Inflation plays a major role in shaping the economy because it directly affects how much people spend, how businesses invest, and how the economy grows as a whole. When inflation is high, it reduces purchasing power, eats into savings, and creates economic uncertainty. On the other hand, low inflation or deflation can discourage spending and investment, potentially leading to economic stagnation.

For forex traders, keeping a close eye on inflation is essential because it has a direct impact on currency values. Exchange rates are influenced by the difference in inflation levels between countries, as well as the market’s expectations for future inflation trends.

When inflation rises in a country, its central bank might step in by raising interest rates to slow it down. Higher interest rates often make a currency more attractive because they offer better returns on investments tied to that currency, drawing in foreign capital.

That said, if inflation becomes persistently high or increases faster than expected, it can raise red flags about deeper economic problems. In such cases, investors may shift their money to safer assets or countries that have better control over inflation. This movement of capital causes shifts in currency exchange rates, which is why inflation data is one of the most closely monitored factors in forex trading.

By analyzing reports like the Consumer Price Index (CPI) and Producer Price Index (PPI), traders can get a clearer picture of inflation trends and predict possible actions by central banks. These decisions can significantly influence the strength or weakness of a currency.

In this guide, we’ll break down the basics of CPI and PPI, explain their broader economic implications, and explore practical trading strategies. By the end, you’ll have a solid understanding of how these inflation indicators shape forex markets and currency movements.

What is Inflation?

Inflation is defined as the general increase in the prices of goods and services over time, which reduces the purchasing power of money. When inflation occurs, each unit of currency buys fewer goods and services than it did previously, meaning the value of money diminishes. Inflation is a natural part of a growing economy, but excessive or uncontrolled inflation can have negative impacts on consumers, businesses, and overall economic stability.

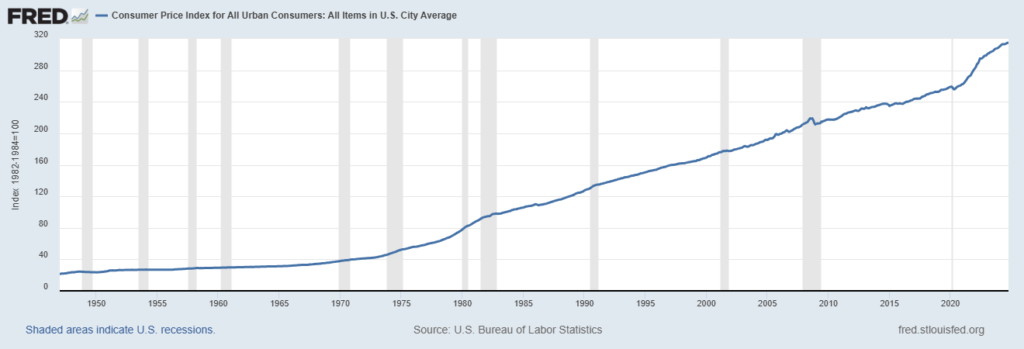

Inflation is typically measured as an annual percentage change in a price index, such as the Consumer Price Index (CPI) or Producer Price Index (PPI). A moderate level of inflation is often considered a sign of a healthy, expanding economy. However, high or unpredictable inflation can erode purchasing power, disrupt savings, and lead to uncertainty in financial markets.

Types of Inflation Data

- Demand-Pull Inflation

- Demand-pull inflation occurs when the overall demand for goods and services in an economy exceeds the available supply. This imbalance between demand and supply drives up prices.

- Causes:

- Increased consumer spending due to rising income levels or lower interest rates.

- Expansionary fiscal policies, such as tax cuts or increased government spending.

- Strong economic growth leading to higher demand across various sectors.

- Example: During a period of economic boom, consumers have more disposable income, and businesses invest heavily in expansion. The increased demand for products and services leads to higher prices, creating demand-pull inflation.

- Cost-Push Inflation

- Cost-push inflation arises when the cost of production for goods and services increases, leading producers to raise prices to maintain profit margins. This form of inflation is driven by rising input costs rather than increased demand.

- Causes:

- Increases in wages or labor costs.

- Rising prices of raw materials (e.g., oil, metals).

- Supply chain disruptions or increased costs due to tariffs and regulations.

- Example: A sharp rise in oil prices increases transportation and production costs for many goods. Companies pass these higher costs on to consumers by raising prices, leading to cost-push inflation.

- Built-In Inflation

- Built-in inflation, also known as wage-price spiral inflation, occurs when workers demand higher wages to keep up with rising living costs, and businesses, in turn, raise prices to cover these increased labor costs. This creates a cycle of rising wages and prices.

- Causes:

- High inflation expectations among workers and businesses.

- Persistent inflation leading to automatic wage adjustments (e.g., cost-of-living adjustments).

- Example: If employees expect inflation to remain high, they may negotiate higher wages during collective bargaining. Employers, facing increased labor costs, raise prices to maintain profitability, perpetuating the inflation cycle.

Key Inflation Indicators in Forex – CPI and PPI

Two primary indicators used to gauge inflationary pressures are the Consumer Price Index (CPI) and the Producer Price Index (PPI). These metrics provide insights into price changes at different stages of the economic cycle, influencing trader sentiment and central bank policies.

Consumer Price Index (CPI)

The Consumer Price Index (CPI) measures the average change in prices paid by consumers for a basket of goods and services over time. It reflects the cost of living and is the most commonly used indicator of inflation at the consumer level. By tracking changes in the CPI, economists and policymakers can assess the rate at which prices are rising or falling, offering insights into the purchasing power of the currency.

Components of CPI:

- Core CPI:

Core CPI excludes volatile items such as food and energy prices, which can fluctuate significantly due to factors like weather events, geopolitical tensions, or seasonal effects.

By removing these volatile components, core CPI provides a more stable and accurate reflection of underlying inflation trends. Central banks often use core CPI as a key metric when making policy decisions because it helps identify persistent inflation pressures without temporary price swings.

- Headline CPI:

Headline CPI includes all items in the basket of goods and services, such as food, energy, housing, transportation, and medical care.

Headline CPI reflects the overall inflation experienced by consumers, capturing short-term fluctuations in prices. It is closely watched by traders as it provides a comprehensive view of inflation that impacts everyday consumer expenses.

Importance for Forex Traders:

- Indicates Changes in Purchasing Power and Inflation Trends:

CPI data gives traders insights into changes in the purchasing power of consumers. Rising CPI indicates higher inflation, reducing the value of money over time and potentially leading to higher interest rates as central banks attempt to control inflation. - Direct Impact on Interest Rate Decisions by Central Banks:

Central banks, such as the Federal Reserve or the European Central Bank, closely monitor CPI data when setting monetary policy. If CPI readings are consistently higher than target levels (e.g., above 2%), central banks may raise interest rates to curb inflation. Higher interest rates typically lead to currency appreciation as they offer higher returns to investors, attracting foreign capital.

Example:

If the U.S. CPI report shows higher-than-expected inflation, the Federal Reserve may respond by signaling potential interest rate hikes. This expectation often leads to a stronger U.S. dollar, as traders anticipate higher returns on USD-denominated assets.

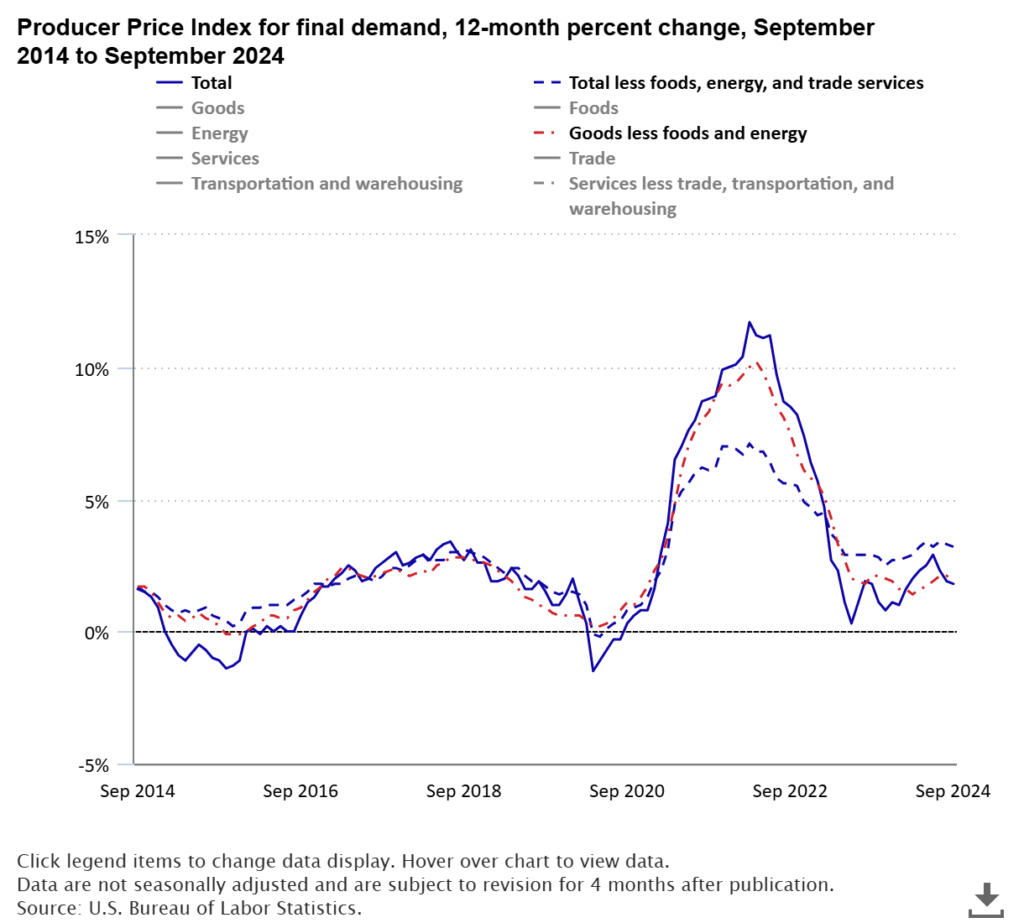

Producer Price Index (PPI)

The Producer Price Index (PPI) measures the average change in selling prices received by domestic producers for their output. It tracks price changes at the wholesale or production level before they reach consumers. Unlike CPI, which reflects consumer-level inflation, PPI focuses on the prices that producers receive for goods and services, providing insights into cost pressures faced by businesses.

Components of PPI:

Final Demand PPI:

Final Demand PPI measures the prices that producers receive for goods and services sold to end users, including consumers, businesses, and government entities.

This component of PPI is a direct indicator of the inflation pressures that might soon be passed on to consumers, making it a critical metric for anticipating changes in CPI.

Intermediate Demand PPI:

Intermediate Demand PPI tracks the prices of goods and services at various stages of production, including raw materials and components used in manufacturing.

By monitoring price changes in intermediate goods, traders can get early signals of inflationary pressures building up in the supply chain, which may eventually affect final goods prices.

Significance in Forex Trading:

- Leading Indicator for CPI:

PPI is often considered a leading indicator for CPI because changes in production costs tend to be passed on to consumers. For instance, if PPI rises significantly, it may signal upcoming increases in consumer prices (CPI), prompting traders to adjust their expectations for inflation and interest rates accordingly. - Provides Early Insights into Inflationary Pressures:

PPI data can reveal early signs of rising or falling inflationary pressures, helping traders anticipate central bank policy changes. If PPI shows an unexpected spike, it may indicate that producers are experiencing higher costs, which could be passed on to consumers, leading to higher CPI and potential rate hikes.

Example:

If the Eurozone PPI data reveals a sharp increase, it could indicate rising production costs for European manufacturers. Traders might then expect higher Eurozone CPI in the following months, which could prompt the European Central Bank to consider tightening monetary policy. This anticipation could lead to an appreciation of the euro against other currencies.

How Inflation Data Affects Forex Pairs

Inflation data, particularly CPI and PPI, plays a pivotal role in shaping the expectations of forex traders and influencing currency strength. Since inflation directly impacts the decision-making process of central banks, any unexpected changes in inflation indicators can lead to significant movements in currency pairs.

Impact on Currency Strength

Higher-than-Expected CPI/PPI:

- Signals Rising Inflation:

When CPI or PPI data comes in higher than expected, it signals that inflation is accelerating. Rising inflation can indicate an overheating economy, prompting central banks to consider tightening monetary policy to prevent prices from spiraling out of control. - Potential Central Bank Response – Tightening Monetary Policy:

Central banks may respond to higher inflation by raising interest rates. Higher interest rates make a currency more attractive to investors seeking better returns, as higher rates offer better yields on investments denominated in that currency. - Currency Appreciation:

As expectations of interest rate hikes increase, the currency typically appreciates. Traders anticipate that higher rates will attract more foreign capital, leading to an increased demand for the currency. For example, if U.S. CPI data surpasses expectations, traders may expect the Federal Reserve to raise rates, leading to a stronger U.S. dollar (USD).

Example:

If the U.S. CPI report shows a significant increase, indicating rising inflation, the USD might strengthen against other currencies like the euro (EUR) or the British pound (GBP) as traders bet on potential rate hikes by the Federal Reserve.

Lower-than-Expected CPI/PPI:

- Indicates Weak Inflation:

When CPI or PPI data is lower than expected, it suggests that inflationary pressures are weaker than anticipated. This may indicate subdued economic activity or weak demand for goods and services. - Potential Central Bank Response – Dovish Monetary Policy:

In response to low inflation, central banks may adopt a dovish stance, considering rate cuts or implementing stimulus measures such as quantitative easing. The goal is to boost economic activity and bring inflation closer to the target level. - Currency Depreciation:

Expectations of lower interest rates or increased monetary stimulus can lead to currency depreciation. Lower rates reduce the returns on investments in that currency, prompting investors to seek higher yields elsewhere.

Example:

If Eurozone CPI data comes in below expectations, indicating weak inflation, traders might expect the European Central Bank (ECB) to maintain or lower interest rates. This expectation can lead to a weaker euro against currencies like the U.S. dollar (EUR/USD) or the Japanese yen (EUR/JPY).

Examples of Inflation Data Impact on Major Forex Pairs

Inflation data can have varying effects on different forex pairs, depending on the economic context of each currency’s country or region. Here are some examples of how inflation data impacts major forex pairs:

1. USD Pairs:

- How CPI Data Affects USD Strength:

The U.S. dollar is highly sensitive to inflation data because the Federal Reserve closely monitors CPI when setting interest rates. A higher-than-expected U.S. CPI often strengthens the USD as traders anticipate tighter monetary policy. - Impact on EUR/USD and GBP/USD:

- EUR/USD: When U.S. CPI is higher than expected, the USD may strengthen, leading to a decline in EUR/USD as investors favor the dollar over the euro.

- GBP/USD: Similarly, strong U.S. inflation data can weaken GBP/USD, as the prospect of rising U.S. interest rates makes the dollar more attractive compared to the British pound.

Example:

If the U.S. CPI report indicates a surge in inflation, the Federal Reserve may signal a potential rate hike, leading to a stronger USD. As a result, pairs like EUR/USD and GBP/USD could decline as traders flock to the higher-yielding USD.

2. EUR and GBP Pairs:

- Influence of Eurozone and UK Inflation Data:

The ECB and the Bank of England (BoE) rely heavily on inflation data to guide their monetary policies. Higher-than-expected CPI in the Eurozone or the UK can prompt expectations of rate hikes, boosting the euro (EUR) or the pound (GBP). - Impact on EUR/GBP and EUR/JPY:

- EUR/GBP: If Eurozone inflation is stronger than expected while UK inflation remains weak, EUR/GBP may rise as the euro strengthens relative to the pound.

- EUR/JPY: Similarly, strong Eurozone CPI can lead to a rise in EUR/JPY as traders anticipate a tighter ECB policy compared to Japan’s typically low-inflation environment.

Example:

If UK CPI data comes in higher than expected, signaling rising inflation, the BoE may consider raising rates sooner. This can lead to GBP appreciation against other currencies like the euro (EUR/GBP) or the yen (GBP/JPY).

3. JPY Pairs:

- Japan’s Low Inflation Environment:

Japan has historically struggled with low inflation or even deflation, making CPI surprises especially significant. Any unexpected rise in Japanese CPI can shift expectations about the Bank of Japan’s (BoJ) monetary policy stance. - Impact on USD/JPY and EUR/JPY:

- USD/JPY: If Japanese CPI data indicates higher inflation, the yen may strengthen as traders speculate on a potential shift in BoJ policy. However, this scenario is less common due to Japan’s prolonged low inflation environment.

- EUR/JPY: Similarly, higher Japanese inflation could lead to yen appreciation, causing EUR/JPY to decline.

Example:

If Japan’s CPI unexpectedly rises, indicating stronger inflation, the market may anticipate a shift in BoJ policy. This can lead to a stronger yen, resulting in declines in pairs like USD/JPY and EUR/JPY as traders adjust their expectations.

Analyzing CPI and PPI Data for Forex Trading

Understanding how to interpret CPI and PPI data is essential for making informed trading decisions in the forex market. By analyzing these inflation indicators, traders can gauge economic conditions, anticipate central bank actions, and forecast currency movements.

Interpreting Inflation Data Releases

When CPI and PPI data are released, forex traders closely examine the figures and compare them to market expectations. Here’s how to effectively interpret these releases:

Understanding the Economic Calendar: Forecasts vs. Actual Data

- Economic Calendar: Forex traders rely on economic calendars that list key data releases, including CPI and PPI reports, along with the expected forecast and previous month’s figures.

- Forecasts vs. Actual Data:

- Forecast: The forecast represents the market’s consensus expectation based on analyst predictions.

- Actual Data: The actual release is the reported figure. The difference between the actual data and the forecast is critical, as it often dictates the market’s reaction.

- Interpreting the Impact:

- Higher-than-Expected Inflation: If actual CPI or PPI data is higher than forecasted, it signals stronger inflationary pressures. This can lead to expectations of tighter monetary policy (interest rate hikes), boosting the currency’s value.

- Lower-than-Expected Inflation: If the actual figures fall short of expectations, it may indicate weaker inflation. This can lead to expectations of dovish central bank policies (rate cuts or additional stimulus), resulting in a weaker currency.

Market Reactions to Inflation Data Surprises

- Positive Surprise (Higher-than-Expected Inflation):

- When inflation data exceeds expectations, it often results in immediate market reactions. Traders may buy the currency in anticipation of central bank tightening, leading to rapid appreciation.

- Negative Surprise (Lower-than-Expected Inflation):

- Conversely, lower-than-expected inflation can cause the currency to depreciate as traders anticipate potential rate cuts or extended accommodative policies.

- Example:

If the U.S. CPI comes in at 4.0% versus an expected 3.5%, this surprise suggests rising inflation. Traders may expect the Federal Reserve to consider rate hikes, leading to USD strength against other currencies.

Using CPI and PPI in Forex Fundamental Analysis

Analyzing CPI and PPI data is a crucial part of fundamental analysis in forex trading. Here’s how traders incorporate these indicators into their analysis:

- Relative Inflation Analysis

- Comparing Inflation Data Across Countries:

Traders often compare CPI and PPI data from different countries to determine the relative strength of currencies. For instance, if U.S. inflation is rising while Eurozone inflation remains weak, traders may expect the Federal Reserve to raise rates faster than the ECB, making the USD more attractive than the EUR. - Determining Forex Pair Bias:

By analyzing relative inflation, traders can gauge which currency may appreciate or depreciate. A country with higher inflation may see its currency weaken unless its central bank is expected to respond aggressively with rate hikes.

- Comparing Inflation Data Across Countries:

- Inflation and Interest Rate Differentials

- Expectations of Rate Changes Based on Inflation:

Traders use inflation data to anticipate changes in interest rate differentials, which are key drivers of currency flows. Higher inflation typically leads to higher interest rates, which attract foreign capital and boost the currency’s value. - Impact on Currency Flows:

If inflation in one country rises sharply, its central bank may increase interest rates. This can lead to an influx of foreign investment as traders seek higher returns, appreciating the currency.

- Expectations of Rate Changes Based on Inflation:

Example:

If U.S. CPI rises while Japanese inflation remains low, traders may expect a widening interest rate differential in favor of the USD, leading to a stronger USD/JPY pair.

- Inflation Trends and Currency Cycles

- Recognizing Long-Term Inflation Trends:

By analyzing inflation trends over time, traders can forecast potential shifts in currency cycles. Persistent high inflation may signal a long-term tightening cycle by central banks, leading to prolonged currency appreciation. - Forecasting Currency Movements:

Identifying whether inflation is trending upward or downward helps traders anticipate future central bank actions and adjust their trading strategies accordingly.

- Recognizing Long-Term Inflation Trends:

Combining CPI and PPI with Other Fundamental Indicators

To make more accurate trading decisions, it’s essential to use CPI and PPI data alongside other fundamental indicators:

- Trade Balance

- The trade balance measures the difference between a country’s exports and imports. A positive trade balance (surplus) supports currency strength, while a negative balance (deficit) can weaken the currency.

- Relation to Inflation: Strong export performance can lead to higher demand for a country’s currency, influencing inflationary pressures and impacting CPI and PPI trends.

- GDP Growth

- Gross Domestic Product (GDP) measures a country’s total economic output. High GDP growth can lead to increased demand for goods and services, potentially driving up inflation.

- Relation to Inflation: Strong GDP growth often correlates with rising inflation, prompting central banks to consider tightening monetary policy to prevent overheating.

- Unemployment Rate

- The unemployment rate reflects the percentage of the labor force that is unemployed but actively seeking work. Lower unemployment typically leads to higher wages, contributing to built-in inflation.

- Relation to Inflation: Low unemployment can increase consumer spending and wage growth, contributing to rising inflation, which is reflected in higher CPI figures.

Building a Holistic View of an Economy’s Health:

By analyzing CPI and PPI data in conjunction with indicators like trade balance, GDP growth, and unemployment, traders can develop a comprehensive understanding of an economy’s health. This holistic approach allows for better forecasting of currency movements, helping traders make informed decisions.

By effectively analyzing CPI and PPI data and combining it with other fundamental indicators, forex traders can gain valuable insights into inflationary trends and their impact on currency values. This analysis is essential for anticipating central bank actions and identifying potential trading opportunities in the forex market.

Trading Strategies Based on Inflation Data

CPI and PPI data points can cause significant market volatility, making it essential to employ well-planned strategies to capitalize on price movements while managing risk effectively.

Event-Driven Trading

Event-driven trading focuses on capitalizing on the immediate market reactions following key economic data releases like CPI and PPI. Here’s how traders can approach these opportunities:

1. Pre-release Positioning

- Analyzing Market Sentiment:

Before inflation data is released, traders often gauge market sentiment and expectations by monitoring analyst forecasts, previous inflation trends, and recent economic indicators. For example, if recent economic data indicates strong demand, traders might anticipate higher CPI and adjust their positions accordingly. - Positioning Ahead of Data Releases:

- Speculative Positions: Traders may take speculative positions before the release based on expected outcomes. For instance, if the consensus forecast suggests a higher CPI, traders might buy the currency in anticipation of a potential rally.

- Hedging Strategies: Some traders might use options or other hedging instruments to protect their positions from adverse moves if the data deviates from expectations.

- Market Behavior Indicators:

Monitoring changes in bond yields, interest rate futures, and forex market volume can provide additional insights into market expectations ahead of the data release.

Example:

If market sentiment suggests an expected rise in U.S. CPI, traders may go long on the USD, anticipating a stronger dollar if the inflation data confirms higher prices.

2. Post-release Reactions

- Strategies for Capitalizing on Surprises:

- Positive Surprise (Higher-than-Expected Inflation): If the actual inflation data exceeds expectations, traders may look to buy the currency as expectations for interest rate hikes increase. For instance, a higher U.S. CPI might prompt traders to go long on USD pairs like USD/JPY or short EUR/USD.

- Negative Surprise (Lower-than-Expected Inflation): If the data comes in lower than expected, it may trigger a sell-off in the currency due to expectations of dovish central bank actions. In this case, traders might short the currency or buy its counterpart in the pair.

- Using Breakout Strategies:

High-impact data releases often lead to sharp price movements, breaking key support or resistance levels. Traders can implement breakout strategies to catch the momentum, setting entry points beyond these levels to ride the trend. - Example Trade Setup:

If U.S. CPI comes in higher than expected, triggering a breakout above a key resistance level in the USD/JPY pair, traders might enter a long position with a tight stop loss below the breakout point.

Long-Term vs. Short-Term Trading Strategies

CPI and PPI data can influence forex pairs over different time horizons, from short-term volatility plays to long-term trend predictions.

1. Long-Term Trends

- Using Inflation Trends for Long-Term Predictions:

- Identifying Inflation Cycles: Traders who focus on long-term trends monitor sustained inflation patterns to forecast central bank policy shifts. For example, consistent high inflation may signal a prolonged tightening cycle by central banks, leading to a stronger currency over time.

- Carry Trade Opportunities: When a central bank raises interest rates in response to rising inflation, it increases the yield differential between currencies. Traders might engage in carry trades, buying a higher-yielding currency while selling a lower-yielding one.

- Example:

If the European Central Bank (ECB) consistently raises rates due to persistent inflation in the Eurozone, traders might expect a stronger euro over time and take long positions in EUR/USD.

2. Short-Term Volatility Plays

- Capitalizing on Immediate Price Movements:

- Scalping Strategy: Traders might employ scalping strategies immediately after the data release, aiming to profit from rapid, short-term price fluctuations. This involves taking multiple quick trades to capitalize on volatility within minutes of the release.

- Fade the Move: In some cases, after an initial sharp reaction, the market might reverse as traders take profits or reassess the implications of the data. Traders who anticipate this reversal might use a “fade the move” strategy, entering positions in the opposite direction of the initial spike.

- Example:

After a higher-than-expected U.S. CPI release causes a quick spike in the USD, a scalper might enter a short-term trade on USD/CHF, aiming to profit from the rapid price movement.

Risk Management Considerations

High-impact data releases like CPI and PPI can lead to significant market volatility, making risk management crucial for traders looking to navigate these events safely.

1. Managing Risk During High-Impact Data Releases

- Understanding Volatility Risks:

Inflation data releases often result in sudden price swings and increased volatility. Traders should be aware that wider bid-ask spreads and slippage can occur during these times, potentially affecting trade execution and profitability. - Using Limit Orders:

To manage the risk of slippage, traders can use limit orders rather than market orders. Limit orders set a specific entry or exit price, helping traders avoid unfavorable fills during rapid market movements.

2. Setting Stop Losses and Position Sizing

- Stop Loss Placement:

Setting appropriate stop losses is essential to protect against unexpected market moves. Traders should place stop losses beyond key support or resistance levels to avoid being stopped out by short-term volatility spikes. - Position Sizing:

Given the heightened risk of significant price swings during data releases, traders should adjust their position sizes accordingly. Reducing position size can help manage the increased risk and limit potential losses. - Example:

If a trader goes long on GBP/USD following a strong UK CPI release, they might set a stop loss below a recent support level to protect against potential downside while adjusting the position size to account for increased volatility.

3. Hedging Strategies

- Using Options for Protection:

Some traders might use options strategies as a hedge against potential losses from volatile market reactions. For instance, buying a put option on a currency pair can provide downside protection if the market moves against the trader’s primary position. - Diversifying Positions:

To mitigate risk, traders can diversify their positions across different currency pairs, reducing exposure to a single currency’s movement based on inflation data alone.

Practical Tips for Trading Inflation Data

Trading inflation data effectively requires not only analyzing CPI and PPI releases but also understanding how central banks respond to these figures. By incorporating practical strategies and tools, traders can make more informed decisions and avoid common pitfalls in the forex market.

Monitoring Central Bank Announcements

Central banks play a pivotal role in influencing currency movements based on their interpretation of inflation data. Understanding how they respond to changes in CPI and PPI is crucial for anticipating market reactions.

1. How Central Banks Interpret Inflation Data

- Inflation Targets:

Most central banks, such as the Federal Reserve, European Central Bank (ECB), and Bank of England, have an inflation target, typically around 2%. When inflation deviates significantly from this target, central banks may adjust their monetary policy stance. - Hawkish vs. Dovish Interpretation:

- Hawkish Stance: If inflation rises above the target, central banks may adopt a hawkish stance, signaling potential interest rate hikes or tighter monetary policy. This tends to strengthen the currency as higher rates attract foreign capital.

- Dovish Stance: If inflation is below target or falls, central banks may take a dovish approach, indicating potential rate cuts or continued accommodative policies, leading to currency depreciation.

- Assessing Policy Response:

Traders should listen to central bankers’ comments on inflation trends, focusing on whether they view inflation as “transitory” or persistent. This insight can help predict future policy actions.

Example:

If the Federal Reserve signals that it is concerned about rising inflation after a strong CPI report, traders might anticipate faster rate hikes, boosting the USD against other currencies.

2. Keeping Track of Central Bank Speeches and Meeting Minutes

- Speeches and Statements:

Central bank officials, including the Fed Chair or ECB President, often give speeches that provide clues about their views on inflation and potential policy changes. Monitoring these speeches can help traders adjust their expectations and positions accordingly. - Meeting Minutes:

The release of meeting minutes from central bank policy meetings offers detailed insights into discussions on inflation and economic outlook. Traders can use these minutes to gauge the central bank’s future policy intentions and potential reactions to upcoming inflation data. - Example:

If the ECB’s meeting minutes reveal concerns about high inflation, it may indicate a willingness to raise rates sooner, leading to a potential rally in the euro.

Using Tools and Resources for Inflation Data Analysis

To effectively trade based on inflation data, traders need access to reliable tools and resources that provide real-time updates and historical analysis.

1. Economic Calendars

- Importance of Economic Calendars:

Economic calendars list upcoming data releases, including CPI and PPI reports, along with consensus forecasts and previous values. These calendars help traders plan their strategies and monitor market-moving events. - Key Features to Look For:

- Real-Time Updates: Instant updates on actual vs. forecasted data.

- Impact Indicators: Highlighting the expected impact of each data release, helping traders prioritize their focus.

- Popular Sources:

Forex Factory, Investing.com, and Trading Economics are widely used economic calendars that provide comprehensive coverage of global inflation data releases.

2. News Feeds and Forex Platforms

- Real-Time News Feeds:

Platforms like Bloomberg, Reuters, and ForexLive offer real-time news updates and analysis, providing immediate reactions to inflation data releases. These sources help traders stay informed about market sentiment and central bank commentary. - Forex Platforms:

Forex trading platforms such as MetaTrader 4/5 and TradingView offer tools for analyzing inflation data’s impact on currency pairs, including charting tools and indicators to track price movements following CPI and PPI releases.

3. Key Sources for Inflation Data

- Bureau of Labor Statistics (BLS):

The BLS provides official CPI and PPI data for the United States, including detailed reports and historical trends. This is a primary source for traders analyzing U.S. inflation data. - Eurostat:

For Eurozone inflation data, Eurostat publishes comprehensive CPI figures and related economic indicators, offering insights into inflationary pressures across EU member countries. - Other Sources:

- UK Office for National Statistics (ONS): For UK CPI data.

- Japan’s Ministry of Internal Affairs and Communications: For Japanese CPI data.

- Reserve Bank of Australia (RBA): For Australian inflation data releases and analysis.

Common Pitfalls and Mistakes to Avoid

Trading inflation data can be complex, and traders must be cautious to avoid common mistakes that can lead to losses.

1. Overreacting to a Single Data Point

- Broader Economic Context Matters:

Reacting solely to one CPI or PPI release without considering the broader economic context can be misleading. For instance, a single high CPI reading may be caused by temporary factors rather than a sustained inflation trend. - Analyzing Trend Patterns:

Traders should look for consistent patterns in inflation data over several months before making significant trading decisions. A single data point should be considered within the larger trend to avoid making premature conclusions. - Example:

If CPI rises unexpectedly due to a temporary spike in energy prices, traders might refrain from taking aggressive long positions until further data confirms a persistent inflation trend.

2. Ignoring Revisions to Previous CPI/PPI Data

- Impact of Data Revisions:

Initial CPI and PPI reports are often subject to revisions as more complete data becomes available. Ignoring these revisions can lead to incorrect interpretations of inflation trends. - Adjusting Analysis Based on Revisions:

Traders should monitor updates to previous data, as significant revisions can alter market sentiment. A downward revision to previous CPI data might soften expectations of aggressive rate hikes, even if the current release is high. - Example:

If a previous month’s CPI is revised downward, it may dampen the hawkish outlook from a central bank despite a high current release, leading to a potential retracement in currency strength.

3. Misjudging Central Bank Responses

- Understanding Central Bank Priorities:

Central banks may not react immediately to changes in inflation data if they believe the underlying causes are temporary. Misjudging the central bank’s response can result in incorrect trading positions. - Monitoring Forward Guidance:

Traders should pay close attention to central bank forward guidance and speeches that clarify how policymakers interpret inflation data and their likely response.

By following these practical tips, forex traders can better navigate the complexities of trading inflation data. Monitoring central bank communications, using reliable tools for data analysis, and avoiding common pitfalls can enhance decision-making and improve trading outcomes. Ultimately, understanding the nuances of CPI and PPI releases and their impact on market sentiment is key to successful forex trading based on inflation data.

Conclusion

Inflation data, represented by key indicators like the Consumer Price Index (CPI) and Producer Price Index (PPI), plays a crucial role in shaping forex market dynamics. For traders, understanding how these metrics reflect changes in an economy’s pricing power and influence central bank policies is vital for making informed trading decisions.

The ability to interpret inflation data and anticipate its impact on forex pairs can give traders a significant edge. However, it is essential to consider the broader economic context and avoid common pitfalls, such as overreacting to single data points or ignoring revisions. With a well-rounded approach that combines a solid understanding of inflation indicators, market sentiment, and central bank policies, traders can better position themselves to capitalize on both short-term opportunities and long-term trends.