Understanding and predicting long-term currency trends in the Forex market is a game-changer for traders aiming to make well-informed decisions. Macroeconomic models provide a solid framework for analyzing how economic fundamentals impact currency values over time.

In this guide, we’ll explore key macroeconomic models like Purchasing Power Parity (PPP) and the International Fisher Effect (IFE) and discuss how you can apply them to forecast long-term currency trends. We’ll also include practical examples and trading strategies to help you incorporate these models into your trading approach.

Purchasing Power Parity (PPP)

The Purchasing Power Parity (PPP) theory suggests that over the long term, exchange rates should adjust so that identical goods and services cost the same across countries. In essence, currencies should have equivalent purchasing power in different economies.

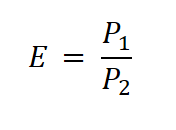

Formula:

Where:

- E: Exchange rate

- P1: Price level in the home country

- P2: Price level in the foreign country

How It Works:

- Spotting Misalignments: PPP helps identify overvalued or undervalued currencies. If the current exchange rate deviates significantly from the PPP-implied rate, a correction might be on the horizon.

- Forecasting Exchange Rates: By considering inflation differences between two countries, PPP can provide insights into how exchange rates might shift over time.

Example:

If a basket of goods costs $100 in the U.S. and €90 in the Eurozone, the PPP exchange rate is:

E=100/90=1.11

If the current exchange rate is 1.20, it indicates that the EUR/USD is overvalued, suggesting a potential long-term depreciation of the Euro.

Strategy:

- Long-Term Trades: Use PPP discrepancies to guide long-term positions. For example, if a currency is undervalued based on PPP, you might go long, anticipating appreciation over time.

International Fisher Effect (IFE)

The International Fisher Effect (IFE) predicts that differences in nominal interest rates between two countries reflect expected changes in exchange rates. Higher interest rates in one country often signal that its currency might depreciate due to inflation expectations.

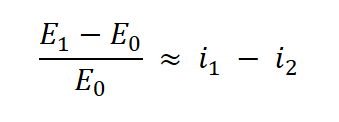

Formula:

Where:

- E0: Current exchange rate

- E1: Expected future exchange rate

- i1: Home country interest rate

- i2: Foreign country interest rate

How It Works:

- Analyzing Interest Rate Differentials: By comparing interest rates, traders can anticipate future currency movements. Higher rates in one country often lead to depreciation over time.

Example:

If the U.S. interest rate is 3% and the Eurozone rate is 1%, IFE predicts:

E1=1.10×(1+0.03−0.01)=1.10×1.02=1.122

This suggests the Euro might depreciate slightly relative to the U.S. Dollar.

Strategy:

- Carry Trades: Traders may borrow in low-interest currencies to invest in higher-interest ones. However, consider potential currency depreciations forecasted by IFE.

Relative Economic Strength Model

This model proposes that currencies of countries with strong economic growth and high interest rates tend to appreciate relative to those of weaker economies. It considers indicators like GDP growth, trade balances, and political stability.

How It Works:

- Broad Analysis: Examine a range of economic indicators to assess the relative strength of countries’ economies.

Example:

If Country A shows strong GDP growth, a trade surplus, and rising interest rates, while Country B struggles with economic stagnation and a trade deficit, Country A’s currency is likely to appreciate against Country B’s.

Strategy:

- Diversified Portfolios: Invest in currencies of strong economies while shorting those of weaker ones.

Bringing It All Together

To make the most of macroeconomic models, here’s a step-by-step plan:

- Gather Data:

- Monitor economic indicators from reliable sources like central banks and international organizations.

- Use tools like economic calendars and financial news platforms to stay updated.

- Combine Models:

- Cross-Check Predictions: Use multiple models (e.g., PPP and IFE) to validate long-term forecasts.

- Manage Risk: Implement strategies like stop-loss orders and portfolio diversification to limit potential losses.

- Test and Apply:

- Backtest: Evaluate models on historical data to gauge reliability.

- Gradual Trades: Build positions incrementally to account for market volatility.

Conclusion

Macroeconomic models like Purchasing Power Parity and the International Fisher Effect are invaluable tools for predicting long-term currency trends. By understanding and applying these frameworks, traders can make more informed decisions and navigate the complexities of the Forex market with greater confidence. Combining these models with robust risk management practices can significantly enhance your trading success over time.