In the forex market, understanding a country’s trade balance is essential for making informed trading decisions. Trade balances—whether deficits or surpluses—play a key role in determining currency strength as they reflect a nation’s economic health and demand for its currency. By examining trade balance data, forex traders can gain valuable insights into currency trends and market sentiment, making it a critical factor in fundamental analysis.

This article explores the role of trade balances in forex, how they affect currency values, and how traders can incorporate trade data into their analysis.

What is a Trade Balance?

The trade balance of a country is the difference between the value of its exports and imports over a given period. It is one of the main components of a nation’s balance of payments and can be in a surplus or a deficit:

- Trade Surplus: Occurs when a country exports more than it imports. This indicates that foreign demand for its goods and services is strong, leading to higher demand for its currency.

- Trade Deficit: Occurs when a country imports more than it exports. This suggests a higher dependency on foreign goods and services, which can result in less demand for the local currency.

Trade balances can impact currency values and reflect a country’s economic stability and global competitiveness.

How Trade Balances Affect Currency Strength

- Currency Demand from Trade Surpluses:

- When a country has a trade surplus, it implies strong global demand for its products, leading to an increase in the demand for its currency. This is because foreign buyers need the local currency to pay for exported goods, creating upward pressure on the currency’s value.

- For example, countries with consistent trade surpluses, like Japan and Germany, often see demand for their currencies (JPY and EUR) rise as foreign buyers purchase their products.

- Currency Weakness from Trade Deficits:

- Trade deficits can indicate that a country relies heavily on foreign goods, meaning that foreign currency is in high demand to pay for imports. This can put downward pressure on the domestic currency, as there is a higher outflow of currency to pay for imports than there is an inflow from exports.

- The United States, for example, has a long-standing trade deficit, which can sometimes weaken the dollar (USD), especially if there are additional economic pressures.

- Capital Flows and Foreign Investment:

- Trade balances influence capital flows, as countries with trade surpluses may invest their foreign exchange reserves abroad, affecting currency demand globally. Likewise, countries with trade deficits often need to attract foreign investment to fund their deficit, which can lead to an appreciation if foreign inflows increase, as investors buy local assets.

- Impact on Inflation and Central Bank Policies:

- A persistent trade deficit can contribute to inflation, especially if a country relies heavily on imported goods that become more expensive when the currency depreciates. Central banks might raise interest rates to combat inflation, which can strengthen the currency despite the trade deficit.

- Conversely, a country with a trade surplus might experience lower inflation as exports boost economic growth. This might lead to a more stable or even lower interest rate environment, depending on the broader economic conditions.

Analyzing Trade Balance Data in Forex Trading

Forex traders often monitor monthly trade balance reports to assess how these figures might impact currency markets. Here are some ways to interpret this data:

- Seasonal and Structural Factors:

- Seasonal factors, like holiday spending or harvest times, can influence trade balances, causing fluctuations in import and export volumes. Understanding these seasonal patterns can help traders anticipate short-term movements in currency values.

- Structural factors, such as a country’s reliance on certain commodities, also influence trade balances. For example, oil-exporting nations may see trade surpluses when oil prices are high, while import-dependent countries face deficits, impacting their currency strength.

- Compare Trade Balances Across Countries:

- Forex traders often compare trade balances between trading partners to understand relative currency strengths. For instance, if China shows a strong trade surplus with the United States, it could lead to increased demand for the Chinese yuan (CNY) relative to the U.S. dollar.

- Comparative trade analysis helps traders gauge which currency might outperform based on economic trends and trade flow patterns.

- Observe Trade Balance Trends Over Time:

- Monitoring trade balance trends, rather than just individual reports, provides a more comprehensive view of a country’s economic health and currency prospects. A consistent trade surplus or deficit can indicate a long-term trend in currency strength or weakness.

- For example, the euro (EUR) might be favored if the Eurozone consistently runs a trade surplus, as this trend suggests a strong demand for European goods and, by extension, the currency.

- Pair Trade Data with Other Economic Indicators:

- For a more accurate prediction of currency movements, traders should analyze trade balance data alongside other economic indicators, such as GDP, inflation, and interest rates. This helps them understand the broader economic context, as a trade surplus might coincide with rising inflation, which could prompt rate hikes and further boost the currency.

Strategies for Forex Traders Using Trade Balance Data

Here are some effective strategies for forex traders leveraging trade balance data:

- Focus on Export-Driven Economies:

- Countries with strong exports and trade surpluses, like Japan and Switzerland, tend to have stronger currencies. Traders may consider going long on currencies from export-driven economies, especially when global demand for their goods is rising.

- Short Currencies of Countries with Persistent Deficits:

- Traders may consider shorting currencies of countries with persistent trade deficits, especially if inflation is rising and there is a lack of foreign investment to offset the deficit. For example, if the U.S. dollar faces pressure due to a widening trade deficit, traders might short USD against currencies from surplus countries.

- React to Unexpected Trade Balance Reports:

- Unexpected trade balance figures often lead to immediate market reactions. For instance, a surprisingly high trade surplus might prompt traders to buy the currency, anticipating stronger demand for the country’s goods and services. Conversely, a deficit larger than anticipated could result in shorting the currency.

- Combine Trade Data with Safe-Haven Strategies:

- Trade deficits during periods of global instability can lead investors to seek safe-haven currencies like the Swiss franc (CHF) or Japanese yen (JPY). Traders can use this strategy to hedge against risk when a trade deficit is paired with economic uncertainty.

- Trade Pairs Based on Trade Relationships:

- Analyzing trade balances between two specific countries can offer insights into currency pairs. For example, if Canada has a growing trade surplus with the U.S., traders might consider a long position in CAD/USD, anticipating CAD strength.

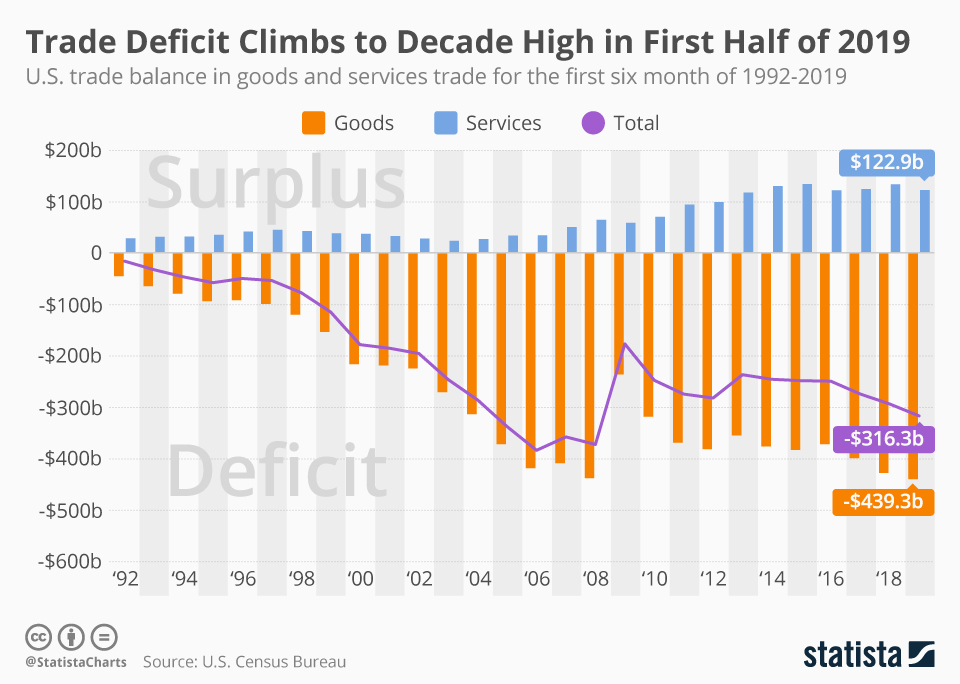

Real-World Example: Trade Balance Impact on the U.S. Dollar

The U.S. has consistently run a trade deficit, largely due to high levels of consumer imports from countries like China and Mexico. This trade deficit can sometimes lead to pressure on the U.S. dollar, as more USD flows out of the country than comes in from exports.

However, the U.S. dollar also serves as the world’s primary reserve currency, and the strength of its economy often attracts foreign investment, helping to counterbalance the trade deficit. Still, forex traders closely monitor the U.S. trade balance, especially during times of economic uncertainty or when trade tensions arise, as these factors can exacerbate the effects of a trade deficit on the dollar.

Conclusion

Understanding trade balances in forex is essential for traders who rely on fundamental analysis. Trade surpluses and deficits provide insight into currency demand, economic stability, and a country’s global competitiveness. By analyzing trade balance data, forex traders can better anticipate currency movements and make informed decisions, especially when combined with other economic indicators.

Incorporating trade data into trading strategies can offer forex traders a significant advantage, particularly in today’s interconnected global economy. Monitoring trade balances and their impact on currency strength enables traders to make strategic moves based on a country’s economic health and global trade position.