Inflation data is crucial for forex traders because it directly impacts currency values and central bank policies. Two of the most important inflation measures that traders monitor are the Consumer Price Index (CPI) and the Producer Price Index (PPI). Understanding these two indices and their effects on the forex markets can provide traders with valuable insights into economic health and potential currency trends.

This article explores the differences between CPI and PPI, discusses their significance in forex trading, and helps traders decide which inflation measure to prioritize in their analysis.

What is CPI?

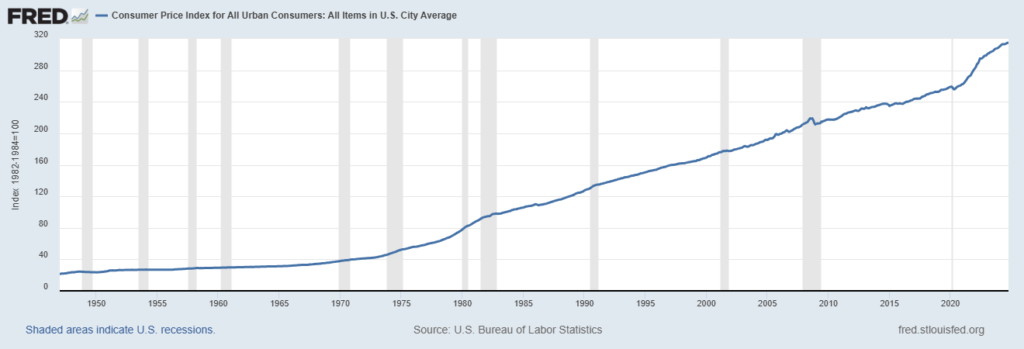

The Consumer Price Index (CPI) is a measure that tracks the average change in prices paid by consumers for a fixed basket of goods and services over time. In simpler terms, CPI reflects the cost of living, which includes essentials such as food, housing, transportation, and healthcare. Central banks closely monitor CPI as it is a primary indicator of inflation or deflation within an economy.

How CPI Affects Forex Markets:

- Influences Central Bank Decisions: Central banks like the Federal Reserve and the European Central Bank use CPI data to assess inflation levels. If CPI rises above target inflation rates, central banks may raise interest rates to cool off the economy. Conversely, if CPI falls below targets, they might lower interest rates to encourage spending. Such interest rate adjustments directly impact currency values.

- Signals Economic Health: A rising CPI generally indicates economic growth, as higher consumer demand often drives up prices. Conversely, a declining CPI may suggest weakening demand or deflationary pressures, which can signal an economic downturn. Forex traders use CPI data to gauge a country’s economic strength relative to others, helping them decide which currencies to buy or sell.

What is PPI?

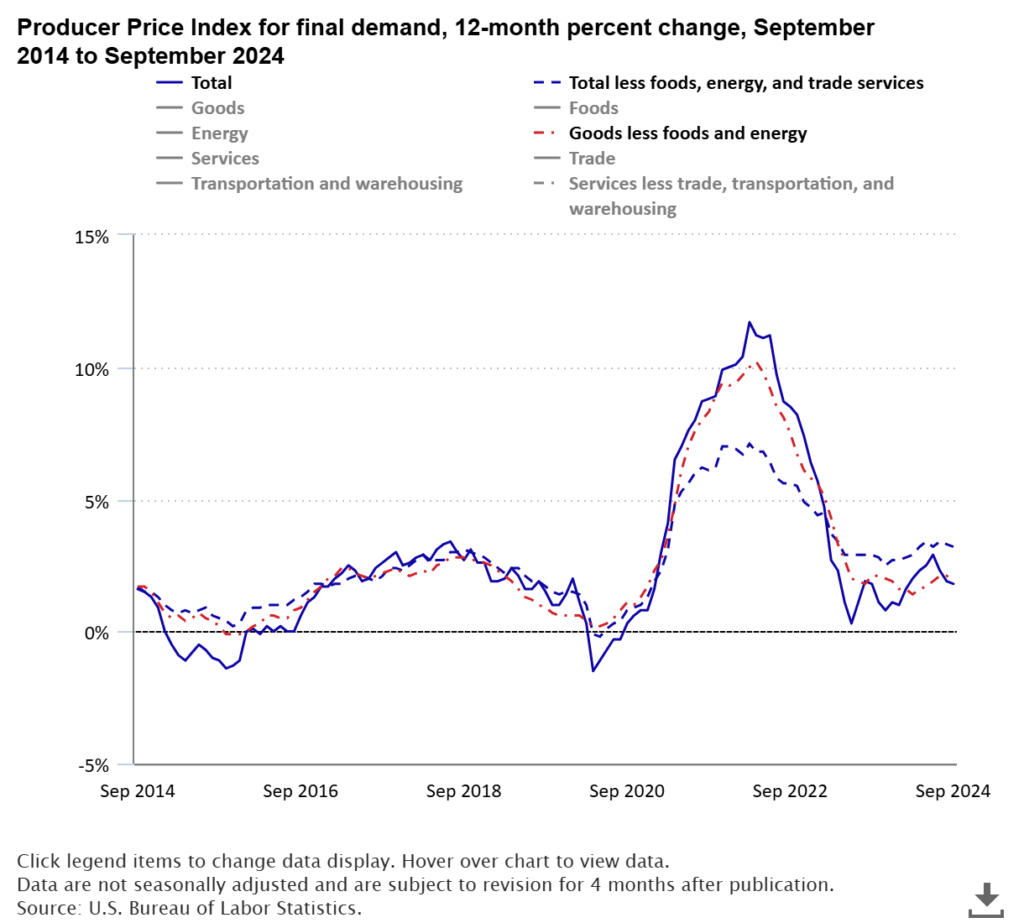

The Producer Price Index (PPI), on the other hand, measures the average change in selling prices received by domestic producers for their goods and services over time. PPI primarily tracks wholesale and production-level prices, making it a leading indicator of inflation. PPI includes data from different stages of production—such as raw materials, intermediate goods, and finished products—offering a broad view of price trends within the production pipeline.

How PPI Affects Forex Markets:

- Provides Early Inflation Signals: PPI is considered a leading indicator of inflation because rising production costs often lead to higher consumer prices. When producers face higher costs, they tend to pass these costs onto consumers, which eventually affects the CPI. Forex traders use PPI data as an early signal of future CPI trends, helping them anticipate central bank actions and potential currency shifts.

- Reflects Business Costs: Rising PPI can indicate increased costs for businesses, which may reduce profit margins if they cannot pass the costs on to consumers. If PPI data consistently shows inflationary pressures, it may prompt central banks to consider tightening monetary policy. These expectations can drive demand for a country’s currency as investors seek higher yields.

CPI vs. PPI: Key Differences

While CPI and PPI both measure inflation, they focus on different stages within the economy and offer unique insights for forex traders. Here’s a breakdown of their main differences:

| Feature | CPI | PPI |

|---|---|---|

| Focus | Tracks retail prices paid by consumers | Tracks wholesale prices received by producers |

| Components | Goods and services in a consumer basket | Raw materials, intermediate goods, and finished products |

| Timing | Reflects current inflation impacting consumers | Often signals future inflation that will impact consumers |

| Impact | Directly affects consumer spending and living costs | Impacts business costs and profitability |

| Monitored By | Central banks to adjust interest rates | Forex traders for early inflation signs |

Both indices are vital to understanding inflationary pressures within an economy, but they serve different purposes. CPI offers a direct measure of consumer inflation, which affects household spending and is central to central bank policies. PPI, meanwhile, provides insights into production-level price trends, giving forex traders an early indication of potential future CPI changes.

How CPI and PPI Impact Currency Values

The significance of both CPI and PPI in forex trading lies in their influence on currency values. Here’s how they impact the forex markets:

- Interest Rate Expectations: Central banks rely on CPI data to make interest rate decisions, as it reflects inflation impacting consumers. However, PPI can act as an early warning of potential CPI increases, giving traders clues about future rate changes. Higher interest rates often strengthen a currency, as investors seek higher returns on investments within that currency.

- Currency Demand Fluctuations: Rising CPI and PPI data typically suggest inflation, which can trigger central bank interventions to curb it. Higher interest rates due to rising inflation can increase demand for a currency, as higher rates attract foreign investors looking for better returns. Forex traders monitor these data points to anticipate changes in demand for currencies.

- Currency Pair Trends: CPI and PPI data impact specific currency pairs differently. For example, a higher-than-expected CPI reading for the US dollar (USD) may lead traders to buy USD against other currencies like the euro (EUR) or Japanese yen (JPY), expecting the Federal Reserve to raise interest rates. Similarly, a high PPI reading can lead traders to anticipate a CPI rise, potentially boosting demand for the USD even before the CPI release.

Which Inflation Measure Matters More for Forex Traders?

When it comes to prioritizing between CPI and PPI, it ultimately depends on the trading strategy and timeline:

- Short-Term Traders: Forex traders focused on short-term price movements may prioritize PPI data, as it offers early indications of inflation trends. By reacting to PPI changes, short-term traders can position themselves ahead of the CPI release, capitalizing on anticipated shifts in central bank policy.

- Long-Term Traders: Traders with a longer time horizon are likely to place more importance on CPI data, as it directly affects consumer behavior, central bank decisions, and interest rates. CPI is also a more widely recognized indicator among policymakers, so long-term forex traders often focus on CPI to gauge the overall health of an economy.

Ultimately, for forex traders, both CPI and PPI provide valuable insights into inflation and economic conditions. By understanding how these indices impact currency values, traders can make more informed decisions and navigate the complexities of the forex markets effectively.

Conclusion

In the debate of CPI vs. PPI in forex trading, the most effective approach is to consider both indices together. CPI directly impacts consumer inflation and central bank decisions, while PPI offers early signals of inflationary trends in production. Monitoring these inflation measures for forex traders can help predict currency movements and refine trading strategies. By keeping an eye on both CPI and PPI, traders can better prepare for shifts in global inflation and make well-informed trading decisions.