In the forex trading, understanding economic indicators, like the inflation data, is key to making informed decisions. One of the most important indicators is the Consumer Price Index (CPI), which tracks inflation by measuring the average change in prices paid by consumers for goods and services.

For forex traders, closely following CPI data is essential because inflation trends can signal shifts in central bank policies, which directly affect currency values.

This article will explore what the CPI is, how it measures inflation, and why it’s crucial for forex traders to monitor CPI data to gain insights into currency trends.

What is the Consumer Price Index (CPI)?

The Consumer Price Index (CPI) is a key measure of inflation, reflecting the price changes in a basket of goods and services consumed by households. Governments and central banks around the world, including the U.S. Bureau of Labor Statistics and the Eurostat, release CPI data on a monthly or quarterly basis.

CPI measures the price changes across a wide range of categories, such as:

- Food and beverages

- Housing

- Apparel

- Transportation

- Healthcare

- Education

By tracking how the prices of these goods and services fluctuate, CPI provides an estimate of inflation, which in turn influences consumer purchasing power and overall economic stability.

How CPI Measures Inflation

CPI serves as a tool to measure the rate at which the general level of prices for goods and services is rising, thereby reducing the purchasing power of a currency. Inflation can be both good and bad for an economy, depending on how it’s managed. Moderate inflation is often a sign of economic growth, while high inflation can erode consumer spending power and create uncertainty in the markets.

Here’s how CPI works as an inflation measure:

- Base Year Comparison: CPI uses a base year to compare current price levels. The index is set at 100 during the base year, and any increase in prices leads to a CPI value above 100. For example, if the CPI rises from 100 to 105, it indicates a 5% inflation rate.

- Year-Over-Year Changes: Forex traders often look at year-over-year CPI changes to track inflation trends. If CPI is rising faster than expected, it can signal increasing inflation, prompting central banks to take action.

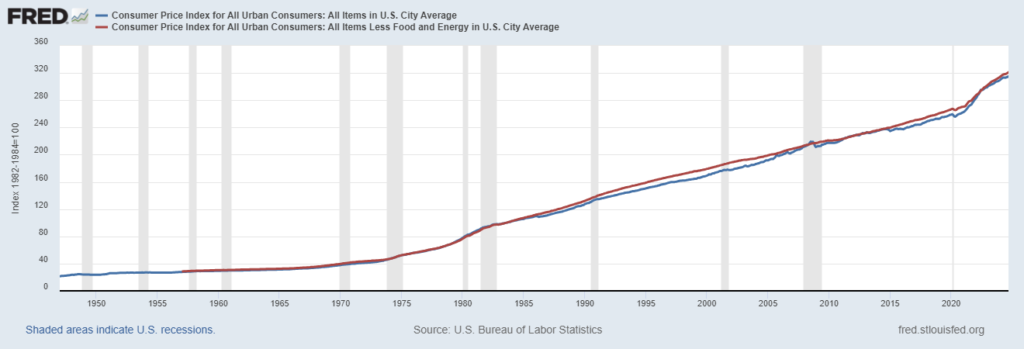

- Core CPI: Core CPI excludes volatile categories like food and energy, offering a more stable view of inflation trends. Central banks tend to focus on core CPI when making decisions about interest rates, as it provides a clearer picture of long-term inflationary pressures.

Why Inflation Data is Crucial for Forex Traders

Monitoring CPI and forex markets is vital for traders because of the direct impact inflation has on currency values. Here are the key reasons why forex traders should pay close attention to CPI data:

Interest Rate Expectations:

Central banks, such as the Federal Reserve, the European Central Bank, and the Bank of Japan, closely monitor CPI data when determining monetary policy. Inflation that is too high may prompt a central bank to raise interest rates to cool down the economy. Conversely, low inflation or deflation may lead to rate cuts to stimulate economic activity.

For forex traders, interest rate changes are critical because higher interest rates tend to strengthen a currency, while lower rates weaken it. For example, if the U.S. CPI shows increasing inflation, traders may anticipate a rate hike by the Federal Reserve, leading to a stronger U.S. dollar (USD).

Currency Value Fluctuations:

CPI data can influence both short-term and long-term movements in currency values. When inflation rises, the purchasing power of a currency typically declines domestically, but central bank actions like raising interest rates can counteract this decline by attracting foreign capital. This dynamic creates opportunities for forex traders to profit from shifts in currency pair values.

For instance, if Japan’s CPI shows persistent low inflation, the Bank of Japan might continue with its accommodative policies, weakening the yen (JPY) against stronger currencies like the euro (EUR) or USD.

Market Sentiment and Volatility:

CPI reports can trigger significant market volatility, particularly if the data deviates from analysts’ expectations. A higher-than-expected CPI may prompt traders to anticipate aggressive rate hikes, leading to sharp movements in the forex markets. Similarly, a lower-than-expected CPI can reduce expectations for rate hikes, causing a currency to weaken.

Traders should be aware of the timing of CPI releases, as these events often result in swift market reactions and offer trading opportunities for those looking to capitalize on currency fluctuations.

How Forex Traders Can Use CPI Data

Understanding the connection between CPI and forex markets is one thing; applying it effectively is another. Here are several ways traders can leverage CPI data to make informed forex trading decisions:

Anticipating Central Bank Policy:

As mentioned earlier, CPI data is closely linked to central bank policy decisions. By analyzing CPI trends, traders can better predict whether a central bank will raise or lower interest rates. For example, if the Eurozone’s CPI continues to rise above the European Central Bank’s target, traders might expect the ECB to consider tightening monetary policy, which could strengthen the euro.

Comparing Inflation Data Across Economies:

Forex traders often compare CPI data from different countries to identify potential opportunities. If one country’s inflation is significantly higher than another’s, it could indicate that their central banks will pursue divergent policies, leading to currency pair movements. For example, if inflation in the U.S. is surging while Japan’s CPI remains low, traders might go long on the USD/JPY pair, expecting the U.S. dollar to appreciate against the yen.

Watching for Economic Surprises:

Traders should keep an eye on CPI forecasts and consensus estimates before the actual data is released. If the actual CPI numbers deviate from expectations, it can lead to sharp market reactions. A surprise rise in inflation might cause immediate currency appreciation, while lower-than-expected CPI may lead to depreciation.

Pairing CPI with Other Indicators:

CPI should not be viewed in isolation. Combining CPI data with other key economic indicators, such as employment numbers, GDP growth, and the Producer Price Index (PPI), can offer a more comprehensive view of an economy’s health. For example, if CPI and employment data both show strength, it may provide stronger confirmation of future rate hikes and currency appreciation.

Example of CPI’s Impact on Forex Markets

Let’s look at an example to see how CPI and forex markets interact.

Suppose the U.S. Bureau of Labor Statistics releases CPI data showing that inflation has reached 4.5%, well above the Federal Reserve’s 2% target. The sharp rise in inflation suggests that the Fed may need to raise interest rates to control price increases. Forex traders react by buying USD, anticipating a stronger dollar due to the expected rate hike.

As a result, currency pairs like EUR/USD and GBP/USD see a decline as the dollar strengthens against the euro and the British pound.

Conclusion: Inflation Data Importance in Forex Trading

For forex traders, monitoring CPI is essential to understanding how inflation affects currency values. As a key indicator of inflation, CPI provides insights into central bank policy decisions and their subsequent impact on forex markets. By using CPI data to anticipate interest rate changes, compare inflation trends across economies, and identify economic surprises, traders can make better-informed decisions and capitalize on opportunities in the forex market.

The relationship between CPI and forex markets is clear: inflation data directly influences currency movements, and by staying on top of CPI releases, traders can position themselves to profit from market changes.