse market conditions.

Developing Emotional Discipline

Emotional discipline is the ability to control one’s emotions and stick to a trading plan, even in the face of adversity. It’s natural for traders to experience emotions such as greed, fear, and hope, but it’s essential to keep these emotions in check and make decisions based on logic and analysis rather than impulse. Developing emotional discipline takes time and practice, but it’s a critical skill that can significantly improve trading performance.

Continuous Learning and Improvement

Forex trading is a dynamic and ever-evolving field, and successful traders are those who are committed to continuous learning and improvement. Whether it’s staying updated on market developments, learning new trading strategies, or analyzing past trades for lessons learned, there’s always room for growth and development in forex trading. By investing in education and actively seeking opportunities to improve, traders can stay ahead of the curve and adapt to changing market conditions.

Developing a Trading Strategy

A trading strategy is a set of rules and criteria that guide a trader’s decision-making process in the forex market. In this chapter, we’ll discuss how to develop a trading strategy that incorporates fundamental analysis and technical analysis to make informed trading decisions.

Building Your Trading Plan

A trading plan is a roadmap that outlines your trading goals, risk tolerance, trading style, and entry and exit criteria. Before you start trading, it’s essential to develop a comprehensive trading plan that aligns with your financial goals and personal preferences. Your trading plan should include:

– Clear Goals and Objectives: Define your financial goals and objectives for trading, such as profit targets, risk tolerance, and time horizon.

– Trading Style: Determine your preferred trading style, whether it’s day trading, swing trading, or long-term investing.

– Risk Management Rules: Establish risk management rules, including position sizing, stop-loss levels, and maximum risk per trade.

– Entry and Exit Criteria: Define your criteria for entering and exiting trades, based on both fundamental and technical analysis signals.

– Trading Schedule: Set a trading schedule that aligns with your availability and trading preferences.

Setting Clear Goals and Objectives

Setting clear and achievable goals is essential for success in forex trading. Whether your goal is to generate supplemental income, achieve financial freedom, or simply grow your trading account, it’s essential to define your goals and develop a plan to achieve them. Setting specific, measurable, attainable, relevant, and time-bound (SMART) goals can help keep you focused and motivated on your trading journey.

Backtesting Your Strategy

Backtesting is the process of testing a trading strategy using historical data to assess its performance and effectiveness. By backtesting your strategy, you can identify strengths and weaknesses, optimize parameters, and gain confidence in your trading approach. It’s essential to use high-quality historical data and realistic trading conditions when backtesting your strategy to ensure accurate results.

Monitoring and Adjusting Your Approach

The forex market is dynamic and constantly evolving, so it’s essential to monitor your trading strategy’s performance and adapt to changing market conditions. Keep track of your trades, analyze your results, and identify areas for improvement. If your strategy is not producing the desired results, be willing to make adjustments and refine your approach based on feedback and experience.

Developing a trading strategy that incorporates fundamental analysis and technical analysis is a key step towards becoming a successful forex trader. By setting clear goals, establishing a disciplined trading plan, and continuously monitoring and adjusting your approach, you can increase your chances of success in the forex market. Remember that consistency, patience, and perseverance are essential qualities for long-term success in trading.

Resources and Further Learning

Continuing education is essential for success in forex trading, and there are many valuable resources available to help you expand your knowledge and skills. In this chapter, we’ll discuss recommended books, websites, and trading communities to support your ongoing learning journey in the world of forex trading.

Recommended Books and Websites

1. “Currency Trading for Dummies” by Kathleen Brooks and Brian Dolan: This comprehensive guide covers everything from the basics of forex trading to advanced trading strategies, making it an excellent resource for beginners and experienced traders alike.

2. Investopedia (www.investopedia.com): Investopedia offers a wealth of educational content on forex trading, including tutorials, articles, and market insights. Their comprehensive resources cover a wide range of topics, from technical analysis to risk management.

3. Babypips (www.babypips.com): Babypips is a popular online resource for forex education, offering a free beginner’s course that covers the basics of forex trading in a beginner-friendly manner. Their forums are also a valuable platform for interacting with other traders and sharing insights.

4. Forex Factory (www.forexfactory.com): Forex Factory is a leading forex forum and calendar platform that provides real-time market data, news, and economic events. Traders can use the platform to stay updated on market developments and engage with the trading community.

Joining Forex Trading Communities

1. Forex Reddit (www.reddit.com/r/Forex): The Forex subreddit is a vibrant community of traders sharing insights, strategies, and market analysis. It’s a great place to connect with other traders, ask questions, and stay updated on the latest developments in the forex market.

2. Forex Factory Forums (www.forexfactory.com/forum.php): The Forex Factory forums are one of the largest online communities for forex traders, with discussions covering a wide range of topics, including trading strategies, broker reviews, and trading systems.

3. TradingView (www.tradingview.com): TradingView is a social network for traders and investors, offering real-time charting tools, technical analysis, and trading ideas. Traders can follow other members, share charts and analysis, and participate in discussions.

By leveraging the resources and learning opportunities discussed in this chapter, you can continue to expand your knowledge and skills in forex trading. Whether you prefer books, online courses, forums, or social networks, there’s a wealth of information available to support your journey towards becoming a successful forex trader. Remember to stay curious, stay engaged, and never stop learning!

Conclusion

Congratulations on completing this guide. Throughout this guide, we’ve covered the fundamentals of forex trading, explored the role of fundamental analysis in making informed trading decisions, and discussed practical strategies for success in the forex market.

Forex trading offers an exciting opportunity for individuals to participate in the global financial markets and potentially achieve their financial goals. By understanding the basics of currency trading, mastering fundamental analysis techniques, and developing a disciplined trading plan, you can increase your chances of success in the forex market.

Remember that forex trading is not without its challenges, and success requires dedication, patience, and continuous learning. Whether you’re a beginner just starting your trading journey or an experienced trader looking to refine your skills, there’s always room for growth and improvement in forex trading.