Inflation is a key economic indicator that has a profound impact on currency values in the forex market. For traders using fundamental analysis, understanding how inflation works and how it influences central bank policies is crucial to making informed trading decisions. Changes in inflation data often lead to significant market reactions, as inflation directly affects purchasing power, interest rates, and overall economic stability.

In this article, we will explore the role of inflation in forex trading, how it affects currency values, and how traders can interpret inflation reports to improve their trading strategies.

What is Inflation?

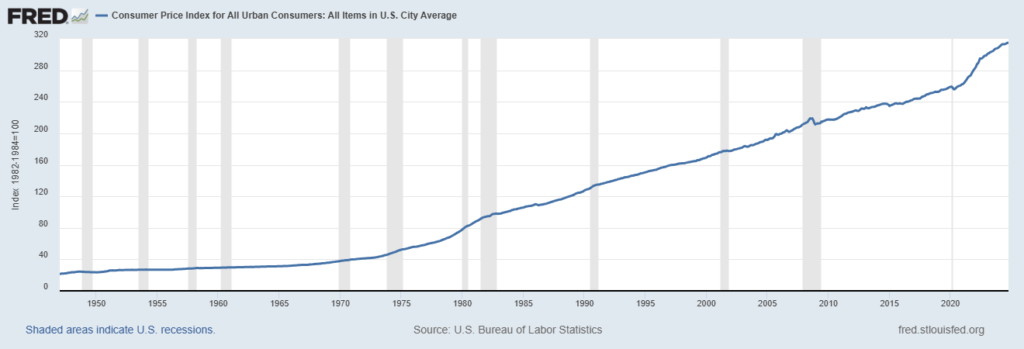

Inflation refers to the rate at which the general level of prices for goods and services in an economy rises, leading to a decrease in the purchasing power of money. In simple terms, when inflation is high, each unit of currency buys fewer goods and services, resulting in a decline in consumer purchasing power.

Governments and central banks monitor inflation closely, as maintaining price stability is essential for economic growth. Inflation is typically measured by two primary indicators:

- Consumer Price Index (CPI): Reflects the average price change in a basket of consumer goods and services.

- Producer Price Index (PPI): Measures the price changes from the perspective of producers, tracking how much suppliers receive for goods and services.

Both CPI and PPI are important for forex traders because they provide insight into inflation trends and expectations.

How Inflation Affects Currency Values

Inflation impacts the forex market in several ways, most notably through its effect on interest rates, central bank policies, and overall economic health. Here’s how inflation in forex trading plays out:

Impact on Interest Rates:

Central banks often use interest rates as a tool to control inflation. When inflation rises above a central bank’s target, policymakers may increase interest rates to cool down the economy and reduce spending. Higher interest rates can attract foreign investment, leading to an appreciation of the local currency.

Conversely, when inflation is low or negative (deflation), central banks may lower interest rates to stimulate spending and investment. This can weaken the currency as lower interest rates make the currency less attractive to investors.

For example, if the U.S. Federal Reserve raises interest rates to combat rising inflation, the U.S. dollar (USD) is likely to strengthen as foreign investors seek higher returns.

Purchasing Power and Currency Demand:

Inflation reduces the purchasing power of a currency. In an inflationary environment, the value of money erodes, making the currency less attractive to investors. If a country experiences prolonged high inflation, its currency may depreciate in the forex market.

Conversely, low or moderate inflation can support a currency’s value, as it signals a stable economy. Forex traders monitor inflation closely to gauge how well an economy is performing and whether a currency is gaining or losing value.

Market Sentiment and Volatility:

Inflation data releases often trigger significant market volatility, especially if the data deviates from expectations. A higher-than-expected inflation report can lead to speculation about interest rate hikes, causing rapid movements in the currency market.

For instance, if the Eurozone’s inflation data comes in higher than expected, traders may anticipate that the European Central Bank (ECB) will raise rates, driving up the value of the euro (EUR). On the other hand, lower-than-expected inflation might weaken the currency as expectations for rate hikes diminish.

Interpreting Inflation Reports for Forex Trading

To effectively trade based on inflation data, forex traders need to understand how to interpret inflation reports and incorporate this information into their trading strategies. Here are some key points to consider:

Monitor Central Bank Targets:

Central banks typically have an inflation target, often around 2%, which they aim to maintain. If inflation rises above or falls below this target, central banks may take action by adjusting monetary policy. Traders should watch how inflation reports compare to the central bank’s target to anticipate potential rate changes.

For example, if the U.K.’s CPI report shows inflation significantly above the Bank of England’s (BoE) 2% target, traders might expect the BoE to raise interest rates, boosting the British pound (GBP).

Year-Over-Year vs. Month-Over-Month Changes:

Inflation reports often present both year-over-year (YoY) and month-over-month (MoM) data. Year-over-year changes provide a long-term view of inflation trends, while month-over-month figures offer insights into short-term fluctuations. Traders should analyze both sets of data to get a clearer picture of inflation dynamics.

For instance, a sharp month-over-month rise in inflation might signal the start of an inflationary trend, even if the year-over-year figure remains stable.

Core Inflation vs. Headline Inflation:

Core inflation excludes volatile components like food and energy prices, providing a clearer picture of underlying inflation trends. Forex traders often focus on core inflation when making trading decisions, as it offers a more stable view of inflation pressures.

If core inflation is rising, traders might expect central banks to tighten monetary policy, which can strengthen the currency.

On the other hand, if only headline inflation is rising due to temporary spikes in energy prices, traders may take a more cautious approach.

Compare Inflation Across Economies:

Forex traders often compare inflation data from different countries to gauge relative currency strength. If one country’s inflation is rising more quickly than another’s, it could signal that the central bank will tighten monetary policy sooner, potentially boosting that country’s currency.

For example, if inflation in the U.S. is rising faster than in Japan, traders might expect the Federal Reserve to raise interest rates sooner than the Bank of Japan (BoJ), which could lead to a stronger USD against the Japanese yen (JPY).

Consider Broader Economic Context:

Inflation data should be analyzed in the context of broader economic conditions. For instance, if inflation is rising in an economy that is already struggling with low growth or high unemployment, central banks may be reluctant to raise rates despite rising prices. This could create a divergence between inflation expectations and actual monetary policy actions, impacting currency movements.

Strategies for Trading Forex with Inflation Data

To capitalize on inflation data in forex trading, consider the following strategies:

- Trade Interest Rate Expectations:

- Inflation reports often influence traders’ expectations for future interest rate decisions. By closely monitoring inflation data and central bank statements, traders can anticipate rate hikes or cuts and position themselves accordingly.

- For instance, if a country’s inflation is trending upward and central bank officials signal their willingness to raise rates, traders might go long on the currency in anticipation of appreciation.

- Use Inflation Data to Confirm Trends:

- Inflation reports can serve as a confirmation tool for existing trends. For example, if a currency has been strengthening due to strong economic data and inflation is also rising, this can confirm the trend and provide traders with more confidence to hold long positions.

- Watch for Inflation Surprises:

- When inflation data deviates from market expectations, it often leads to sharp price movements. Traders can use these opportunities to enter or exit positions based on how the market reacts to inflation surprises.

- For instance, if inflation comes in higher than expected and the currency initially strengthens, traders might consider going long. However, if inflation unexpectedly drops, traders might look to short the currency if expectations for rate hikes are reduced.

Conclusion

Inflation plays a crucial role in determining currency values and guiding central bank decisions. For forex traders, understanding how inflation impacts the economy, interest rates, and market sentiment is essential to making informed trading decisions. By monitoring inflation reports and interpreting them in the context of broader economic trends, traders can better navigate the forex market and capitalize on opportunities driven by inflationary pressures.