The relationship between the FTSE 100 and the GBP currency (British Pound Sterling) is complex and multifaceted. Both the FTSE 100 index and the GBP are influenced by a range of economic factors, and their relationship can vary based on market conditions. Here are some key aspects of their relationship:

Inverse Relationship during Currency Depreciation

In general terms, there is often an inverse relationship between the GBP and the FTSE 100. When the value of the GBP depreciates, it can be positive for companies listed on the FTSE 100 that generate a significant portion of their revenue in foreign currencies. A weaker pound can make exports more competitive, benefiting multinational companies.

Impact of Currency Fluctuations on Earnings

Many companies in the FTSE 100 generate a substantial portion of their revenues from overseas markets. When the GBP strengthens, it can have a negative impact on the earnings of these companies when translated back into pounds. Conversely, a weaker GBP can boost the reported earnings of these companies.

Currency as a Safe-Haven

The GBP is considered a safe-haven currency, especially during times of global economic uncertainty. In contrast, the FTSE 100 may experience increased volatility during periods of uncertainty. Consequently, during times of market stress, investors might favor the safety of the GBP over the equities represented by the FTSE 100.

Economic Indicators and Monetary Policy

Both the FTSE 100 and the GBP are influenced by common economic indicators such as GDP growth, inflation rates, and interest rates. Changes in monetary policy by the Bank of England, including interest rate decisions, can impact both the currency and the stock market.

Brexit and Political Events

Political events, especially those related to Brexit, have had a significant impact on the relationship between the FTSE 100 and the GBP. Developments in the Brexit process can cause fluctuations in both the currency and the stock market as investors react to changing economic conditions.

Global Economic Conditions

Both the FTSE 100 and the GBP are influenced by global economic conditions. Trends in global markets, trade dynamics, and geopolitical events can impact investor sentiment and, subsequently, both the currency and the stock market.

Divergence during Economic Data Releases

Short-term divergences between the FTSE 100 and the GBP can occur during economic data releases. Positive economic data may boost the currency while causing concerns about potential interest rate hikes, impacting equities.

Long-Term Trends

Long-term trends in the relationship between the FTSE 100 and the GBP can be influenced by economic cycles, structural changes in the global economy, and shifts in investor preferences.

Why do we look at Stock Market?

We look at Stock Markets because this is the main home for the pensions of a resident of a country through Index Funds, Mutual Funds etc. A country and its stock market are continuously and intermittently linked.

For example, if a country’s currency goes down by 50% against all other currencies, but the stock market stays at the same level as before the market has just become priced 50% lower than the previous period to the rest of the world.

If a stock trades in local currency and the currency falls by 50% relative to the rest of the World, then that stock becomes 50% lower priced than the previous period. This means the residents of a country have seen the value of their pension’s wealth erode on an international basis by the same amount. Also, international investors may increase their holdings in domestic stocks as they fall in value.

We can analyze this fundamental driver from the perspective of the rest of the world or as the world’s benchmark currency through the perspective of the USD in the case of GBP/USD.

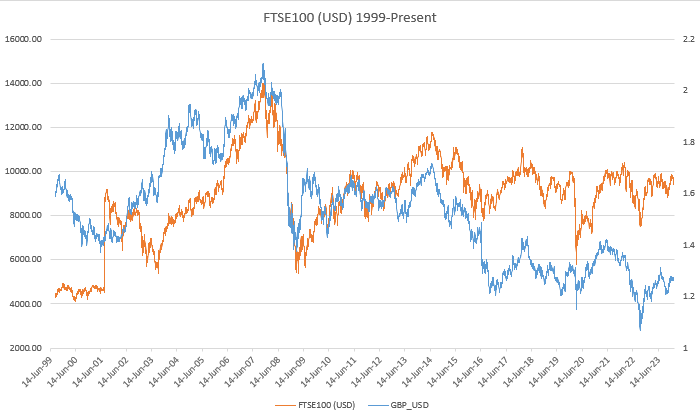

If we price the British FTSE 100 stock market in USD terms, then we can see the British Stock Market on an international scale of wealth.

If the FTSE 100 priced in USD falls, this is deflationary for the UK because it means the UK pensions are becoming worth less relative to the rest of the world. Here we must look to sell GBP and buy USD to protect against deflation in FTSE assets.

If the FTSE 100 priced in USD rises this is inflationary for the UK because it means the UK pensions are becoming worth more relative to the rest of the world. Here we must look to buy GBP and sell USD to protect against inflation in FTSE assets.

We take this approach because we are assessing relative wealth. If the Index in international USD terms falls by a large amount this is deflationary as people are becoming poorer on an international scale. They do not get richer until the index has gone back through the previous high.

If FTSE 100 priced in USD falls too far from its highs, we must be prepared to reduce our conviction because it means authorities are more than likely to use extreme measures to prevent extreme deflation and cause inflation.

If FTSE 100 priced in USD rises too far above previous highs, we must be prepared to reduce our conviction because it means authorities are more than likely to use extreme measures to prevent hyperinflation and cause slowdown/deflation.

For our analysis, we use the high watermark of the FTSE 100 index priced in USD which was achieved on 27th November 2007 with a value of 13889.92 (FTSE/USD).

The FTSE 100 is now currently down 31.77% in USD terms from its highs. This means that the stock market is falling due to lower earnings. The fundamental bias is Short GBP, Long USD.