Interest rate differentials are a major driver in the forex market, directly influencing currency values and guiding trader decisions. When it comes to any currency pair, the gap between the interest rates set by their respective central banks plays a significant role in determining how that pair moves. Traders keep a close eye on these differentials because they can indicate where capital might flow in search of higher returns, opening up potential opportunities for profit.

To fully understand the impact of interest rate differentials, you need a solid foundation in fundamental analysis and an awareness of the broader economic factors that shape central bank decisions. This guide will break down what interest rate differentials are, how they influence currency pairs, and how you can use this information to create more effective trading strategies. Whether you’re new to forex or looking to refine your approach, understanding this concept is essential for staying ahead in the market.

Understanding Interest Rates and Their Role in Forex Markets

Interest rates are one of the most important factors in finance, acting as a key indicator of a country’s economic health. In the forex market, they heavily influence currency values and shape the decisions traders make.

To see how interest rates affect currencies, it’s important to understand what they are, why they change, and how those changes impact the forex market.

What are Interest Rates?

Interest rates reflect the cost of borrowing money or the return earned on lending it. For example, if you take out a loan, the interest rate determines how much extra you’ll pay in addition to the loan amount. Similarly, when you deposit money in a bank, the interest rate tells you how much your savings will grow.

In forex trading, interest rates are typically set by a country’s central bank. These rates act as a benchmark for the broader economy, influencing how commercial banks lend money to businesses and consumers. For instance, the Federal Reserve (Fed) in the U.S. sets the Federal Funds Rate, while the European Central Bank (ECB) manages the Main Refinancing Rate.

What Drives Interest Rate Changes?

Central banks adjust interest rates as part of their monetary policy to meet specific economic goals like controlling inflation, promoting growth, or stabilizing the currency. The main factors they consider include:

1. Inflation

Inflation measures how quickly prices for goods and services are rising. When inflation is high, central banks may raise interest rates to slow it down. Higher rates make borrowing more expensive, which reduces spending and investment, ultimately helping to curb inflation.

On the flip side, if inflation is too low, central banks may lower interest rates to encourage borrowing and spending, which can help stimulate economic growth.

2. Economic Growth (GDP)

Strong GDP growth often signals rising demand for goods and services, which can lead to higher inflation. In such cases, central banks might raise rates to keep the economy from overheating.

During recessions or slowdowns, central banks usually lower interest rates to make borrowing cheaper and encourage spending, which can help kickstart growth.

3. Employment Data

Job market strength is another key factor. High employment often points to a healthy economy and can lead to higher interest rates to prevent inflation. In contrast, high unemployment might push central banks to cut rates to support job creation and recovery.

4. Central Bank Stance: Hawkish vs. Dovish

When central banks take a hawkish approach, they prioritize controlling inflation, which usually leads to higher interest rates. A dovish stance, on the other hand, focuses on boosting growth and employment, often resulting in lower rates.

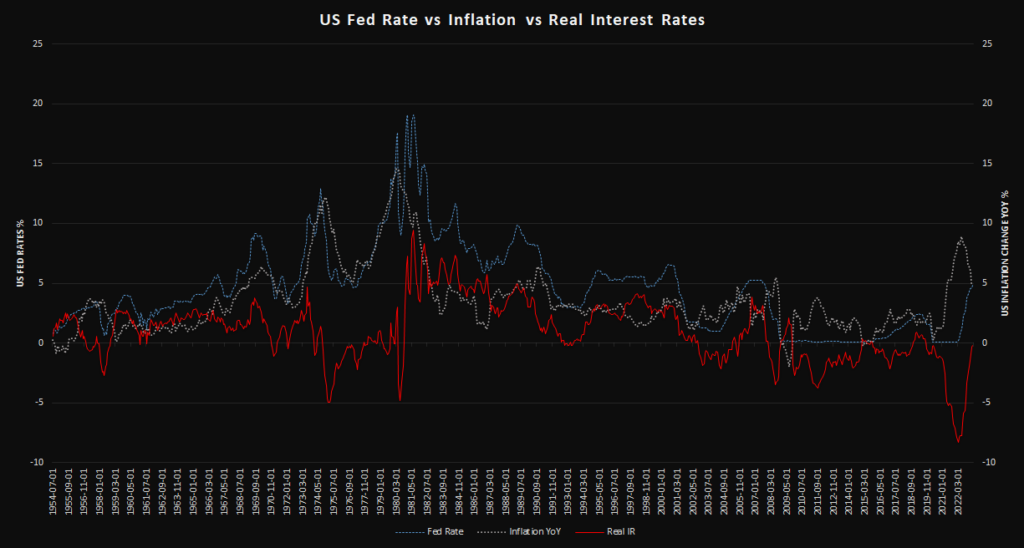

Real vs. Nominal Interest Rates

To truly understand how interest rates affect forex markets, you need to know the difference between nominal and real interest rates:

- Nominal Rates are the stated rates set by central banks and financial institutions, not adjusted for inflation.

- Real Rates account for inflation, providing a clearer picture of purchasing power. Real interest rates are calculated as:

Real Interest Rate = Nominal Rate − Inflation Rate

For example, if the nominal rate is 5% and inflation is 2%, the real interest rate is 3%. Traders often focus on real rates to assess the actual yield on investments and currency holdings.

How Interest Rates Influence Forex Markets

1. Capital Flows and Investment Decisions

Higher interest rates tend to attract foreign investors seeking better returns. For example, if the U.S. raises rates while Europe’s remain low, investors may shift capital into U.S. assets, increasing demand for the dollar and pushing its value higher against the euro.

2. Carry Trades

Interest rates are at the core of carry trades, a popular strategy where traders borrow in a low-rate currency and invest in a higher-rate currency to profit from the difference. This strategy works best in stable, low-volatility environments.

3. Market Sentiment and Speculation

Traders constantly speculate on future rate changes based on economic data and central bank statements. For instance, strong economic data might lead to expectations of a rate hike, causing a currency to strengthen even before the decision is announced.

The Importance of Central Bank Announcements

Central bank meetings and rate decisions are some of the most anticipated events in forex trading. Even small changes in rates—or hints at future policy moves—can cause big market swings.

- An unexpected rate hike usually triggers a rapid increase in the currency’s value as traders adjust their positions.

- Conversely, a surprise rate cut or dovish tone can lead to a sharp decline in the currency.

To stay ahead, traders use economic calendars to track these announcements and key speeches from central bank officials to prepare for potential market reactions. Understanding the connection between central bank decisions and currency movements is key to making informed trading decisions.

By mastering the role of interest rates in forex, traders can better anticipate market trends, identify trading opportunities, and build stronger strategies.

The Concept of Interest Rate Differentials

At its core, an interest rate differential is the difference between the interest rates of two countries whose currencies form a currency pair. Traders and investors closely watch these differentials because they can signal potential changes in capital flows, affecting the relative strength or weakness of currencies.

Defining Interest Rate Differentials

Interest rate differentials are calculated by subtracting the interest rate of one currency from the interest rate of another in a currency pair. The formula is straightforward:

Interest Rate Differential = (Interest Rate of Base Currency) − (Interest Rate of Quote Currency)

For example, if the interest rate set by the Federal Reserve (Fed) for the US Dollar (USD) is 5% and the interest rate set by the European Central Bank (ECB) for the Euro (EUR) is 3%, the interest rate differential for the EUR/USD pair is:

5% − 3% = 2%

In this case, the differential is positive in favor of the USD, meaning the USD offers a higher yield compared to the EUR. This difference can influence investor behavior, as traders may prefer holding the currency with the higher interest rate to earn more interest income.

Positive vs. Negative Interest Rate Differentials

Interest rate differentials can be either positive or negative, and the direction of the differential plays a significant role in shaping currency movements:

- Positive Interest Rate Differential:

- When the base currency has a higher interest rate than the quote currency, the differential is positive. In such cases, investors may be more inclined to buy the base currency, expecting a better return from holding it.

- For example, if the interest rate for the Australian Dollar (AUD) is 4% and the interest rate for the Japanese Yen (JPY) is 0.1%, the interest rate differential for the AUD/JPY pair is: 3.9%. The positive differential in favor of the AUD may attract traders looking to capitalize on the higher yield, potentially driving up the value of the AUD relative to the JPY.

- Negative Interest Rate Differential:

- When the base currency has a lower interest rate than the quote currency, the differential is negative. In this scenario, investors may prefer holding the quote currency due to its higher yield.

- For example, if the interest rate for the Euro (EUR) is 2% and the interest rate for the British Pound (GBP) is 4%, the interest rate differential for the EUR/GBP pair is: −2%. The negative differential indicates that the GBP offers a higher yield compared to the EUR, potentially attracting investors to the GBP and causing the EUR to weaken relative to the GBP.

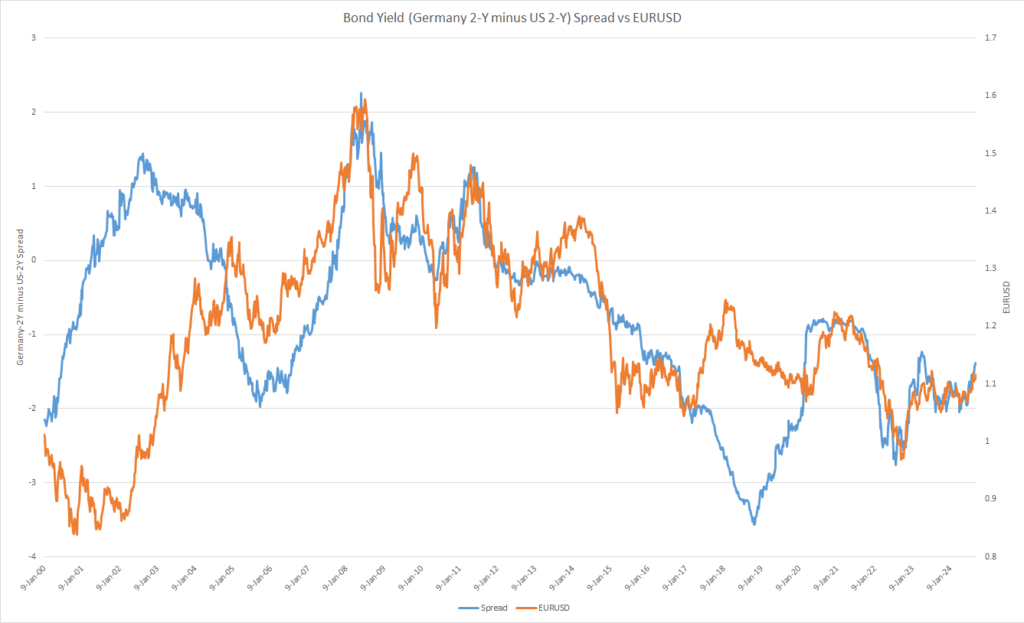

Yield Spreads as Indicators

Yield spreads, which refer to the difference in yields between two government bonds, are often used as a proxy for interest rate differentials. Traders monitor yield spreads to gauge expectations of future interest rate changes. For instance:

- A widening yield spread between US 10-year Treasury bonds and German 10-year Bunds may indicate a growing interest rate differential between the USD and EUR, suggesting potential appreciation of the USD against the EUR.

- A narrowing yield spread may signal a reduced interest rate differential, possibly leading to a weakening of the USD against the EUR.

Yield spreads are valuable indicators because they reflect investor expectations about future interest rates, helping traders anticipate currency movements based on changes in economic outlook and monetary policy.

How Interest Rate Differentials Influence Currency Prices

Interest rate differentials directly impact currency values by influencing the flow of capital between countries. Here’s how this mechanism works:

- Attraction of Capital Flows:

- Currencies with higher interest rates tend to attract more capital from foreign investors seeking better returns. When a country offers higher yields, it becomes more appealing for investors to buy assets denominated in that currency, increasing demand and driving up its value.

- For example, if the Bank of Canada raises its interest rates while the US Federal Reserve keeps rates unchanged, the CAD might appreciate against the USD as investors shift their funds into Canadian assets to benefit from the higher yield.

- Impact on Forex Carry Trades:

- Interest rate differentials are at the heart of the carry trade strategy, where traders borrow a currency with a low interest rate (funding currency) to invest in a currency with a higher interest rate (target currency).

- For instance, if Japan’s interest rates are near zero and Australia’s rates are significantly higher, traders may borrow JPY at low cost and buy AUD to earn the interest rate differential. This demand for AUD can lead to its appreciation against the JPY.

- Influence of Market Sentiment:

- Changes in market sentiment based on expected interest rate differentials can cause currency volatility. If traders anticipate that a central bank will raise rates, they may start buying that currency in advance, driving up its value. Conversely, expectations of rate cuts may lead to selling pressure.

- For example, if strong US economic data increases expectations of a Federal Reserve rate hike, traders might buy USD in anticipation of higher yields, causing the USD to appreciate against other currencies.

Examples of Interest Rate Differentials Impacting Forex Pairs

- USD/JPY During Fed Rate Hikes:

- When the Federal Reserve increases interest rates while the Bank of Japan maintains ultra-low rates, the interest rate differential between the USD and JPY widens. This often results in capital flows into USD-denominated assets, leading to an appreciation of the USD against the JPY.

- EUR/USD and Divergent Central Bank Policies:

- If the European Central Bank keeps rates low to stimulate the Eurozone economy while the US Federal Reserve adopts a tightening policy with rate hikes, the widening interest rate differential can lead to a stronger USD and a weaker EUR.

The Effect of Interest Rate Differentials on Currency Prices

Interest rate differentials are a key factor influencing currency prices in the forex market. The difference between the interest rates of two currencies in a pair can create significant shifts in investor behavior, leading to changes in currency demand and, consequently, their exchange rates. Understanding the mechanics of how interest rate differentials impact currency prices is essential for traders seeking to make informed trading decisions.

1. Attracting Foreign Investment

Currencies with higher interest rates tend to attract more foreign investment because they offer better returns on deposits, bonds, and other interest-bearing assets. When a country has a higher interest rate compared to another, investors are incentivized to move capital into that higher-yielding currency to earn a better return. This flow of capital increases demand for the higher-yielding currency, driving up its value.

For example, suppose the interest rate in the United States is 5%, while the interest rate in Japan is 0.5%. In this scenario, investors looking for higher returns may choose to invest in US bonds or deposit their funds in US-based accounts rather than in Japanese assets. The increased demand for the US Dollar (USD) against the Japanese Yen (JPY) can lead to an appreciation of the USD/JPY pair.

2. The Impact on Carry Trades

The carry trade is a popular forex trading strategy that directly leverages interest rate differentials. In a carry trade, traders borrow money in a currency with a low interest rate (the funding currency) and invest in a currency with a higher interest rate (the target currency). The aim is to profit from the interest rate differential between the two currencies.

How Carry Trades Affect Currency Prices:

- When a significant interest rate differential exists, traders may engage heavily in carry trades, increasing demand for the higher-yielding currency and putting upward pressure on its value. Conversely, if the differential narrows due to changes in monetary policy, carry trades may become less attractive, leading to a sell-off of the target currency and a decrease in its value.

- Consider the AUD/JPY pair. Historically, the Australian Dollar (AUD) has had higher interest rates compared to the Japanese Yen (JPY). Traders might borrow in JPY (low cost) to buy AUD (higher yield), increasing demand for AUD and causing its value to appreciate against the JPY.

However, this strategy carries risks, particularly during periods of market volatility or sudden changes in interest rates. If global market sentiment shifts towards risk aversion, traders may unwind their carry trades, rapidly selling off the high-yielding currency, leading to sharp depreciation.

3. Influence of Market Expectations

In forex markets, prices often react not just to the current interest rate differential but also to market expectations of future changes in interest rates. Traders speculate on upcoming interest rate decisions based on economic indicators, central bank statements, and geopolitical developments.

Forward-Looking Nature of Forex Markets:

- If traders expect a central bank to increase interest rates in the near future, they may start buying that currency in anticipation of higher yields, causing it to appreciate even before the actual rate hike occurs. Conversely, expectations of a rate cut can lead to selling pressure and depreciation of the currency.

- If strong US employment data increases expectations that the Federal Reserve will raise interest rates, traders might buy USD in anticipation of higher returns, causing the USD to appreciate against other currencies even before the official rate decision is made.

4. The Role of Real Interest Rate Differentials

While nominal interest rate differentials are commonly discussed, real interest rate differentials provide a clearer picture of the actual yield that investors can expect after accounting for inflation. Real interest rates are calculated as:Real Interest Rate=Nominal Interest Rate−Inflation Rate\text{Real Interest Rate} = \text{Nominal Interest Rate} – \text{Inflation Rate}Real Interest Rate=Nominal Interest Rate−Inflation Rate

Why Real Interest Rates Matter:

- If a country has a high nominal interest rate but also high inflation, the real interest rate may be low or even negative, reducing its attractiveness to investors. Conversely, a country with a lower nominal interest rate but minimal inflation may offer a higher real yield, attracting more capital.

- If the nominal interest rate in Brazil is 10% but inflation is running at 8%, the real interest rate is only 2%. Meanwhile, if the nominal interest rate in Switzerland is 1% with near-zero inflation, the real interest rate is almost 1%. Despite the lower nominal rate in Switzerland, the minimal inflation may make it a more attractive destination for investors seeking stable real returns.

5. The Effect of Changing Interest Rate Differentials

Interest rate differentials are dynamic and can change based on shifts in central bank policies, economic conditions, and inflation rates. When differentials change, they can trigger significant currency movements:

- Widening Interest Rate Differentials: If the interest rate of the base currency increases relative to the quote currency, the differential widens. This typically leads to an appreciation of the base currency as investors seek higher returns. For example, if the European Central Bank (ECB) maintains its rates while the US Federal Reserve raises its rates, the widening differential may boost demand for USD, causing the EUR/USD pair to decline.

- Narrowing Interest Rate Differentials: If the interest rate of the base currency decreases relative to the quote currency, the differential narrows. This can lead to a depreciation of the base currency as its yield becomes less attractive compared to the quote currency. For example, if the Reserve Bank of Australia cuts rates while the Bank of England maintains or raises rates, the narrowing differential may lead to a weaker AUD against the GBP.

6. Impact on Emerging Market Currencies

Interest rate differentials also play a significant role in the behavior of emerging market currencies. High-yielding emerging market currencies often attract investors seeking higher returns compared to the lower rates typically offered in developed economies. However, these currencies can be highly sensitive to changes in global interest rate expectations:

- Rising US Interest Rates: When the Federal Reserve raises rates, it can lead to capital outflows from emerging markets as investors shift their funds into USD-denominated assets for higher and safer returns. This often results in a depreciation of emerging market currencies.

- In periods of Fed rate hikes, currencies like the South African Rand (ZAR) and the Brazilian Real (BRL) may weaken as capital flows back into the US.

The Carry Trade Strategy

The carry trade is a popular forex trading strategy that aims to capitalize on the interest rate differentials between two currencies. It involves borrowing a currency with a low interest rate (the “funding currency”) and using the borrowed funds to invest in a currency with a higher interest rate (the “target currency”). The goal is to profit from the difference in interest rates, known as the “carry,” while also potentially benefiting from currency appreciation.

How the Carry Trade Works

The basic premise of the carry trade is to exploit the difference in yields between two currencies. Here’s how it works step by step:

- Identifying the Funding and Target Currencies:

- The first step is to choose a pair where there is a significant interest rate differential. The funding currency is typically one with a low or near-zero interest rate, such as the Japanese Yen (JPY) or the Swiss Franc (CHF). The target currency is one with a relatively high interest rate, such as the Australian Dollar (AUD) or the New Zealand Dollar (NZD).

- Borrowing the Funding Currency:

- The trader borrows the low-yielding currency. For example, they may take out a loan in Japanese Yen at an interest rate close to 0%.

- Converting to the Target Currency:

- The borrowed funds are then exchanged for the target currency. For instance, the trader might use the JPY to buy AUD, which offers a higher interest rate.

- Investing in High-Yielding Assets:

- The trader holds the high-yielding currency, earning interest from assets like government bonds or interest-bearing accounts in the target currency. The profit comes from the difference in interest rates between the two currencies.

- Earning the Carry:

- The trader earns the “carry” or interest rate differential as long as they hold the position. If the differential is positive (the target currency’s interest rate is higher than the funding currency’s), the trader earns interest daily.

Example of a Carry Trade

Let’s consider a hypothetical example involving the AUD/JPY pair:

- Interest Rate in Australia (AUD): 4%

- Interest Rate in Japan (JPY): 0.1%

- Interest Rate Differential: 4% – 0.1% = 3.9%

In this scenario, a trader borrows JPY at a low interest rate of 0.1% and converts it to AUD, which has a higher rate of 4%. The trader earns the 3.9% interest rate differential as profit.

Profit Sources:

- Interest Income: The main profit comes from the difference in interest rates, the “carry.”

- Potential Currency Appreciation: If the AUD appreciates against the JPY during the trade, the trader also benefits from capital gains.

Risk:

- If the AUD depreciates against the JPY, the trader could face losses from currency movements, which may offset the interest income earned.

Why Traders Use the Carry Trade

The carry trade is attractive for several reasons:

- Earning Interest Income:

- The primary appeal of the carry trade is the ability to earn regular interest income from the positive interest rate differential. This income accrues daily and can be a consistent source of profit, especially when the differential is large.

- Potential for Currency Appreciation:

- In addition to interest income, traders may also gain from currency appreciation. If the target currency (high-yielding currency) strengthens against the funding currency (low-yielding currency), the trader benefits from both the interest differential and the exchange rate movement.

- Long-Term Strategy:

- The carry trade is typically a long-term strategy, as it relies on holding positions over time to accumulate interest income. It is often seen as a lower-risk strategy during periods of stable economic growth and low market volatility.

Risks of the Carry Trade

While the carry trade can be profitable, it also carries significant risks, particularly in volatile or uncertain market conditions:

- Exchange Rate Risk:

- The main risk is that the target currency depreciates against the funding currency. For example, if the AUD depreciates against the JPY, the losses from the exchange rate movement could outweigh the interest income earned.

- If the AUD/JPY exchange rate falls from 90.00 to 85.00 while holding a carry trade, the trader would incur a loss when converting back to JPY, potentially offsetting any gains from the interest differential.

- Interest Rate Risk:

- Changes in interest rates can affect the profitability of the carry trade. If the central bank of the target currency lowers interest rates or the central bank of the funding currency raises rates, the interest rate differential narrows. This reduces the income from the trade and can lead to an unwinding of carry trades, causing sharp currency movements.

- If the Reserve Bank of Australia unexpectedly cuts rates, the interest rate differential between AUD and JPY narrows, making the carry trade less attractive. Traders may sell AUD and buy back JPY, causing the AUD to weaken sharply.

- Market Volatility:

- Carry trades perform well in stable, low-volatility environments. However, during periods of high market volatility or risk aversion, investors often unwind their carry trades, selling off high-yielding currencies in favor of safe-haven currencies like the JPY or USD. This can lead to sudden and sharp currency movements.

- During the 2008 financial crisis, many carry trades were rapidly unwound as investors sought safety. This caused high-yielding currencies like the AUD and NZD to plummet against low-yielding currencies like the JPY.

Best Conditions for Carry Trades

Successful carry trades depend on favorable market conditions:

- Stable or Widening Interest Rate Differentials:

- The ideal environment for carry trades is when the interest rate differential is wide and expected to remain stable or widen further. This ensures a steady income stream from the interest differential.

- Low Market Volatility:

- Carry trades thrive in low-volatility markets. When traders are confident and willing to take on risk, they are more likely to engage in carry trades, supporting high-yielding currencies.

- Positive Economic Outlook:

- A positive economic outlook for the target currency’s country can boost the appeal of its assets, leading to currency appreciation and additional gains for carry traders.

Central Bank Policies and Their Influence on Interest Rate Differentials

Central banks play a crucial role in shaping the economic landscape and influencing currency values through their monetary policies. One of the key ways they impact the forex market is by setting and adjusting interest rates, which directly affect interest rate differentials between currency pairs. Understanding how central bank policies influence these differentials is essential for forex traders looking to predict currency movements and capitalize on market opportunities.

1. The Role of Central Banks in Setting Interest Rates

Central banks, such as the Federal Reserve (Fed) in the United States, the European Central Bank (ECB), the Bank of England (BoE), and the Bank of Japan (BoJ), are responsible for managing a country’s monetary policy. One of their primary tools is the setting of benchmark interest rates, which influence borrowing costs, consumer spending, and overall economic activity.

Key Objectives of Central Bank Policies:

- Control Inflation: Central banks aim to keep inflation within a target range (often around 2%) to maintain price stability.

- Promote Economic Growth: By adjusting interest rates, central banks can either stimulate growth (lowering rates) or cool down an overheating economy (raising rates).

- Ensure Financial Stability: Central banks intervene to stabilize the financial system during periods of economic uncertainty or crises.

Changes in interest rates by central banks directly affect interest rate differentials between currencies, influencing capital flows and exchange rates in the forex market.

2. Impact of Interest Rate Hikes on Differentials

When a central bank decides to raise interest rates, it signals an attempt to combat inflation or slow down rapid economic growth. An increase in interest rates makes a country’s currency more attractive to investors because it offers a higher yield on deposits and bonds.

Effect on Interest Rate Differentials:

- Widening Differential: If the central bank of a country increases its interest rate while the rate in another country remains unchanged or rises at a slower pace, the interest rate differential widens in favor of the currency with the higher interest rate.

- Currency Appreciation: The currency with the higher rate is likely to appreciate as investors seek to earn better returns, increasing demand for that currency.

Example:

- If the US Federal Reserve raises its interest rates while the European Central Bank keeps its rates steady, the interest rate differential between the USD and EUR widens. This often leads to an appreciation of the USD against the EUR, as investors prefer holding USD-denominated assets to benefit from the higher yield.

3. Impact of Interest Rate Cuts on Differentials

Conversely, when a central bank lowers interest rates, it usually aims to stimulate economic growth by making borrowing cheaper. However, lower interest rates reduce the yield on investments in that currency, making it less attractive to foreign investors.

Effect on Interest Rate Differentials:

- Narrowing Differential: If a central bank cuts interest rates while the rate in another country remains steady or falls at a slower rate, the interest rate differential narrows in favor of the currency with the relatively higher rate.

- Currency Depreciation: The currency with the lower rate is likely to weaken, as investors may move their capital to currencies offering better returns.

Example:

- If the Bank of England decides to cut its interest rates while the Federal Reserve maintains its rates, the interest rate differential between the GBP and USD narrows. This could lead to a depreciation of the GBP against the USD, as investors shift their focus to higher-yielding USD assets.

4. Forward Guidance and Market Expectations

Central banks often use forward guidance to signal their future monetary policy intentions. This communication strategy involves providing insights into the central bank’s outlook on economic conditions and its expected path for interest rates. Traders pay close attention to forward guidance as it shapes market expectations about future changes in interest rate differentials.

Impact on Currency Prices:

- If a central bank signals future rate hikes, traders may start buying the currency in anticipation of higher yields, causing it to appreciate even before the actual rate change occurs.

- Conversely, if a central bank indicates potential rate cuts, traders may sell the currency in anticipation of lower yields, leading to depreciation.

Example:

- If the European Central Bank hints at raising rates to combat rising inflation, traders may start buying the Euro, expecting the EUR/USD pair to strengthen due to an anticipated widening of the interest rate differential in favor of the EUR.

5. Divergent Central Bank Policies

Divergent monetary policies, where different central banks take opposite stances on interest rates, can significantly impact interest rate differentials and forex markets. Divergence occurs when one central bank is in a tightening cycle (raising rates), while another is in an easing cycle (cutting rates).

Effect on Currency Pairs:

- A currency pair with divergent central bank policies often experiences strong trends driven by changes in interest rate differentials. The currency of the tightening central bank (higher rates) is likely to appreciate, while the currency of the easing central bank (lower rates) tends to depreciate.

Example:

- During 2022, the US Federal Reserve aggressively raised interest rates to combat inflation, while the Bank of Japan maintained its ultra-low interest rate policy. The resulting widening differential between USD and JPY led to a significant appreciation of the USD/JPY pair, with the USD strengthening against the JPY as investors sought higher yields.

6. Quantitative Easing and Its Impact on Interest Rate Differentials

In addition to adjusting interest rates, central banks may use unconventional monetary policy tools like quantitative easing (QE) to stimulate the economy. QE involves large-scale purchases of government bonds and other financial assets to inject liquidity into the financial system, lowering long-term interest rates.

Impact on Interest Rate Differentials:

- QE tends to lower interest rates in the implementing country, narrowing the interest rate differential against currencies of countries with stable or rising rates. This can lead to depreciation of the currency undergoing QE, as lower yields make it less attractive to investors.

Example:

- The European Central Bank implemented QE from 2015 to 2018 to support economic recovery in the Eurozone. The resulting lower interest rates in the Eurozone reduced the interest rate differential between the EUR and USD, contributing to a period of EUR depreciation against the USD.

7. Central Bank Intervention in Forex Markets

In some cases, central banks may directly intervene in forex markets to influence currency values and stabilize exchange rates. This intervention can involve buying or selling currencies in the open market or adjusting interest rates to impact the interest rate differential and guide currency movements.

Example:

- The Bank of Japan has occasionally intervened in the forex market to weaken the JPY by increasing its asset purchases or lowering interest rates, aiming to boost exports and support economic growth. Such interventions impact the interest rate differential, often leading to a weaker JPY.

Analyzing Interest Rate Differentials for Forex Trading

Interest rate differentials are a fundamental component of forex trading and play a significant role in determining currency pair movements. By analyzing these differentials, traders can gain insights into the relative strength or weakness of currencies and identify potential trading opportunities. Here are the steps involved in analyzing interest rate differentials and how traders can incorporate this analysis into their trading strategies.

1. Understanding the Current Interest Rate Landscape

The first step in analyzing interest rate differentials is to gather information on the current interest rates set by central banks. Major central banks like the Federal Reserve (Fed), European Central Bank (ECB), Bank of England (BoE), and Bank of Japan (BoJ) regularly announce their benchmark interest rates, which are widely tracked by traders.

Key Information to Collect:

- Current Benchmark Interest Rates: Look up the latest interest rates for the currencies you are analyzing. This information can be found on central bank websites or financial news platforms.

- Market Expectations: Pay attention to market sentiment and expectations for future rate changes. Financial news, economic indicators, and forward guidance from central banks can provide valuable insights into upcoming rate decisions.

Example:

- If the current interest rate in the US is 5.5% and the rate in the Eurozone is 4%, the interest rate differential between the USD and EUR is 1.5%, favoring the USD.

2. Calculating Interest Rate Differentials

Once you have the current interest rates, the next step is to calculate the interest rate differential between the two currencies in a pair. The formula is straightforward:Interest Rate Differential=Interest Rate of Base Currency−Interest Rate of Quote Currency\text{Interest Rate Differential} = \text{Interest Rate of Base Currency} – \text{Interest Rate of Quote Currency}Interest Rate Differential=Interest Rate of Base Currency−Interest Rate of Quote Currency

Example:

- For the AUD/USD pair, if the interest rate in Australia is 4.25% and the interest rate in the US is 5.5%, the interest rate differential is: 4.25% − 5.5% = −1.25%. In this case, the differential is negative, meaning the USD offers a higher yield than the AUD.

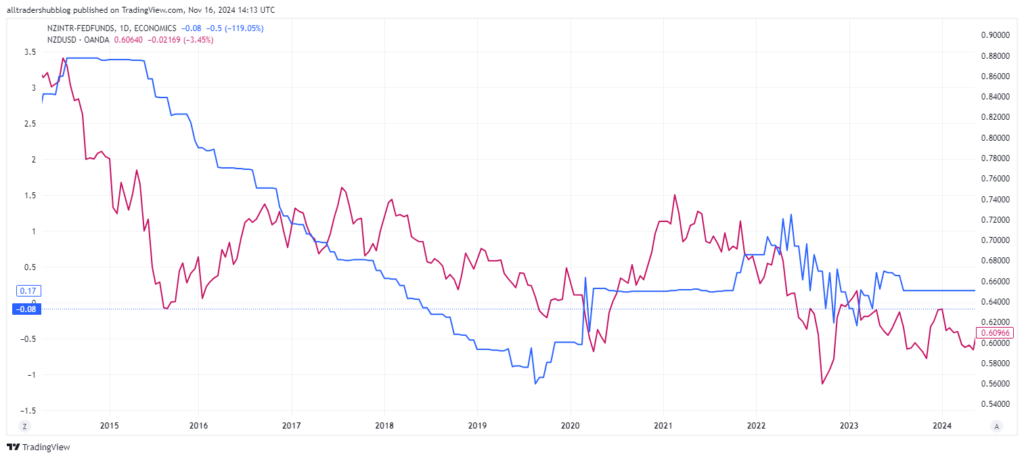

3. Analyzing Historical Trends and Changes

Analyzing historical trends in interest rate differentials can provide insights into potential future movements of a currency pair. By examining how changes in differentials have historically impacted exchange rates, traders can better understand the relationship between interest rates and currency prices.

Key Factors to Consider:

- Historical Data: Look at historical changes in interest rate differentials and how they have affected currency movements over time. This can help identify patterns or correlations that may repeat in similar economic conditions.

- Policy Changes: Monitor significant shifts in central bank policies that have led to changes in interest rate differentials. For example, periods of aggressive rate hikes or cuts can create strong trends in forex markets.

Example:

- If historical data shows that when the interest rate differential between USD and JPY exceeds 2%, the USD/JPY pair tends to appreciate, this trend can inform trading decisions when the differential reaches or surpasses this level.

4. Using Interest Rate Differentials in Fundamental Analysis

Interest rate differentials are a crucial component of fundamental analysis in forex trading. They provide insights into the broader economic conditions and monetary policies that influence currency values. By incorporating interest rate differentials into their analysis, traders can develop a clearer picture of a currency pair’s potential direction.

Factors to Integrate:

- Economic Indicators: Assess key economic data such as GDP growth, inflation rates, and employment figures. These indicators influence central bank decisions on interest rates and can help predict future changes in interest rate differentials.

- Central Bank Statements: Pay attention to speeches and press releases from central bank officials. Hints about future rate hikes or cuts can provide early signals of changes in interest rate differentials.

Example:

- If the Federal Reserve signals a series of rate hikes to combat inflation while the European Central Bank adopts a more cautious approach, traders may anticipate a widening interest rate differential in favor of the USD, leading to potential appreciation of the USD against the EUR.

5. Assessing the Impact on Currency Pair Selection

Traders can use interest rate differentials to inform their currency pair selection. Pairs with significant interest rate differentials often present opportunities for carry trades, where traders earn interest income from holding a higher-yielding currency.

Steps for Selection:

- Identify Pairs with Wide Differentials: Look for currency pairs where there is a large and stable interest rate differential. These pairs are likely to attract carry trade interest and exhibit stronger trends.

- Consider Market Sentiment: Assess the overall risk sentiment in the market. In a risk-on environment, traders may favor high-yielding currencies, while in a risk-off environment, safe-haven currencies may be preferred despite lower yields.

Example:

- A trader looking for carry trade opportunities might choose the NZD/JPY pair if New Zealand offers a significantly higher interest rate than Japan. The trader would buy NZD and sell JPY to benefit from both the interest income and potential appreciation of the NZD.

6. Monitoring Economic Data and Central Bank Meetings

Economic data releases and central bank meetings are key events that can lead to changes in interest rate differentials. Traders need to stay informed about these events and adjust their analysis accordingly.

Key Events to Monitor:

- Central Bank Meetings: Regular meetings where interest rate decisions are announced can significantly impact interest rate differentials and currency values.

- Economic Reports: Inflation data (CPI), employment reports, and GDP figures can influence central bank decisions on interest rates, affecting the interest rate differential between currencies.

Example:

- If the Bank of England raises interest rates due to strong inflation data, the interest rate differential between GBP and USD may increase, potentially leading to a stronger GBP against the USD.

7. Incorporating Interest Rate Differentials into Trading Strategies

Interest rate differentials can be integrated into various trading strategies, including:

- Carry Trades: Traders can take advantage of wide interest rate differentials by borrowing in low-yielding currencies and investing in high-yielding ones to earn interest income.

- Trend Trading: When the interest rate differential widens in favor of one currency, it often supports a long-term trend. Traders can use this as a signal to enter trend-following positions.

- Hedging: Traders can use interest rate differentials to hedge their exposure to currencies that may be affected by central bank policy changes.

Example:

- A trader might go long on the USD/JPY pair when the interest rate differential widens in favor of the USD, expecting the pair to trend higher as investors move towards the higher-yielding USD.

8. Using Tools and Indicators for Analysis

Several tools and indicators can help traders analyze interest rate differentials effectively:

- Economic Calendars: Provide updates on central bank meetings and economic data releases that could influence interest rates.

- Yield Curves: Show the relationship between interest rates and different maturities, offering insights into market expectations for future rate changes.

- Interest Rate Forecasts: Analysts and financial institutions often publish forecasts for future interest rates, which can help traders anticipate changes in differentials.

Trading Strategies Based on Interest Rate Differentials

Interest rate differentials are a powerful tool in the arsenal of forex traders, providing insights into currency trends and potential trading opportunities. This section explores practical strategies for leveraging interest rate differentials, with a focus on how traders can incorporate these insights into their forex trading plans. From the popular carry trade to trend-following strategies, understanding how to use interest rate differentials can help traders make more informed decisions.

1. Carry Trade Strategy

The carry trade is one of the most popular strategies based on interest rate differentials. It involves borrowing in a currency with a low interest rate (funding currency) and using the funds to invest in a currency with a higher interest rate (target currency). The trader earns the interest rate differential, known as the carry, while potentially benefiting from currency appreciation.

How to Implement a Carry Trade:

- Identify High and Low-Yielding Currencies: Look for currency pairs with significant interest rate differentials. For example, if the interest rate in New Zealand (NZD) is 5% and in Japan (JPY) it is 0.5%, the interest rate differential is 4.5% in favor of the NZD.

- Open a Long Position in the High-Yielding Currency: In this example, a trader would go long on NZD/JPY, buying the NZD and selling the JPY.

- Earn Interest Income: As long as the position remains open, the trader earns interest income from the positive differential, provided the rate remains favorable.

Key Considerations:

- Market Sentiment: Carry trades are most successful in a risk-on environment, where investors are willing to take on more risk for higher returns. During risk-off periods, investors may unwind carry trades, leading to sharp reversals.

- Interest Rate Trends: Monitor central bank policies and economic indicators, as changes in interest rates can alter the attractiveness of the carry trade.

Example:

- In 2022, with the Federal Reserve raising interest rates aggressively, the USD became a popular choice for carry trades against currencies with low rates like the JPY. Traders long on USD/JPY could earn the interest rate differential and potentially benefit from the USD appreciating against the JPY.

2. Trend Trading Based on Interest Rate Differentials

Interest rate differentials can provide a foundation for trend trading strategies, where traders look to capitalize on long-term currency trends influenced by widening or narrowing differentials. When one currency’s central bank is hiking rates while another’s is maintaining or cutting rates, the interest rate differential can drive a sustained trend.

How to Implement a Trend Trading Strategy:

- Analyze Central Bank Policies: Assess the monetary policies of the relevant central banks to determine the direction of interest rate differentials. If a central bank is expected to raise rates, this may create a trend favoring that currency.

- Use Technical Analysis: Combine fundamental analysis of interest rate differentials with technical analysis tools like moving averages, trend lines, and momentum indicators to time entry and exit points.

- Identify Trend Confirmation: Look for confirmation of trends, such as higher highs and higher lows in the case of an appreciating currency pair, or vice versa.

Example:

- In 2023, the ECB began raising rates to combat inflation, widening the interest rate differential between the EUR and the JPY. Traders who identified this trend could go long on EUR/JPY, benefiting from both the higher interest rate in the Eurozone and the upward trend in the pair’s price.

3. Pair Trading Based on Diverging Interest Rates

Pair trading involves taking simultaneous long and short positions in two different currency pairs that are expected to move in opposite directions based on their interest rate differentials. This strategy aims to capitalize on relative strength while minimizing exposure to overall market movements.

How to Implement a Pair Trading Strategy:

- Select Correlated Currency Pairs: Choose two pairs that are influenced by diverging interest rates, such as AUD/USD (high interest rate) and EUR/USD (lower interest rate).

- Go Long on the Higher-Yielding Pair and Short on the Lower-Yielding Pair: For example, a trader might go long on AUD/USD while shorting EUR/USD, expecting the AUD to outperform the EUR based on interest rate expectations.

- Monitor Economic Data: Keep an eye on key economic indicators and central bank announcements that could affect interest rate differentials.

Example:

- If the Reserve Bank of Australia (RBA) raises rates while the ECB signals a pause in its rate hikes, a trader might pair trade by going long on AUD/USD and short on EUR/USD, taking advantage of the diverging interest rate policies.

4. Position Trading Based on Central Bank Forward Guidance

Position trading involves holding trades for extended periods based on fundamental analysis, particularly central bank forward guidance. This strategy focuses on anticipating changes in interest rate differentials before they occur, using central bank communication as a guide.

How to Implement a Position Trading Strategy:

- Analyze Forward Guidance: Pay close attention to statements from central banks about future rate changes. Forward guidance can offer insights into upcoming shifts in interest rates and help traders anticipate changes in interest rate differentials.

- Establish Long-Term Positions: Based on the expected direction of interest rate changes, establish long-term positions in the currency pairs likely to be impacted.

- Adjust Positions Based on Economic Data: Stay updated with economic reports, such as inflation and employment data, as these can affect central bank decisions.

Example:

- If the Fed signals a prolonged tightening cycle, indicating several upcoming rate hikes, traders might take long positions in USD pairs like USD/JPY, anticipating a widening interest rate differential in favor of the USD.

5. Hedging Strategies Using Interest Rate Differentials

Hedging with interest rate differentials can help traders mitigate risk from currency exposure by taking advantage of expected changes in interest rates. This strategy is especially useful for businesses and investors with international exposure, aiming to protect against adverse currency movements.

How to Implement a Hedging Strategy:

- Identify Currency Exposure: Determine the currency pairs where exposure exists and assess the interest rate differentials.

- Take Opposite Positions: Use forex futures, options, or spot positions to hedge against potential losses from unfavorable currency movements.

- Earn Interest Income: If the interest rate differential is in your favor, you can earn carry income while hedging against currency risk.

Example:

- A European company expecting to receive payments in USD might hedge against EUR appreciation by going long on USD/EUR. If the Fed raises rates relative to the ECB, the interest rate differential favors the USD, potentially providing both a hedge and an interest income.

6. Risk Management When Trading Based on Interest Rate Differentials

While trading strategies based on interest rate differentials can be profitable, they also carry risks, especially during periods of economic uncertainty or unexpected central bank interventions. Effective risk management is crucial.

Key Risk Management Tips:

- Use Stop-Loss Orders: Set stop-loss orders to protect against sudden market reversals caused by unexpected changes in interest rates or central bank policies.

- Monitor Market Sentiment: Changes in global risk sentiment can impact carry trades and trend-following strategies. Be prepared to adjust your positions if market conditions change.

- Diversify Exposure: Avoid concentrating all trades on a single currency pair. Diversify across pairs to spread risk.

Risks and Limitations of Trading Based on Interest Rate Differentials

While trading based on interest rate differentials can be a highly effective strategy, it comes with its own set of risks and limitations. Understanding these challenges is crucial for traders to manage their positions effectively and avoid unexpected losses. This section explores the key risks associated with this approach and offers guidance on how to mitigate them.

1. Market Sentiment Shifts and Risk Aversion

One of the primary risks of trading based on interest rate differentials, especially with carry trades, is the potential for sudden shifts in market sentiment. The carry trade strategy, which involves borrowing in low-yield currencies and investing in high-yield currencies, thrives in a risk-on environment when investors are willing to take on more risk for higher returns. However, during risk-off periods, when market sentiment shifts towards risk aversion, these trades can quickly unwind.

Risks:

- Unwinding of Carry Trades: In times of market turmoil, investors tend to move towards safe-haven currencies like the USD, JPY, or CHF. This can lead to a rapid unwinding of carry trades, causing sharp reversals in currency pairs with high-interest rate differentials.

- Increased Volatility: Risk aversion can lead to heightened market volatility, making it challenging for traders to maintain their positions and potentially triggering stop-loss orders.

Example:

- During the 2008 financial crisis, the unwinding of carry trades led to a rapid appreciation of the JPY as investors sought safety, causing significant losses for traders holding high-yielding currencies like the AUD or NZD against the JPY.

Mitigation:

- Traders should closely monitor global risk sentiment and economic indicators such as stock market performance, geopolitical events, and financial market stress signals. Using technical analysis and stop-loss orders can help protect against sudden market reversals.

2. Central Bank Interventions and Policy Changes

Central banks play a critical role in setting interest rates, and unexpected policy changes can significantly impact interest rate differentials. Sudden rate hikes or cuts, changes in forward guidance, or unconventional monetary policies like quantitative easing (QE) can alter the landscape of interest rates, catching traders off guard.

Risks:

- Unexpected Rate Decisions: If a central bank unexpectedly raises or lowers interest rates, it can lead to sharp movements in the affected currency pair, disrupting existing trades based on previous interest rate expectations.

- Policy Divergence: Even if a central bank signals a clear rate path, external factors such as inflation shocks, economic downturns, or geopolitical tensions can force them to change their policy stance abruptly.

Example:

- In 2015, the Swiss National Bank (SNB) unexpectedly removed the CHF’s peg to the EUR, leading to a sharp appreciation of the CHF and significant market volatility. Traders relying on interest rate differentials were caught off guard by this sudden policy change.

Mitigation:

- Stay updated with central bank announcements, speeches, and meeting minutes. Traders can also use economic calendars to anticipate key events and manage their positions accordingly. Diversifying trades and using options as a hedge can provide additional protection against sudden policy shifts.

3. Currency Depreciation Risk

High-interest rate currencies often belong to economies with higher inflation or weaker fundamentals. While the carry trade can offer attractive interest income, it may come at the cost of potential currency depreciation. If the higher-yielding currency weakens due to economic instability or inflation concerns, the loss from the exchange rate can outweigh the interest income.

Risks:

- Currency Depreciation: High-yielding currencies may be more susceptible to depreciation, especially if the country’s economic outlook deteriorates or if there are concerns about inflation eroding the currency’s value.

- Negative Carry: If the interest rate differential reverses, traders may end up with a negative carry, where they are paying interest instead of earning it, leading to potential losses.

Example:

- The Turkish Lira (TRY) has historically offered high interest rates, attracting carry traders. However, due to economic instability and high inflation, the TRY has often depreciated significantly, resulting in losses for traders who were long on the currency despite the high interest rate differential.

Mitigation:

- Assess the underlying economic fundamentals of the high-yielding currency. Monitor inflation data, GDP growth, and political stability to evaluate the risks of currency depreciation. Consider implementing a stop-loss strategy to limit potential losses.

4. Interest Rate Convergence Risk

Interest rate differentials can change over time due to economic convergence or shifts in central bank policies. When the interest rates of two countries move closer together, the differential narrows, reducing the profitability of trading strategies based on this spread. This phenomenon, known as interest rate convergence, can diminish the attractiveness of carry trades and trend-following strategies.

Risks:

- Reduced Profitability: As interest rate differentials narrow, the potential income from the carry trade decreases, making the strategy less attractive to investors.

- Reversal of Trends: If the interest rate differential narrows in favor of the lower-yielding currency, it can lead to a reversal in the currency pair’s trend, causing potential losses for traders holding positions based on previous differentials.

Example:

- If the Federal Reserve starts cutting interest rates while the ECB maintains or increases its rates, the narrowing interest rate differential between the USD and EUR could lead to a depreciation of the USD against the EUR, negatively impacting trades based on a previous wide differential.

Mitigation:

- Regularly update your analysis of interest rate differentials and adjust your trading strategy to reflect changes in central bank policies. Use economic forecasts and market expectations to anticipate potential shifts in interest rates.

5. High Leverage and Margin Calls

Trading based on interest rate differentials often involves using leverage to amplify potential returns, especially in carry trades. While leverage can enhance profits, it also increases the risk of significant losses, particularly during periods of high market volatility.

Risks:

- Magnified Losses: Leverage can magnify losses if the market moves against the trader’s position, leading to substantial losses and potential margin calls.

- Forced Liquidation: In extreme cases, large, unexpected moves in currency pairs can trigger margin calls, forcing traders to close their positions at a loss to meet the required margin levels.

Example:

- In 2019, during a sudden spike in market volatility, many retail traders using high leverage in carry trades were forced to liquidate their positions due to margin calls, resulting in significant losses.

Mitigation:

- Use conservative leverage levels and ensure adequate margin to withstand potential market swings. Implement risk management strategies, such as stop-loss orders, to limit exposure and protect your capital.

6. Currency Risk from External Economic Factors

External economic factors such as geopolitical tensions, trade wars, and unexpected economic data releases can impact currency movements and alter interest rate differentials. These external shocks can disrupt even well-planned trades based on interest rate analysis.

Risks:

- Geopolitical Events: Political instability, trade conflicts, and unexpected sanctions can lead to sharp currency movements that may not align with the expected behavior based on interest rate differentials alone.

- Economic Surprises: Unexpected economic data, such as surprise GDP growth or inflation spikes, can prompt sudden changes in market sentiment and interest rate expectations.

Example:

- During the COVID-19 pandemic, unexpected lockdowns and economic shocks led to extreme volatility in forex markets, causing sharp movements in currency pairs that did not align with interest rate differentials.

Mitigation:

- Stay informed about global economic and political developments. Use tools like economic calendars, news alerts, and risk analysis to anticipate potential disruptions and adjust your positions accordingly.

Tools and Resources for Monitoring Interest Rate Differentials

To effectively trade based on interest rate differentials, forex traders need access to reliable tools and resources that provide up-to-date information on interest rates, central bank policies, and economic indicators. This section covers the essential tools and resources that can help traders monitor interest rate differentials and make well-informed trading decisions.

1. Economic Calendars

An economic calendar is a fundamental tool for tracking key events that affect interest rates and monetary policy, such as central bank meetings, interest rate announcements, and major economic data releases. These events can significantly impact interest rate differentials and currency movements.

Key Features:

- Central Bank Meetings: Displays scheduled meetings of major central banks (e.g., Federal Reserve, ECB, Bank of Japan) where interest rate decisions are announced.

- Economic Data Releases: Lists important economic indicators such as inflation, GDP growth, employment data, and PMI reports that influence central bank rate decisions.

- Market Impact Indicators: Many economic calendars include a feature indicating the potential market impact of upcoming events, helping traders prioritize the most influential announcements.

Recommended Platforms:

- Forex Factory: Offers a detailed economic calendar with real-time updates on economic releases and their potential market impact.

- Investing.com: Provides a comprehensive economic calendar with filters for specific countries, events, and impact levels.

- TradingView: Features an integrated economic calendar that allows traders to track events directly on their charts.

2. Central Bank Websites and Reports

Central banks are the primary institutions responsible for setting interest rates. Monitoring their official communications, reports, and press conferences can provide valuable insights into current and future monetary policy directions, helping traders anticipate changes in interest rate differentials.

Key Resources:

- Monetary Policy Statements: Official statements released after central bank meetings provide insights into current interest rates and the economic outlook.

- Meeting Minutes and Transcripts: Detailed records of central bank meetings offer a deeper understanding of the discussions and potential future rate decisions.

- Economic Projections: Central banks often release forecasts for GDP growth, inflation, and unemployment, which are key factors influencing interest rate decisions.

Recommended Websites:

- Federal Reserve (federalreserve.gov): Access FOMC statements, meeting minutes, and economic projections for insights into U.S. interest rate policy.

- European Central Bank (ecb.europa.eu): Monitor ECB press conferences, monetary policy decisions, and economic bulletins for updates on Eurozone interest rates.

- Bank of Japan (boj.or.jp): Follow the BOJ’s policy statements and economic outlook reports to understand Japanese interest rate policy.

3. Interest Rate Differential Charts and Tools

Specialized financial tools and platforms provide charts and indicators that track the interest rate differentials between currency pairs. These visual aids help traders analyze trends and identify potential trading opportunities based on changes in interest rate spreads.

Key Features:

- Interest Rate Spread Charts: Display the difference between the yields of two currencies, making it easy to identify widening or narrowing interest rate differentials.

- Historical Data Analysis: Allows traders to view historical interest rate differentials and identify correlations with currency pair movements over time.

- Custom Alerts: Set alerts for significant changes in interest rate differentials to stay informed about potential shifts in market dynamics.

Recommended Tools:

- TradingView: Offers customizable charts where traders can plot interest rate differentials as indicators alongside currency pair price movements.

- Myfxbook: Provides a dedicated section for interest rate differentials, allowing traders to compare rates and analyze spreads across various currency pairs.

- OANDA Interest Rate Differentials: Features an interest rate comparison tool that highlights the current spreads between major currency pairs, helping traders spot opportunities.

4. Bond Yield Analysis Platforms

Bond yields are a direct reflection of interest rate expectations and play a crucial role in understanding interest rate differentials. Changes in bond yields, especially government bonds, can indicate shifts in market expectations about future interest rates, offering insights into potential currency movements.

Key Resources:

- Government Bond Yields: Track yields on major government bonds (e.g., U.S. Treasuries, German Bunds, Japanese Government Bonds) as they often influence forex markets through their relationship with interest rates.

- Yield Spread Analysis: The spread between two countries’ bond yields can provide a proxy for the interest rate differential, helping traders gauge the direction of currency pairs.

Recommended Platforms:

- Investing.com Bond Yields: Offers a comprehensive list of government bond yields, including historical data and charts for comparison.

- Trading Economics: Provides real-time updates on global bond yields and detailed economic data, helping traders analyze interest rate trends.

- Bloomberg Terminal: A professional tool that offers extensive bond market data, including yield curves, spread analysis, and economic forecasts.

5. Forex Brokers and Trading Platforms

Many forex brokers and trading platforms offer integrated tools and resources for analyzing interest rate differentials. These platforms typically provide access to interest rate data, economic indicators, and charting tools to help traders make informed decisions.

Key Features:

- Interest Rate Data: Access to current and historical interest rates for major currencies, including central bank rates and short-term interbank rates (e.g., LIBOR, EURIBOR).

- Economic News and Analysis: In-platform news feeds and analysis from financial experts provide real-time updates on interest rate changes and market reactions.

- Charting Tools: Advanced charting features with indicators for analyzing interest rate trends and their impact on currency pairs.

Recommended Brokers:

- MetaTrader 4/5 (MT4/MT5): Offers a wide range of indicators and plugins that help traders track interest rate changes and analyze their effects on forex pairs.

- cTrader: Features advanced charting tools and economic calendars to help traders monitor interest rate differentials and central bank announcements.

- ThinkMarkets: Provides integrated tools for interest rate analysis, including access to up-to-date interest rate data and economic news.

6. News Websites and Financial Media

Staying informed about global economic events and central bank announcements is essential for monitoring interest rate differentials. Financial news websites and media platforms provide real-time updates, expert analysis, and insights into the factors driving changes in interest rates.

Key Resources:

- Breaking News Alerts: Many financial news websites offer alert services that notify traders of important central bank decisions and economic data releases.

- Expert Analysis: Access to commentary and analysis from economists and financial analysts provides a deeper understanding of the implications of interest rate changes on currency markets.

- Economic Research Reports: Research reports from banks and financial institutions offer detailed forecasts and analysis of interest rate trends.

Recommended Websites:

- Bloomberg: Provides comprehensive coverage of global financial markets, including real-time updates on interest rate changes and central bank policies.

- Reuters: Offers breaking news, analysis, and insights into global economic events that impact interest rate differentials.

- CNBC: Features live updates and expert commentary on central bank announcements and interest rate decisions.

Case Studies of Interest Rate Differentials Impacting Forex Pairs

To illustrate the practical impact of interest rate differentials on currency pairs, this section examines real-world examples where changes in interest rates and central bank policies significantly influenced forex market dynamics. These case studies demonstrate how traders can use interest rate analysis to anticipate currency movements and capitalize on shifts in market sentiment.

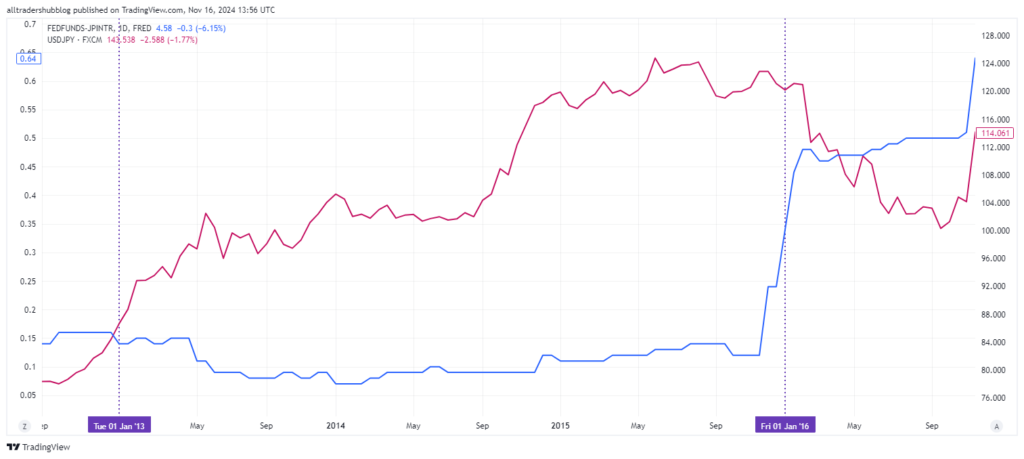

Case Study 1: USD/JPY and the Impact of the U.S.-Japan Interest Rate Differential (2013-2015)

Background:

In the early 2010s, the U.S. Federal Reserve and the Bank of Japan (BOJ) pursued divergent monetary policies. The Federal Reserve began to taper its quantitative easing program and signal interest rate hikes as the U.S. economy showed signs of recovery. Meanwhile, the BOJ implemented aggressive monetary easing policies, including negative interest rates, as part of its Abenomics strategy to combat deflation and stimulate growth.

Interest Rate Differential:

- U.S. Federal Reserve: Moving towards tightening monetary policy with potential rate hikes.

- Bank of Japan: Maintaining an ultra-loose policy with negative interest rates and aggressive asset purchases.

Impact on USD/JPY:

- As the interest rate differential widened in favor of the USD, the USD/JPY pair saw a significant upward trend. Traders anticipated higher returns from holding U.S. assets compared to Japanese assets, making the USD more attractive.

- From 2013 to 2015, USD/JPY surged from around 80 to over 120, reflecting the increasing attractiveness of the dollar due to the higher interest rate outlook in the U.S. versus Japan’s continued low rates.

Key Takeaway:

- The widening interest rate differential between the U.S. and Japan created a strong upward trend in USD/JPY. Traders who monitored this differential were able to capitalize on the bullish trend, especially in a favorable risk-on environment where investors sought higher returns.

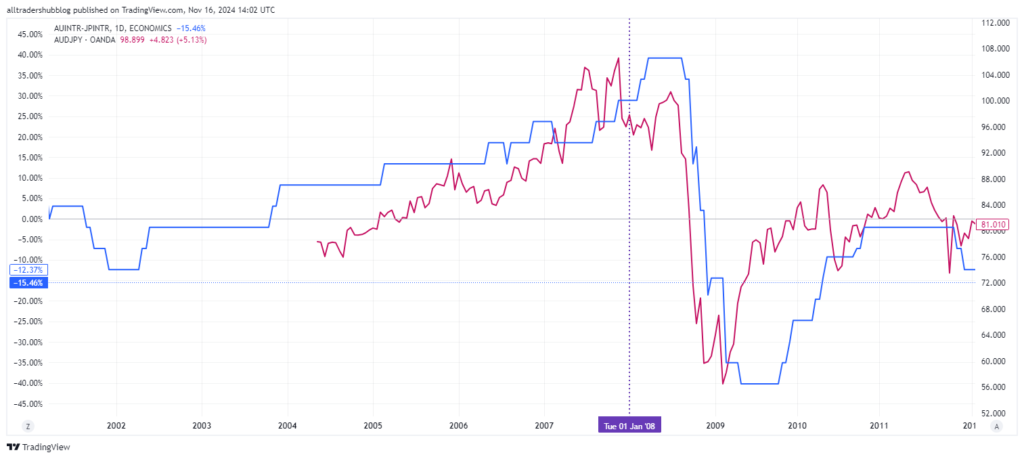

Case Study 2: AUD/JPY and the Carry Trade Unwind During the 2008 Financial Crisis

Background: The Australian dollar (AUD) was a popular currency for carry trades before the 2008 financial crisis due to its relatively high interest rates. In contrast, the Japanese yen (JPY) had low interest rates, making it an ideal funding currency for carry trades. However, during the financial crisis, a sudden shift towards risk aversion led to a massive unwinding of these positions.

Interest Rate Differential:

- Reserve Bank of Australia (RBA): Maintained higher interest rates to control inflation before the crisis, attracting carry trade investments.

- Bank of Japan: Kept interest rates near zero, making it a preferred funding currency for carry trades.

Impact on AUD/JPY:

- As the global financial crisis unfolded, investors fled risky assets and moved towards safe-haven currencies like the JPY. The unwinding of carry trades led to a sharp depreciation of the AUD against the JPY.

- AUD/JPY dropped from around 104 in mid-2008 to below 56 by the end of the year, a decline of nearly 50%, driven by the rapid shift in market sentiment and the closing of carry trade positions.

Key Takeaway:

- This case highlights the risk of relying solely on interest rate differentials in a volatile market environment. While the differential initially favored the AUD, the global shift towards risk aversion during the financial crisis led to a rapid reversal. Traders need to be aware of broader market conditions when trading based on interest rate differentials.

Case Study 3: EUR/USD and the Divergence Between ECB and Fed Policies (2014-2017)

Background: From 2014 to 2017, the European Central Bank (ECB) and the U.S. Federal Reserve pursued starkly different monetary policies. The ECB launched a large-scale quantitative easing program and cut interest rates to stimulate growth and combat low inflation in the Eurozone. Meanwhile, the Federal Reserve began to raise interest rates gradually as the U.S. economy showed signs of recovery.

Interest Rate Differential:

- European Central Bank: Negative interest rates and aggressive quantitative easing.

- U.S. Federal Reserve: Gradual rate hikes and the tapering of quantitative easing.

Impact on EUR/USD:

- The widening interest rate differential between the U.S. and the Eurozone led to a sustained decline in EUR/USD. The euro weakened as investors anticipated lower returns from Eurozone assets due to the ECB’s ultra-loose monetary policy.

- Between mid-2014 and the end of 2016, EUR/USD fell from around 1.39 to below 1.05, a decline of over 30%, driven by the increasing attractiveness of the U.S. dollar due to higher interest rates.

Key Takeaway:

- Traders who closely monitored the divergence in monetary policies between the ECB and the Fed were able to capitalize on the bearish trend in EUR/USD. This case underscores the importance of analyzing central bank policies and their impact on interest rate differentials when trading forex pairs.

Case Study 4: GBP/USD and the Impact of Brexit (2016-Present)

Background: The 2016 Brexit referendum had a profound impact on the British pound (GBP) and its interest rate outlook. The uncertainty surrounding the U.K.’s exit from the European Union led the Bank of England (BoE) to adopt a more accommodative stance, including cutting interest rates to support the economy.

Interest Rate Differential:

- Bank of England: Lowered interest rates post-referendum to support economic growth amid Brexit uncertainty.

- U.S. Federal Reserve: Continued its policy of gradual rate hikes as the U.S. economy remained robust.

Impact on GBP/USD:

- The narrowing interest rate differential, along with heightened economic and political uncertainty, led to significant depreciation in GBP/USD. The pair fell from around 1.50 before the referendum to below 1.20 in the months following the vote, reflecting the market’s anticipation of lower rates in the U.K. compared to the U.S.

- Despite occasional rebounds, GBP/USD remained under pressure for years as Brexit negotiations dragged on, with traders factoring in the risk of further rate cuts or dovish policies from the BoE.

Key Takeaway:

- This case study demonstrates how political events can significantly influence interest rate expectations and forex pairs. Traders analyzing the interest rate differential were able to identify the bearish bias in GBP/USD amid dovish BoE policies and Brexit-related uncertainties.

Case Study 5: NZD/USD and the RBNZ’s Rate Hikes in 2021-2022

Background: In 2021-2022, the Reserve Bank of New Zealand (RBNZ) was one of the first central banks to raise interest rates in response to surging inflation post-pandemic. The aggressive rate hikes contrasted with more cautious approaches from other major central banks, increasing the interest rate differential in favor of the New Zealand dollar (NZD).

Interest Rate Differential:

- Reserve Bank of New Zealand: Initiated a series of rate hikes to combat rising inflation.

- U.S. Federal Reserve: Delayed rate hikes initially, focusing on economic recovery and labor market stability.

Impact on NZD/USD:

- The widening interest rate differential initially boosted NZD/USD as traders anticipated higher returns from New Zealand assets. However, as the Federal Reserve began to signal and implement its own rate hikes, the differential started to narrow, putting downward pressure on the pair.

- The pair saw fluctuations driven by market expectations of future interest rate changes, highlighting the dynamic nature of trading based on interest rate differentials.

Key Takeaway:

- Monitoring the pace and extent of rate hikes by different central banks helped traders anticipate shifts in the interest rate differential and adjust their positions accordingly. This case underscores the importance of staying informed about evolving central bank policies.

Conclusion

Interest rate differentials are a critical factor influencing forex market dynamics. As this guide has shown, the differences in interest rates between countries can drive significant currency movements, providing valuable opportunities for traders who understand and monitor these shifts. By analyzing central bank policies, economic indicators, and global financial trends, traders can effectively predict changes in interest rate differentials and implement strategies like the carry trade to capitalize on potential profits.

However, trading based on interest rate differentials is not without its risks. Market sentiment, geopolitical events, and unexpected central bank interventions can disrupt the expected outcomes, leading to potential losses. Therefore, a comprehensive approach that incorporates a deep understanding of fundamental analysis, risk management, and the use of reliable tools and resources is essential for successful trading.

By applying the concepts and strategies outlined in this article, traders can enhance their ability to navigate the forex market and make informed decisions based on interest rate differentials. With the right knowledge and preparation, this powerful indicator can become a cornerstone of a robust forex trading strategy.