Consumer Price Index, or CPI data is one of the most closely watched indicators in the forex market, as it reflects changes in inflation, which directly influences central bank policy decisions.

For forex traders, understanding how CPI data in forex trading impacts major currency pairs can provide a strategic edge. By analyzing CPI releases, traders can anticipate currency movements based on expected changes in monetary policy, making it an essential element of fundamental analysis.

In this article, we’ll dive into how CPI reports influence major currency pairs like EUR/USD and GBP/USD, with examples of trading strategies based on CPI data.

What is CPI and Why is it Important?

The Consumer Price Index (CPI) measures the average price change over time of a fixed basket of goods and services purchased by consumers. It serves as a primary indicator of inflation and cost-of-living changes in an economy. Central banks monitor CPI data closely because their primary goal is to maintain price stability.

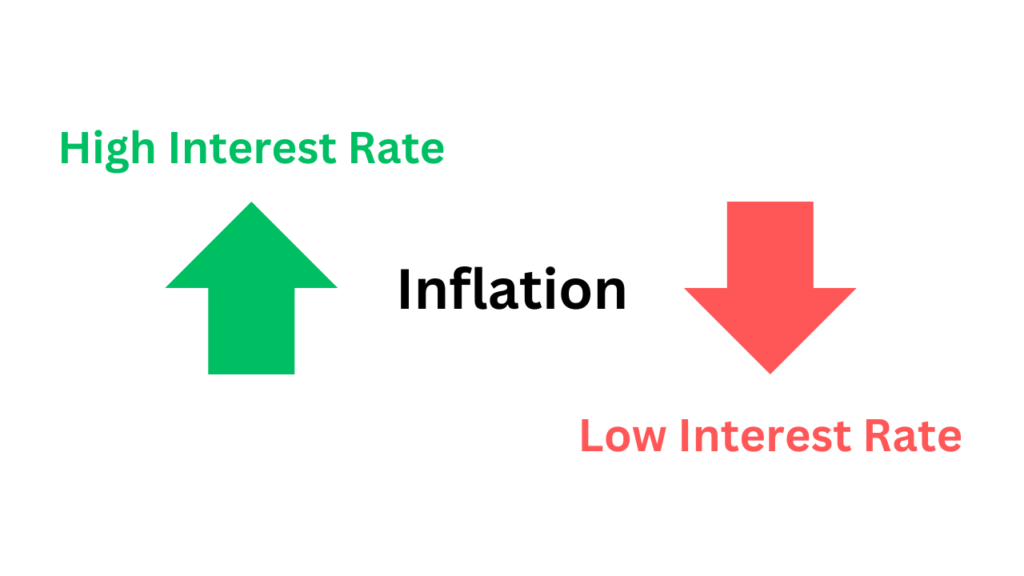

When CPI rises too quickly, indicating high inflation, central banks may raise interest rates to cool down the economy. Conversely, if CPI is low, they may lower rates to encourage spending and investment.

How CPI Affects Major Currency Pairs

CPI data can have significant implications for currency pairs, especially those involving major economies like the United States, the Eurozone, and the United Kingdom. Here’s how CPI data in forex trading affects key currency pairs:

EUR/USD:

The U.S. dollar and euro are two of the most traded currencies globally. CPI data from either the United States or the Eurozone can influence the EUR/USD exchange rate, as central banks (the Federal Reserve for USD and the European Central Bank for EUR) use inflation data to guide interest rate policy.

For example, if U.S. CPI data shows higher-than-expected inflation, traders may anticipate an interest rate hike by the Federal Reserve, which could strengthen the dollar against the euro. In contrast, if CPI data shows lower inflation in the Eurozone, the euro may weaken as traders expect the European Central Bank to adopt a more dovish stance.

GBP/USD:

The GBP/USD pair is another major currency pair affected by CPI data, with both the Bank of England (BoE) and the Federal Reserve closely monitoring inflation. If the U.K. posts strong CPI numbers, indicating rising inflation, the BoE might raise interest rates, which would likely strengthen the British pound against the U.S. dollar.

Conversely, lower-than-expected U.K. CPI data might weaken the pound as traders anticipate that the BoE will maintain lower interest rates, making GBP less attractive relative to USD.

USD/JPY:

CPI data also impacts USD/JPY, as inflation trends affect both the Federal Reserve’s and the Bank of Japan’s (BoJ) policy directions. Since Japan has historically low inflation and often relies on stimulus policies, stronger U.S. inflation data can increase the appeal of USD against JPY if the Fed leans toward rate hikes. However, if Japan’s inflation unexpectedly rises, the yen may strengthen, leading to shifts in the USD/JPY pair.

AUD/USD:

The Australian dollar is sensitive to both domestic CPI and global inflation trends, especially those in the U.S. Strong CPI in Australia might prompt the Reserve Bank of Australia (RBA) to raise rates, strengthening AUD. Conversely, strong U.S. CPI often strengthens the USD against AUD, especially if the Federal Reserve hints at rate hikes.

Interpreting CPI Data in Forex Trading

To make the most of CPI data, forex traders must understand how to interpret CPI reports and how central banks might respond to inflation changes. Here are some strategies for incorporating CPI data in forex trading:

- Compare Expected vs. Actual CPI Figures:

- The market often anticipates a certain CPI figure based on forecasts. If the actual CPI release is significantly higher or lower than expected, it can lead to sharp currency movements. For instance, if U.S. CPI comes in much higher than forecasted, USD might strengthen as traders expect the Fed to raise rates.

- Monitoring economic calendars and understanding CPI forecasts can help traders prepare for potential volatility.

- Focus on Core CPI vs. Headline CPI:

- Core CPI, which excludes volatile food and energy prices, is often more indicative of underlying inflation trends. Many central banks focus on core CPI when determining rate policy, so traders should watch this measure closely.

- For example, if U.S. core CPI rises more than expected, USD might rally against other currencies as the market prices in potential Fed tightening.

- Understand Regional CPI Differences:

- CPI can vary greatly from one economy to another, and forex traders should be aware of these differences. For example, while the U.S. might experience rising CPI and higher rates, the Eurozone could face lower inflation, which might lead to a dovish ECB stance, weakening EUR against USD.

Examples of Trading Strategies Based on CPI Data

Trade CPI Surprises:

CPI surprises—when actual data deviates from market expectations—often create quick trading opportunities. Traders can capitalize on this by entering positions immediately after the release, depending on the direction of the surprise.

For instance, if U.S. CPI is released significantly higher than expected, traders might go long on USD/EUR, anticipating dollar strength as the Fed could raise rates sooner.

Long-Term Positioning Based on Inflation Trends:

For traders with a longer outlook, analyzing inflation trends over several months can provide insight into a central bank’s policy trajectory. For example, if inflation in the Eurozone is consistently below the ECB’s target, traders might expect ongoing euro weakness.

In this scenario, traders might adopt a bearish stance on EUR/USD, expecting the ECB to maintain low interest rates compared to the Federal Reserve, which may raise rates if U.S. inflation trends upward.

Using CPI Data as a Confirmation Tool:

CPI data can be used to confirm existing trends. For instance, if the USD is already on an upward trend against EUR due to strong U.S. economic data, a higher-than-expected CPI report might reinforce the trend and lead traders to strengthen their long positions on USD/EUR.

Similarly, if a currency pair is showing weakness, weaker CPI data can serve as confirmation to short the currency in anticipation of continued policy easing.

Combine CPI Data with Other Indicators:

CPI should be used alongside other economic indicators, such as GDP growth, employment data, and retail sales. A high CPI figure paired with strong job growth might suggest robust economic health, supporting a currency’s strength, while high inflation paired with low growth could lead to different outcomes.

For example, if U.K. CPI is high but job growth is sluggish, the Bank of England may hesitate to raise rates, which might lead traders to short GBP/USD in anticipation of a dovish stance.

Example: CPI Data and the Federal Reserve

The Federal Reserve closely watches U.S. CPI data to guide its policy decisions. During periods of high inflation, such as in the post-COVID recovery phase, rising CPI figures led the Fed to signal potential rate hikes to curb inflation. This contributed to a stronger dollar as investors expected tighter monetary policy.

For example, if the U.S. CPI rises sharply while Eurozone CPI remains low, USD/EUR may strengthen as traders expect the Fed to raise rates faster than the ECB. By analyzing CPI trends and central bank policy responses, forex traders can strategically position themselves to benefit from expected currency movements.

Conclusion

Incorporating CPI data in forex trading is essential for understanding how inflation impacts currency values and central bank policies. By tracking CPI releases and interpreting the data in a broader economic context, forex traders can make informed decisions and develop effective trading strategies. Whether focusing on CPI surprises or using inflation trends to confirm market sentiment, CPI analysis can provide valuable insights for forex trading in today’s data-driven environment.