Interest rate decisions made by central banks, especially the U.S. Federal Reserve (Fed), have a major impact on the forex market. These decisions directly influence currency values by shaping the broader economic outlook and driving investor sentiment.

For forex traders, understanding how interest rate decisions work and the ripple effects they create in currency markets is essential. This knowledge can help traders anticipate market movements and make more informed decisions.

What Are Interest Rates?

Interest rates represent the cost of borrowing money. Central banks, like the U.S. Federal Reserve (Fed), the European Central Bank (ECB), and the Bank of England (BoE), set these benchmark rates to manage inflation, promote economic growth, and maintain financial stability. These rates affect a wide range of financial activities, from mortgage and loan costs to the returns people earn on their savings and investments.

How Interest Rate Decisions Impact Forex Markets

Interest rate decisions made by central banks are some of the most closely followed events in the financial world. These decisions don’t just affect the domestic economy—they also have a global influence on forex markets.

When a central bank raises or lowers its benchmark interest rate, it triggers a ripple effect. This impacts everything from consumer spending to international capital flows, ultimately influencing the value of currencies.

For forex traders, understanding how these rate adjustments work—and their broader effects on currency movements—is essential for making informed trading decisions.

Currency Appreciation or Depreciation

Rate Hikes:

When a central bank raises interest rates, it often leads to an appreciation of that country’s currency. Higher rates make investments in that currency more appealing by offering better returns, which attracts foreign capital and increases demand for the currency. For instance, if the Federal Reserve hikes rates, the U.S. dollar typically strengthens against other currencies.

Rate Cuts:

On the other hand, when a central bank lowers interest rates, it usually causes the currency to depreciate. Lower rates make the currency less attractive to investors, reducing demand and weakening its value. For example, if the European Central Bank cuts rates, the euro may lose value against stronger currencies like the U.S. dollar or Japanese yen.

Impact on Economic Indicators

Interest rate decisions are heavily influenced by key economic indicators such as inflation, GDP growth, and unemployment. Central banks might raise rates to combat rising inflation or lower them to stimulate economic growth during slowdowns. These decisions reflect the central bank’s view of the economy, and forex traders closely monitor them to anticipate potential currency movements.

Investor Sentiment and Risk Appetite

Interest rate decisions also shape investor sentiment and risk appetite. Higher rates often increase demand for the country’s bonds and equities, as they offer better returns. This inflow of capital can strengthen the currency. Conversely, lower rates may encourage investors to seek higher-yielding, riskier assets in other countries, which can weaken the currency.

For forex traders, understanding how rate changes influence capital flows and investor behavior is crucial for identifying trading opportunities.

Carry Trade Opportunities

Traders often engage in carry trades, where they borrow in a currency with a low-interest rate and invest in a currency with a higher rate. When interest rates rise in one country relative to another, it can increase the attractiveness of carry trades, leading to stronger demand for the higher-yielding currency.

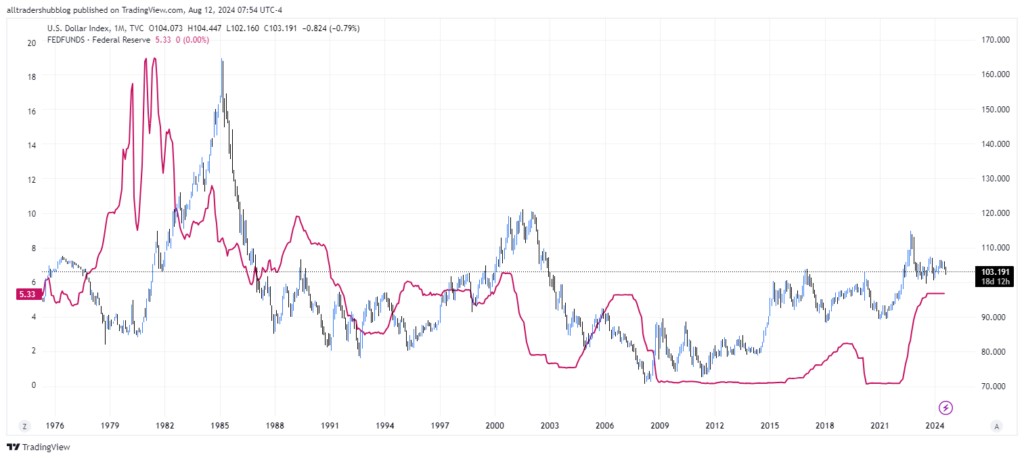

Example: U.S. Federal Reserve’s Rate Decisions

When the Fed raises interest rates, it generally strengthens the U.S. dollar. Higher rates make holding U.S. assets more attractive because they offer better returns.

Conversely, when the Fed cuts rates, the dollar typically weakens as returns on U.S. assets diminish, making them less attractive to investors. This change in demand impacts the exchange rates of major currency pairs.

As of September 2024, the U.S. Federal Reserve is expected to cut interest rates due to slowing economic activity and moderating inflation. This potential rate cut has significant implications for the forex market, particularly for the U.S. dollar. Traders are already pricing in the likelihood of a weaker dollar as the Fed shifts from its previous tightening cycle.

The anticipated rate cuts highlight how central banks adjust policies in response to economic conditions and how these changes can impact currency values globally.

Trading Strategies in Response to Rate Cuts

Forex traders should closely monitor the Fed’s actions and the accompanying economic data. A rate cut typically leads to a weaker U.S. dollar, which could present opportunities to trade currency pairs like EUR/USD or GBP/USD, where the non-U.S. currency may strengthen relative to the dollar.

However, traders must also consider the broader economic context and potential market volatility when planning their trades.

Conclusion

Interest rate decisions are a powerful tool used by central banks to influence their economies, and they have a direct impact on the forex markets. For traders, understanding these decisions and their effects on currency values is essential for making informed trading decisions. By monitoring central bank policies and economic indicators, forex traders can better predict currency movements and capitalize on opportunities in the market.