When it comes to forex trading, many traders primarily focus on popular economic indicators like interest rates and inflation data to gauge currency movements. While these factors certainly play a significant role, there’s another critical, yet often overlooked, aspect of fundamental analysis: the trade balance.

The trade balance, which measures the difference between a country’s exports and imports, can provide valuable insights into a nation’s economic health and influence its currency value significantly. Understanding the trade balance is essential for forex traders because it reveals the underlying demand for a country’s currency on the global stage.

This article dives deep into what trade balance is, why it matters in forex trading, and how traders can use this crucial piece of data to make informed decisions. By analyzing trade balance figures, forex traders can gain insights into a country’s economic performance, identify trends in currency strength, and anticipate potential market movements.

What is Trade Balance?

The trade balance is a key economic indicator that represents the difference between a country’s exports and imports of goods and services over a specific period. It is one of the primary components of a country’s current account and offers valuable insights into its economic interactions with the rest of the world.

- Exports are goods and services produced domestically and sold to foreign buyers. They bring money into the country and increase demand for its currency, as foreign buyers need to exchange their local currency for the currency of the exporting country.

- Imports are goods and services purchased from other countries. They result in domestic spending on foreign products and increase the demand for foreign currencies, as local buyers need to exchange their currency to pay for these imports.

The trade balance can be categorized into two distinct outcomes:

- Trade Surplus: This occurs when a country exports more than it imports. A trade surplus is generally seen as a positive sign of economic health because it indicates strong foreign demand for a country’s goods and services. For example, Germany is known for its consistent trade surplus, driven by its robust automotive and industrial exports.

- Trade Deficit: This occurs when a country imports more than it exports. A trade deficit can be a sign of economic challenges, as it suggests that domestic consumers rely heavily on foreign products. The United States, for example, often runs a trade deficit due to its high level of imports, particularly in consumer goods and electronics.

Components of Trade Balance

The trade balance is a straightforward calculation:

Trade Balance = Exports − Imports

- If the result is positive, the country has a trade surplus.

- If the result is negative, the country has a trade deficit.

To better understand the dynamics of trade balance, it’s important to consider both goods and services:

- Goods: Physical items like cars, machinery, electronics, and agricultural products. These are often the largest components of a country’s trade balance and can be influenced by factors such as global demand, production costs, and international trade policies.

- Services: Non-physical items such as tourism, financial services, and technology services. Countries with strong service industries, like the United States and the United Kingdom, often see significant contributions from service exports to their trade balance.

Example of Trade Surplus and Trade Deficit

To illustrate, let’s look at two contrasting examples:

Germany (Trade Surplus): Germany is known for its strong export sector, particularly in automobiles, machinery, and chemical products. The country’s well-developed manufacturing base and high-quality industrial goods make it a leading exporter globally. As a result, Germany consistently runs a trade surplus, which boosts demand for the euro (EUR) as foreign buyers convert their local currencies to purchase German products.

United States (Trade Deficit): The U.S. frequently runs a trade deficit, importing a wide range of goods from other countries, such as electronics from China, automobiles from Japan, and oil from the Middle East. While the U.S. is a major exporter of services and agricultural products, its consumer-driven economy and demand for foreign goods often result in a negative trade balance. This can lead to a weaker U.S. dollar (USD) over time, as there is higher demand for foreign currencies to pay for these imports.

How Trade Balance Affects Currency Value

The trade balance is a critical factor in determining the strength of a country’s currency. By analyzing whether a nation has a trade surplus or deficit, traders can gauge the underlying demand for that currency in the global market. The relationship between trade balance and currency value is driven by basic principles of supply and demand, as well as the economic signals these figures provide.

Demand and Supply of Currency

The most direct impact of trade balance on currency value is through the demand and supply dynamics of the forex market:

- Trade Surplus and Currency Appreciation:

- When a country exports more than it imports, it runs a trade surplus. In this scenario, foreign buyers need to purchase the exporting country’s goods and services, which increases the demand for its currency.

- For example, when Japan exports cars to the United States, American buyers must exchange their U.S. dollars (USD) for Japanese yen (JPY) to complete the transaction. This higher demand for yen can lead to its appreciation against the dollar.

- A consistent trade surplus signals strong global demand for a country’s products, contributing to a steady increase in its currency value.

- Trade Deficit and Currency Depreciation:

- Conversely, a trade deficit occurs when a country imports more than it exports. This situation increases the demand for foreign currencies because domestic buyers need to exchange their currency to pay for imported goods and services.

- For example, the United States often imports electronics from China, leading to a higher demand for Chinese yuan (CNY) as American consumers exchange their dollars for yuan to pay for these imports. As a result, the value of the U.S. dollar may weaken due to the increased supply of dollars in the forex market.

- A persistent trade deficit can exert downward pressure on the currency, signaling weaker demand for domestic products and potentially reducing investor confidence in the economy.

Impact on Foreign Exchange Reserves

Foreign exchange reserves play a crucial role in the relationship between trade balance and currency value:

- Accumulation of Foreign Reserves:

- Countries with a trade surplus, such as China, tend to accumulate large amounts of foreign exchange reserves. These reserves are often held in major currencies like the U.S. dollar or euro and are used to stabilize the domestic currency, pay off foreign debt, or invest in international assets.

- For example, China’s substantial trade surplus allows it to maintain large reserves of U.S. dollars. This strengthens the Chinese yuan (CNY) by providing the government with the resources to manage its value in global markets effectively.

- Forex traders closely monitor changes in foreign exchange reserves as they can indicate shifts in a country’s economic strategy or intervention in the currency market.

- Depletion of Foreign Reserves:

- In contrast, countries with a persistent trade deficit may see a depletion of their foreign exchange reserves. This can lead to currency depreciation, as the country may struggle to meet its foreign currency obligations.

- For instance, if a country with limited reserves continues to run a trade deficit, it may face pressure to devalue its currency to make its exports cheaper and reduce its import bill. This situation can lead to increased volatility in the forex market, as traders react to potential currency interventions or shifts in economic policy.

Long-term Effects on Currency Value

The long-term effects of trade balance on currency value are significant and can shape broader economic trends:

- Sustained Trade Surpluses:

- Countries with sustained trade surpluses often experience long-term currency appreciation. This is because continuous high demand for their goods and services supports consistent buying pressure on their currency.

- For example, Germany’s consistent trade surplus has contributed to the euro’s relative strength, as the demand for European goods in international markets bolsters the currency’s value over time.

- Sustained Trade Deficits:

- Persistent trade deficits can lead to a gradual weakening of a country’s currency. Over time, the increased need to exchange the domestic currency for foreign currencies to pay for imports reduces its value.

- The United States, despite its strong global economic position, frequently faces downward pressure on the U.S. dollar due to its sizable trade deficit. This can lead to depreciation, which may result in inflationary pressures as the cost of imported goods rises.

Example: U.S. Dollar and Trade Balance Dynamics

A practical example of how trade balance affects currency value can be seen with the U.S. dollar. When the U.S. runs a significant trade deficit, it indicates higher demand for foreign goods and, consequently, foreign currencies. As the supply of U.S. dollars increases in the global market, it puts downward pressure on its value. On the other hand, during periods when the trade deficit narrows, the reduced supply of dollars may help support a stronger dollar.

Forex traders closely monitor trade balance reports as they offer insights into these demand and supply dynamics, providing clues about potential shifts in currency value. Understanding how trade balance affects a currency’s strength allows traders to anticipate market movements and adjust their trading strategies accordingly.

How to Interpret Trade Balance Data for Forex Trading

Understanding and interpreting trade balance data is a key part of fundamental analysis for forex traders. By analyzing the figures released in trade balance reports, traders can gain insights into a country’s economic performance and anticipate potential movements in its currency. Here’s how traders can effectively interpret trade balance data to make better trading decisions.

1. Analyzing the Trade Balance Report

Trade balance data is typically released on a monthly basis by government agencies or central banks. The report includes figures on total exports, total imports, and the resulting trade balance (surplus or deficit). Here’s how to read the report:

- Positive Trade Balance (Surplus):

- A positive trade balance, or surplus, indicates that a country is exporting more than it imports. This suggests strong global demand for the country’s goods and services, which can be a bullish signal for its currency.

- For example, if Japan reports a higher-than-expected trade surplus, it could indicate strong foreign demand for Japanese products. As a result, forex traders might anticipate an appreciation of the Japanese yen (JPY), as increased export activity boosts currency demand.

- Negative Trade Balance (Deficit):

- A negative trade balance, or deficit, indicates that a country is importing more than it exports. This often leads to increased demand for foreign currencies, as local buyers need to exchange their currency to pay for imports. Consequently, this can be a bearish signal for the domestic currency.

- For instance, if the United States reports a widening trade deficit, it could signal increased demand for foreign goods, leading to more U.S. dollars (USD) being exchanged for other currencies. Traders may interpret this as a potential weakening of the dollar in the forex market.

- Changes in Trade Balance Over Time:

- Traders should also pay attention to changes in trade balance figures over time. A narrowing trade deficit or a growing trade surplus can indicate an improving economic outlook, potentially leading to currency appreciation. Conversely, a widening deficit may signal economic challenges, putting downward pressure on the currency.

2. Market Reactions to Trade Balance Data

The release of trade balance data can lead to immediate reactions in the forex market. Traders closely monitor these reports, and significant deviations from expected figures can trigger sharp movements in currency pairs.

- Better-than-Expected Surplus:

- If a country reports a trade surplus that is higher than analysts’ expectations, it often leads to a rally in its currency. The unexpected increase in exports signals stronger economic performance and higher demand for the country’s goods and services, boosting the currency’s value.

- For example, if the eurozone posts a higher-than-expected trade surplus, traders may anticipate increased demand for the euro (EUR), leading to a potential appreciation against other currencies like the U.S. dollar (USD).

- Worse-than-Expected Deficit:

- Conversely, if a country reports a larger-than-expected trade deficit, it can lead to a sell-off in its currency. The widening deficit indicates increased reliance on foreign goods and higher demand for foreign currencies, which can weaken the domestic currency.

- For instance, if the UK reports a significantly larger trade deficit than expected, traders may expect a weakening of the British pound (GBP) as the data suggests lower demand for UK exports and higher import activity.

3. Factors Influencing Trade Balance and Currency Impact

Several factors can influence a country’s trade balance, which in turn impacts its currency. Understanding these factors helps traders interpret trade balance data more effectively:

- Exchange Rates:

- The value of a country’s currency can affect its trade balance. A stronger currency makes exports more expensive and imports cheaper, potentially leading to a trade deficit. Conversely, a weaker currency makes exports cheaper and imports more expensive, which can improve the trade balance.

- Forex traders often watch for shifts in exchange rates that could impact a country’s export and import activities. For example, a weakening euro might boost exports from the eurozone, improving the trade balance and potentially leading to euro appreciation over time.

- Economic Growth:

- The relative economic growth of a country compared to its trading partners can influence its trade balance. A country experiencing strong economic growth may see increased demand for imports, potentially leading to a trade deficit. On the other hand, weaker economic growth can reduce import demand, narrowing the deficit.

- Traders analyze economic data, such as GDP growth figures, alongside trade balance reports to assess the overall impact on currency value.

- Trade Policies and Tariffs:

- Government policies, including tariffs and trade agreements, can significantly impact a country’s trade balance. Protectionist measures, such as tariffs on imports, can reduce the volume of imported goods, potentially improving the trade balance.

- Forex traders need to stay informed about changes in trade policies, as these can lead to shifts in import and export activities, affecting currency demand.

Example: Interpreting U.S. Trade Balance Data

Let’s consider an example with the U.S. trade balance data:

- In recent years, the U.S. has experienced a consistent trade deficit due to high demand for imported consumer goods. However, during certain periods, the deficit has narrowed due to increased exports, particularly in agricultural products and technology services.

- If a monthly report shows a narrower trade deficit than expected, it might indicate stronger U.S. export performance, potentially signaling a bullish outlook for the U.S. dollar. Traders could interpret this as a sign of improving economic conditions, leading to potential appreciation of the USD against other major currencies like the euro (EUR) or the Japanese yen (JPY).

Strategies for Trading Forex Based on Trade Balance Data

Trade balance data provides valuable insights that can help forex traders develop effective trading strategies. By analyzing whether a country has a trade surplus or deficit, and understanding the underlying factors driving these figures, traders can make more informed decisions when entering or exiting trades. Here are some practical strategies for trading forex using trade balance data.

1. Trend Following Strategy Based on Trade Balance Data

One of the simplest strategies for forex traders is to follow the trend indicated by changes in trade balance figures:

- Identify Long-term Trends:

- If a country consistently posts a trade surplus, it typically indicates a strong export sector and sustained demand for its currency. In this case, traders might adopt a bullish outlook on the currency, expecting its value to appreciate over time.

- For example, Japan’s regular trade surpluses often create a positive sentiment for the Japanese yen (JPY), prompting traders to look for buying opportunities in yen pairs like USD/JPY or EUR/JPY.

- React to Shifts in Trade Balance:

- Traders can also look for significant changes in the trade balance that could signal a shift in the currency’s trend. If a country with a history of trade deficits suddenly reports a narrowing deficit or even a surplus, it may indicate improving economic conditions and potential currency strength.

- Conversely, if a country with a strong trade surplus begins to see a decline in its surplus, this could be an early warning sign of weakening export demand, prompting traders to reassess their positions.

Example:

- Let’s say the eurozone reports a significant increase in its trade surplus due to rising exports. A trader observing this trend might anticipate a stronger euro (EUR) and look for opportunities to buy EUR/USD, expecting the euro to appreciate against the U.S. dollar.

2. Pairing Strong and Weak Economies (Relative Trade Balance Analysis)

Another effective strategy is to trade currency pairs based on the relative strength of their economies as indicated by their trade balances:

- Pairing Surplus with Deficit Currencies:

- Traders can look for opportunities to go long on currencies of countries with strong trade surpluses and short on currencies of countries with large trade deficits. The idea is that countries with trade surpluses are likely to see their currencies appreciate due to higher foreign demand for their exports, while currencies of countries with trade deficits may weaken.

- For instance, a trader might choose to buy EUR/USD if the eurozone is reporting a widening trade surplus while the U.S. is experiencing a growing trade deficit. The expectation is that the demand for euros will rise, strengthening the EUR against the USD.

- Monitoring Changes in Relative Trade Balances:

- Traders should also monitor changes in relative trade balances between two countries to anticipate potential currency movements. If the trade balance of one country improves significantly while its trading partner’s balance worsens, this could indicate a shift in currency pair strength.

- For example, if Canada reports an unexpected trade surplus while the U.K. reports a widening trade deficit, a trader might consider selling GBP/CAD, expecting the Canadian dollar (CAD) to appreciate against the British pound (GBP).

3. News Trading Strategy Around Trade Balance Reports

Trade balance reports are highly anticipated economic events, and traders can capitalize on the market volatility following their release:

- Setting Up for the Release:

- Before the release of trade balance data, traders can assess market expectations by reviewing economic forecasts. If the forecast predicts a trade surplus and the actual figure significantly exceeds this expectation, it is likely to boost the currency’s value. Conversely, a worse-than-expected trade deficit can lead to a sell-off in the currency.

- Traders might place buy or sell orders based on their anticipation of the market’s reaction. For example, if analysts forecast a trade deficit for the eurozone but the actual data shows a surprising surplus, traders might look to buy EUR/USD in anticipation of a euro rally.

- Using Stop Losses and Limit Orders:

- Given the volatility surrounding trade balance releases, it is crucial for traders to use stop losses and limit orders to protect their positions. Setting appropriate stop losses can help mitigate risk in case the market moves unexpectedly against their trades.

Example:

- Suppose the U.K. is set to release its monthly trade balance report. Analysts are predicting a trade deficit, but if the report shows a smaller deficit than expected, it could be seen as a positive economic signal. Traders might anticipate a temporary rise in GBP/USD following the news, creating a potential buying opportunity.

4. Integrating Trade Balance Data with Other Economic Indicators

While trade balance data is valuable on its own, integrating it with other economic indicators can enhance a trader’s analysis:

- Combining with GDP Growth:

- Trade balance figures are closely linked to a country’s GDP. A positive trade balance contributes to GDP growth, while a negative balance can detract from it. By analyzing trade balance data alongside GDP reports, traders can gain a more comprehensive view of a country’s economic health and adjust their forex strategies accordingly.

- For example, if Canada reports strong GDP growth driven by a rising trade surplus, traders might take a bullish view on the Canadian dollar (CAD), expecting continued appreciation against other currencies like USD or EUR.

- Using Inflation and Interest Rate Data:

- Trade balance data can also be used in conjunction with inflation and interest rate data. A country with a strong trade surplus may see upward pressure on its currency, which could lead to higher inflation. Central banks might then raise interest rates to control inflation, further boosting the currency’s value.

- Forex traders can use this combined analysis to anticipate central bank actions and position their trades accordingly.

Example:

- If Japan reports a substantial trade surplus and the Bank of Japan signals potential interest rate hikes to control inflation, traders might expect the yen to strengthen. This could lead them to buy JPY against weaker currencies like the euro (EUR) or U.S. dollar (USD).

By incorporating trade balance data into their fundamental analysis, forex traders can develop more nuanced strategies and make better-informed decisions.

Analyzing the Trade Balance in Major Currency Pairs

Understanding how trade balance influences major currency pairs is key for forex traders using fundamental analysis. By examining the trade dynamics between countries, traders can better predict currency movements and make informed trading decisions. In this section, we analyze the impact of trade balance on three major currency pairs: EUR/USD, USD/JPY, and AUD/USD.

EUR/USD: The Eurozone’s Trade Surplus vs. the U.S. Trade Deficit

The EUR/USD is the most traded currency pair in the forex market, representing the euro and the U.S. dollar. The trade balances of the Eurozone and the United States play a crucial role in determining the strength of this pair.

- Eurozone’s Trade Surplus:

- The Eurozone, driven by its largest economies like Germany, often runs a trade surplus. This surplus indicates that the region exports more than it imports, generating strong demand for the euro (EUR) from international buyers who need the currency to purchase European goods and services.

- A higher trade surplus tends to strengthen the euro because it increases foreign demand for EUR. For example, when the Eurozone reports strong export data, investors may expect a boost in the euro’s value against other currencies, especially if the U.S. is reporting a trade deficit at the same time.

- U.S. Trade Deficit:

- In contrast, the U.S. frequently runs a trade deficit, importing more goods and services than it exports. This deficit can weaken the U.S. dollar (USD) as it reflects greater demand for foreign currencies, putting downward pressure on the USD.

- For example, when the U.S. trade deficit widens, traders might anticipate a decline in the USD’s value against the euro, leading to a bullish outlook on EUR/USD. Conversely, if the U.S. trade deficit narrows unexpectedly, it could provide temporary support for the dollar, potentially weakening the euro against the USD.

Example:

- In 2022, the Eurozone experienced a strong recovery in exports due to increased demand from the global economic rebound, leading to a significant trade surplus. This contributed to the euro gaining strength against the U.S. dollar, pushing the EUR/USD pair higher.

USD/JPY: Japan’s Trade Surplus and the Safe-Haven Yen

The USD/JPY pair reflects the relationship between the U.S. dollar and the Japanese yen. Japan’s trade balance and its role as a global exporter significantly influence this currency pair.

- Japan’s Consistent Trade Surplus:

- Japan has a long history of running trade surpluses due to its robust export sector, which includes automobiles, electronics, and machinery. This consistent surplus indicates strong international demand for Japanese products, increasing demand for the yen (JPY).

- When Japan posts strong trade surplus figures, it often leads to an appreciation of the yen, as foreign buyers exchange their currencies for JPY to pay for Japanese exports. This can result in a decline in the USD/JPY pair, as the yen strengthens against the U.S. dollar.

- Safe-Haven Status of the Yen:

- The yen is also considered a safe-haven currency, which means it tends to appreciate during times of global economic uncertainty. Even if Japan’s trade balance faces challenges, investors might still buy the yen as a refuge, further impacting the USD/JPY pair.

- For example, during the COVID-19 pandemic, despite disruptions to Japan’s export sector, the yen strengthened against the U.S. dollar as investors sought safe-haven assets, leading to a drop in USD/JPY.

Example:

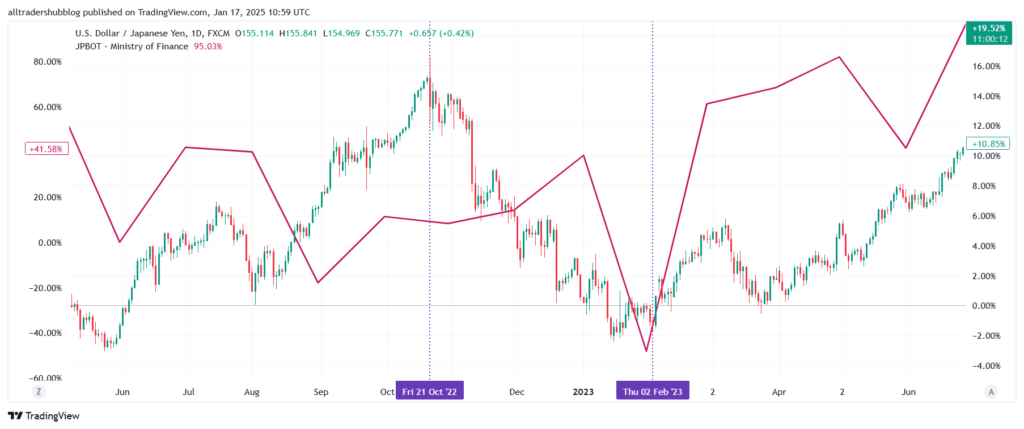

- In late 2022, Japan reported an unexpected trade surplus, boosted by strong exports to Asia. This contributed to the yen appreciating against the dollar, and the USD/JPY pair saw a notable decline as traders anticipated stronger performance for the yen.

AUD/USD: Australia’s Trade Balance and Commodity Exports

The AUD/USD pair is heavily influenced by Australia’s trade balance, which is largely driven by its export of commodities like iron ore, coal, and natural gas.

- Commodity-Driven Trade Balance:

- Australia’s trade balance is highly sensitive to global commodity prices. When commodity prices are high, Australia tends to run a trade surplus due to increased export revenues. This surplus can strengthen the Australian dollar (AUD), as foreign buyers need AUD to purchase Australian commodities.

- For instance, a surge in iron ore prices can lead to a trade surplus for Australia, boosting the AUD’s value against the U.S. dollar. Traders monitoring the trade balance data and commodity prices can anticipate movements in the AUD/USD pair based on these trends.

- Impact of Trade Relations:

- Australia’s trade relations, particularly with China, its largest trading partner, also play a significant role in determining the AUD’s performance. When China’s demand for Australian commodities rises, Australia’s trade surplus typically expands, strengthening the AUD. Conversely, any trade disputes or reduced demand from China can lead to a decline in the trade balance, weakening the AUD.

- For example, during the 2020 trade tensions between Australia and China, the AUD faced downward pressure as concerns about reduced demand for Australian exports impacted market sentiment.

Example:

- In late 2022, a spike in iron ore prices due to strong demand from China led to a record trade surplus for Australia. As a result, the Australian dollar appreciated against the U.S. dollar, pushing the AUD/USD pair higher. Forex traders who anticipated this trend based on the rising trade balance data were able to profit from long positions in AUD/USD.

Case Study: Impact of China-U.S. Trade Tensions on EUR/USD

One notable example of how trade balance data can lead to significant currency movements is the 2018-2019 trade tensions between the U.S. and China:

- During the height of the trade war, the U.S. imposed tariffs on Chinese imports, and China responded with tariffs on U.S. goods. This disrupted trade flows and led to changes in trade balances for both countries.

- As the U.S. trade deficit with China initially widened, there was increased pressure on the U.S. dollar, contributing to a period of weakness against major currencies, including the euro (EUR).

- At the same time, the Eurozone’s trade balance was bolstered by rising exports to other global markets, leading to euro strength. The EUR/USD pair saw significant volatility during this period, with sharp movements based on new trade balance data releases and updates on trade negotiations.

This case study highlights how shifts in trade balances due to geopolitical factors can influence currency pairs, providing forex traders with actionable insights.

By analyzing trade balance data for major currency pairs like EUR/USD, USD/JPY, and AUD/USD, forex traders can better understand market dynamics and develop effective trading strategies. The next section will explore practical tips for incorporating trade balance analysis into a broader forex trading strategy.

Strategies for Using Trade Balance Data in Forex Trading

Incorporating trade balance data into forex trading strategies can provide traders with valuable insights into a country’s economic health and potential currency movements. In this section, we discuss three key strategies for using trade balance data effectively: fundamental analysis, trend trading, and combining trade balance data with other economic indicators.

1. Fundamental Analysis Strategy

Fundamental analysis involves evaluating economic data, such as trade balance reports, to understand the underlying factors affecting a currency’s value. By analyzing trade balance data, traders can assess the demand for a country’s goods and services, which in turn influences the demand for its currency.

How to Incorporate Trade Balance Data:

- Compare Expected vs. Actual Trade Balance Reports:

- Traders can start by looking at the market’s expectations for an upcoming trade balance report. Analysts often provide forecasts based on current economic conditions and recent trade trends. If the actual trade balance data deviates significantly from expectations, it can trigger strong market reactions.

- For example, if analysts predict a trade deficit for the Eurozone but the report unexpectedly shows a surplus, this could indicate stronger-than-expected demand for Eurozone exports. Such a positive surprise may lead to increased demand for the euro (EUR), providing a potential buying opportunity.

Example:

- Let’s say analysts forecast a $40 billion trade deficit for the U.S., but the actual data reveals only a $25 billion deficit. This smaller-than-expected deficit could signal that the U.S. economy is performing better than anticipated, potentially boosting investor confidence in the U.S. dollar (USD). Traders might interpret this as a buying signal for the USD against other currencies like the euro (EUR) or the Japanese yen (JPY).

Key Takeaway:

- When using fundamental analysis, it’s crucial to not only monitor the absolute figures of the trade balance but also consider the market’s expectations. A positive surprise can be bullish for the currency, while a negative surprise may indicate bearish sentiment.

2. Trend Trading Strategy

Trend trading is a strategy where traders look to capitalize on long-term movements in currency pairs based on persistent economic trends. In the context of trade balance, observing whether a country consistently runs a trade surplus or deficit can provide insights into the long-term direction of its currency.

How to Use Long-Term Trade Balance Trends:

- Persistent Trade Surplus:

- A country that consistently runs a trade surplus, such as Germany within the Eurozone or Japan, indicates strong demand for its exports. This persistent demand can create upward pressure on the country’s currency over time, leading traders to adopt a bullish outlook on that currency.

- For instance, traders who observe a consistent trade surplus in the Eurozone might look for buying opportunities in the EUR/USD pair, expecting the euro to strengthen against the U.S. dollar.

- Persistent Trade Deficit:

- Conversely, a country with a long-standing trade deficit, like the United States or Turkey, may experience downward pressure on its currency. The need to fund this deficit through borrowing or foreign investment can lead to a weaker currency over time.

- Trend traders might take a bearish position on the U.S. dollar if they see persistent trade deficits and no signs of improvement, especially if combined with other negative economic indicators.

Example:

- In 2021, Australia experienced a significant trade surplus due to rising commodity prices, particularly in iron ore. Trend traders who recognized this pattern could have anticipated a strengthening of the Australian dollar (AUD) against the U.S. dollar, taking a long position in AUD/USD.

Key Takeaway:

- By monitoring long-term trade balance trends, traders can develop a clearer picture of a currency’s likely trajectory, helping them align their trades with broader economic movements.

3. Combining Trade Balance Data with Other Indicators

While trade balance data is a valuable tool in forex trading, relying solely on it can be risky. To gain a more comprehensive view of a currency’s likely direction, traders should combine trade balance analysis with other fundamental indicators like GDP growth, inflation, and interest rates.

How to Use Multiple Indicators:

- Trade Balance and GDP:

- Trade balance contributes directly to a country’s GDP. A trade surplus can boost GDP growth, signaling a strong economy, while a trade deficit can weigh on GDP. Traders can use this relationship to anticipate currency movements, especially when GDP figures are released in conjunction with trade data.

- For example, if a country reports a growing trade surplus alongside strong GDP growth, this combination may indicate robust economic performance, leading traders to take a bullish stance on the currency.

- Trade Balance and Inflation:

- Changes in the trade balance can influence inflation. A trade surplus may lead to increased currency value, reducing import costs and helping control inflation. Conversely, a trade deficit may weaken the currency, making imports more expensive and contributing to higher inflation.

- Forex traders who observe a widening trade deficit along with rising inflation might anticipate central bank intervention, such as rate hikes, to curb inflation. This expectation could affect trading decisions, particularly in currency pairs like USD/JPY or EUR/USD.

- Trade Balance and Interest Rates:

- Central banks closely monitor trade balance data when setting interest rates. A strong trade surplus may reduce the need for aggressive rate hikes, while a significant trade deficit could pressure central banks to raise rates to attract foreign investment and stabilize the currency.

- Traders can use this information to predict central bank policy moves and adjust their positions accordingly. For instance, if the European Central Bank (ECB) signals that it may keep rates steady due to a strong trade surplus, traders might expect euro strength and consider long positions in EUR pairs.

Example:

- During the 2022 economic recovery, Canada reported a widening trade surplus driven by rising energy exports. At the same time, inflation was climbing, prompting the Bank of Canada to increase interest rates. Traders who combined trade balance data with rising inflation trends and central bank signals were able to anticipate a stronger Canadian dollar (CAD) against the U.S. dollar (USD), making profitable trades in the USD/CAD pair.

Key Takeaway:

- By integrating trade balance data with other key economic indicators, traders can develop a well-rounded analysis of market conditions, improving their ability to anticipate currency movements and make informed trading decisions.

These strategies demonstrate how trade balance analysis can be a powerful component of forex trading. Whether through fundamental analysis, trend trading, or combining with other economic data, understanding trade balance dynamics can help traders gain an edge in the forex market.

Challenges and Limitations of Using Trade Balance Data

While trade balance data can be a valuable tool in forex trading, it is not without its challenges and limitations. Traders need to be aware of the pitfalls that come with analyzing trade balance figures to avoid misinterpreting the data and making poor trading decisions. In this section, we explore three major challenges: time lags in data, the influence of other economic factors, and complexities in global supply chains.

1. Time Lags in Data

One of the primary challenges in using trade balance data for forex trading is the significant time lag between when trade activities occur and when the data is reported.

- Delayed Reporting:

- Trade balance reports are typically released monthly, often weeks after the period they cover. For example, a trade balance report for January might only be published in early March. This delay means the data reflects past economic conditions rather than current market realities, limiting its usefulness for short-term traders looking for timely indicators of currency movements.

- Forex markets are highly dynamic and react swiftly to real-time information. As a result, by the time trade balance data is released, the market may have already adjusted to other economic developments, reducing the impact of the report.

- Impact on Short-Term Trading:

- For short-term traders who rely on immediate market reactions, the delayed nature of trade balance reports can make it challenging to use this data effectively. These traders often need to look for more immediate indicators, such as inflation reports, interest rate decisions, or employment figures, which are released with less of a time lag.

Example:

- In July 2023, the U.S. reported a significant narrowing of its trade deficit for May, driven by a decrease in imports. However, by the time the data was released, market participants had already shifted their focus to the latest Federal Reserve meeting, where interest rate decisions took center stage. The market’s reaction to the trade data was minimal, as traders had already accounted for more recent economic developments.

Key Takeaway:

- Traders should be cautious about relying solely on trade balance data for short-term decisions and should consider it as part of a broader, longer-term fundamental analysis.

2. Influence of Other Economic Factors

Another major challenge in using trade balance data is that its impact on currency values can be overshadowed by other economic indicators, such as interest rates, inflation, and GDP growth.

- Competing Economic Indicators:

- Central banks’ interest rate decisions often have a more immediate and pronounced effect on currency values than trade balance figures. For instance, a significant rate hike by a central bank can drive a currency higher, even if the country is running a trade deficit.

- Similarly, inflation reports can have a direct impact on currency strength as they influence expectations for future interest rate changes. If inflation data indicates rising prices, traders may anticipate tighter monetary policy, potentially strengthening the currency regardless of a worsening trade balance.

- Example of Overshadowing Impact:

- In early 2024, the Eurozone reported a better-than-expected trade surplus, which under normal circumstances might have boosted the euro. However, around the same time, the European Central Bank announced a dovish outlook, signaling a pause in interest rate hikes. This announcement led to a sell-off in the euro despite the positive trade data, as traders focused more on the central bank’s policy direction.

Key Takeaway:

- Forex traders need to analyze trade balance data in conjunction with other key economic reports to form a comprehensive view of the currency’s likely direction. Relying solely on trade data without considering broader economic factors can lead to incomplete analysis and potential trading mistakes.

3. Global Supply Chain Complexities

The modern global economy is characterized by intricate and interconnected supply chains, making it challenging to interpret trade balance data accurately.

- Multi-Country Sourcing:

- In today’s globalized market, many products are assembled from components sourced from various countries. For instance, a smartphone may have parts made in China, Japan, South Korea, and the U.S. before being assembled in a specific country. This complexity means that a country’s trade deficit or surplus might not fully capture the economic reality, as parts and raw materials flow across borders multiple times before the final product is exported.

- The traditional view of trade balance data assumes that exports represent finished goods produced entirely within one country, but this is increasingly rare. The rise of global supply chains has made it harder to assess the real economic impact of trade balance figures on a country’s currency.

- Example of Supply Chain Impact:

- Consider Germany, a major exporter of automobiles. If Germany reports a strong trade surplus due to high car exports, the data might suggest robust demand for German products. However, many components of these cars are imported from other countries, such as electronics from South Korea or steel from China. If global supply chain disruptions occur, such as semiconductor shortages, it can reduce Germany’s exports despite strong underlying demand, making the trade balance data less reflective of actual economic conditions.

Key Takeaway:

- Traders need to be aware of the complexities of global supply chains and understand that trade balance data might not fully capture the value-added processes of exports. Analyzing supplementary data, such as import/export breakdowns and supply chain reports, can help provide a clearer picture.

Examples of Trade Balance Impact on Forex Markets

Understanding the theoretical concepts behind trade balance is one thing, but seeing how these dynamics play out in the real world can provide forex traders with practical insights. In this section, we explore a few real-world examples of how trade balance data has influenced major currency pairs, highlighting the connection between trade balances and currency value fluctuations.

1. The U.S. Trade Deficit and Its Impact on the U.S. Dollar (USD)

The United States has consistently run a trade deficit for decades, importing more goods and services than it exports. This persistent deficit has had notable effects on the U.S. dollar’s performance in the forex markets:

- Increased Demand for Foreign Currencies:

- When the U.S. imports more than it exports, American consumers and businesses must purchase foreign currencies to pay for these imports. This increased demand for foreign currencies, such as the euro (EUR), Japanese yen (JPY), or Chinese yuan (CNY), can weaken the U.S. dollar (USD).

- For example, if the U.S. trade deficit widens significantly, traders may interpret this as a signal of weakened economic performance and reduced global demand for American goods. As a result, they may sell off the USD, leading to a decline in its value against other major currencies.

- Case Study: U.S. Trade Deficit with China:

- A prominent example is the U.S. trade deficit with China, which has been one of the largest bilateral trade imbalances in the world. When trade tensions escalated in 2018, with the U.S. imposing tariffs on Chinese imports, the initial reaction was a temporary strengthening of the U.S. dollar. However, as the trade war intensified, it led to market uncertainty and a weakening of the dollar, particularly against safe-haven currencies like the Japanese yen.

2. Germany’s Trade Surplus and the Euro (EUR)

Germany is one of the largest export-driven economies in the world, consistently running a substantial trade surplus. This strong export performance has had significant implications for the euro (EUR), especially within the broader context of the eurozone.

- Support for Euro Strength:

- Germany’s consistent trade surplus indicates high demand for its goods and services, which often translates into increased demand for the euro as international buyers exchange their currencies for EUR to purchase German products. This demand can bolster the strength of the euro against other major currencies.

- For example, during periods when Germany reports a rising trade surplus, traders often anticipate a stronger euro, particularly against currencies of countries with weaker trade balances, such as the British pound (GBP) or the Japanese yen (JPY).

- Impact During the European Debt Crisis:

- During the European debt crisis (2010-2012), concerns about the stability of the eurozone led to fluctuations in the euro’s value. However, Germany’s strong trade surplus acted as a stabilizing factor, providing some support for the euro despite the economic challenges faced by other member countries like Greece, Italy, and Spain.

3. The Japanese Trade Balance and the Yen (JPY)

Japan’s trade balance has experienced significant shifts over the years, influenced by global economic conditions, natural disasters, and changes in energy imports. These fluctuations have had a direct impact on the Japanese yen (JPY), especially as Japan’s economy is heavily dependent on exports.

- Shifts in Trade Balance Due to External Shocks:

- After the 2011 Fukushima disaster, Japan shut down many of its nuclear reactors, leading to a sharp increase in energy imports. As a result, the country experienced a temporary trade deficit, putting downward pressure on the yen. The increased demand for foreign currencies to pay for energy imports weakened the JPY, leading to its depreciation against other major currencies like the U.S. dollar (USD).

- Conversely, when Japan later experienced a recovery in its export sector, the trade balance improved, and the yen appreciated as demand for Japanese goods increased globally.

- Safe-Haven Status and Trade Balance:

- Despite fluctuations in its trade balance, the yen is often considered a safe-haven currency during times of global economic uncertainty. Even when Japan runs a trade deficit, increased risk aversion in the market can lead to yen appreciation as investors flock to safer assets. For example, during the COVID-19 pandemic, the yen strengthened against many currencies, even as Japan’s trade balance faced challenges due to disrupted supply chains.

4. Australia’s Trade Balance and the Australian Dollar (AUD)

Australia’s trade balance is heavily influenced by its commodity exports, such as iron ore, coal, and natural gas. Changes in global demand for these commodities can significantly impact the Australian dollar (AUD).

- Commodity Price Influence:

- When global commodity prices rise, Australia often experiences a trade surplus due to increased export revenues. This surplus tends to strengthen the AUD, as international buyers need to purchase Australian dollars to pay for these commodities.

- For example, during the 2021 commodity boom, driven by increased demand from China and other emerging markets, Australia reported strong trade surplus figures. The rising export revenues boosted the AUD, leading to its appreciation against major currencies like the U.S. dollar (USD) and the euro (EUR).

- Impact of Trade Relations with China:

- China is Australia’s largest trading partner, and any changes in trade relations between the two countries can significantly impact Australia’s trade balance and, consequently, the AUD. For instance, when China imposed tariffs on Australian wine and beef in 2020, it led to concerns about reduced demand for Australian exports. As a result, the AUD faced downward pressure in the forex market.

5. Emerging Markets: Trade Balance and Currency Volatility

In emerging market economies, trade balance figures can be even more influential in determining currency values due to their higher dependency on exports and foreign capital inflows.

- Case Study: Turkey’s Trade Deficit and the Turkish Lira (TRY):

- Turkey has historically run a trade deficit, relying heavily on imports for energy and industrial goods. This persistent deficit has contributed to the depreciation of the Turkish lira (TRY) over time, especially during periods of economic instability.

- For example, in 2018, Turkey’s widening trade deficit, coupled with political tensions and inflation concerns, led to a sharp sell-off of the lira. Forex traders who anticipated this decline based on the trade deficit data were able to profit from short positions in USD/TRY.

By examining these real-world examples, forex traders can better understand how trade balance figures influence currency movements and incorporate this knowledge into their trading strategies.

Conclusion

Trade balance data offers valuable insights into a country’s economic performance and can influence currency strength. However, traders should be mindful of its limitations, including time lags, the overshadowing effects of other economic indicators, and the complexities introduced by global supply chains. By understanding these challenges, forex traders can use trade balance analysis more effectively as part of a broader strategy that considers multiple economic factors.