When it comes to forex markets, central banks wield significant influence—not just through the policies they implement but also through how they communicate those policies. In fact, the words and tone used by central bankers can sometimes drive market movements more than the actual decisions themselves. For traders, this creates an opportunity: by understanding and interpreting these subtle signals, they can gain valuable insight into future monetary policy shifts and market trends.

In this article, we’ll dive into the strategies central banks use to communicate their intentions and explore how traders can decode these messages to refine their trading strategies.

Central Banks and Their Role in Forex Markets

Institutions like the Federal Reserve (Fed), the European Central Bank (ECB), and the Bank of Japan (BoJ) play a pivotal role in shaping the forex market. Through tools like interest rate adjustments, quantitative easing, and other monetary measures, they influence currency values and overall economic stability.

However, it’s not just the decisions themselves that impact markets—it’s also how those decisions are communicated. Traders and investors scrutinize every word, press conference, and official statement for clues about what might come next. Even a subtle change in language or tone can trigger significant market movements, creating opportunities for those paying close attention.

How Central Banks Shape Market Expectations

Central banks have perfected the art of using communication to guide market expectations, often without needing to take immediate action. By signaling their intentions early, they can influence market behavior and shape economic outcomes. Here’s a closer look at some of their key communication strategies:

Forward Guidance: Paving the Way for Future Moves

Forward guidance is a tool central banks use to provide hints about the direction of future monetary policy. Sometimes, the message is explicit—like committing to keeping interest rates low until certain economic goals are met. Other times, it’s more subtle, leaving room for interpretation.

For instance, in recent years, the Federal Reserve has repeatedly emphasized its commitment to an accommodative policy stance until inflation stabilizes around 2% and full employment is achieved. Such transparency helps traders anticipate future actions and align their strategies accordingly.

Speeches: Reading Between the Lines

When central bankers speak, every word is carefully chosen—and traders know it. Words like “vigilant,” “patient,” or “accommodative” often signal shifts in policy direction, from dovish (favoring looser monetary policy) to hawkish (favoring tighter monetary policy).

Take the ECB as an example. If the ECB President moves from a dovish tone to a more hawkish one, the Euro may strengthen as traders anticipate tighter monetary policy. The ability to pick up on these subtle shifts can be a game-changer for forex traders.

Press Conferences and Q&A: Clarity Meets Volatility

Press conferences following policy meetings are a goldmine for traders. While the official statement sets the tone, it’s often during the Q&A sessions that central bankers reveal their confidence—or concerns—about the economy.

For example, after an FOMC meeting, the Fed Chair’s responses to journalists’ questions can lead to immediate market reactions. Even a seemingly minor comment can send shockwaves through the forex market, as traders recalibrate their expectations.

Official Statements and Meeting Minutes: Reading the Fine Print

Central banks carefully craft their official statements and meeting minutes, often tweaking language to reflect subtle changes in their outlook. For traders, these small shifts can be incredibly telling.

For instance, if the Fed shifts its description of inflation from “transitory” to “persistent,” it could indicate a more aggressive approach to raising interest rates—likely boosting the U.S. dollar. The key is to compare these updates with previous statements to spot meaningful changes.

How to Decode Central Bank Communication

Interpreting central bank language isn’t just about understanding the words—they must be analyzed within the context of current economic conditions. Here are a few tips to help traders decode these signals like a pro:

- Pay Attention to Key Phrases: Changes in language compared to previous communications are often intentional. If certain words or phrases are repeated, it could signal a strong commitment to a particular policy direction.

- Understand the Economic Backdrop: The significance of central bank communication depends on the context. For example, a hawkish tone during a period of high inflation might carry more weight than during stable economic times.

- Watch Market Reactions: Analyze how markets react immediately following central bank announcements. Sharp currency movements can provide insight into how others are interpreting the message.

- Compare Central Banks: It’s not just about what one central bank is doing but how their stance compares to others. For instance, if both the Fed and ECB adopt hawkish tones, but the ECB seems more aggressive, the Euro might strengthen against the dollar.

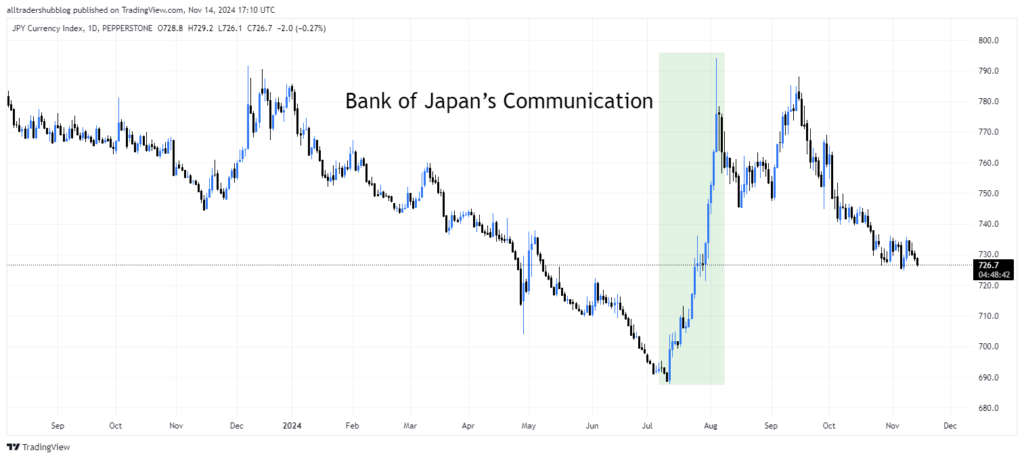

Recent Example: The Bank of Japan’s Communication

In late 2024, the BoJ surprised markets by signaling a potential shift away from its ultra-loose monetary policy. While the BoJ did not immediately raise rates, the more hawkish tone led to a rapid appreciation of the Japanese yen as traders anticipated tighter policy in the near future. This example highlights how even subtle changes in communication can have outsized effects on currency markets.

Conclusion

Central bank communication is a powerful tool that influences forex markets just as much—if not more—than actual policy decisions. By learning to interpret the language and tone of central bankers, traders can gain a valuable edge in predicting market movements and adjusting their strategies.

Whether it’s a speech, an official statement, or a press conference, the words of central bankers carry weight. Staying attuned to these signals and understanding the economic context can help traders react more effectively to an ever-changing market landscape.