The foreign exchange market—commonly referred to as Forex or FX—is the largest and most liquid financial market in the world. With daily trading volumes exceeding $6.6 trillion, it dwarfs all other capital markets. But despite its modern complexity and technological sophistication, the roots of the forex market stretch deep into human history.

This lesson takes a comprehensive look at the evolution of the Forex market—from the earliest forms of currency exchange to today’s algorithm-driven, decentralized trading environment. Understanding this history provides valuable insight into how global economics, politics, and technology have shaped the market we trade today.

Ancient Beginnings: Barter, Coins, and the Origins of Currency Exchange

The concept of currency exchange predates modern economies by thousands of years. Before money, ancient societies operated on a barter system, trading goods and services directly. As trade routes expanded and the limitations of barter became apparent, early civilizations began developing more standardized forms of exchange.

The first known gold coins were minted around the 6th century BC in Lydia, a kingdom in what is now western Turkey. These coins introduced a consistent measure of value, making it easier for merchants to conduct trade across regions. As different civilizations adopted their own coinage, currency exchange became a practical necessity, especially in bustling trade centers like Rome, Athens, and later, Constantinople.

Though rudimentary and informal, these early exchanges laid the groundwork for the sophisticated forex systems of the future.

The Gold Standard Era (1819–1930s): Establishing Trust in Money

The 19th century marked a critical shift toward a more formalized currency system with the advent of the gold standard. Under this system, countries agreed to peg their national currencies to a specific amount of gold, creating a fixed exchange rate that enhanced trust in international trade.

- England became the first major country to adopt the gold standard in 1819, and by the late 19th century, it had spread to France, Germany, Japan, and others.

- This framework provided monetary stability, allowing businesses and governments to conduct cross-border transactions with reduced currency risk.

However, the system’s fragility became apparent during World War I, as countries suspended gold convertibility to fund wartime expenses. The Great Depression of the 1930s further disrupted global economies, and by the end of the decade, most nations had abandoned the gold standard altogether.

The Bretton Woods Agreement (1944–1971): The Birth of Modern Forex

To restore stability after World War II, global leaders convened in Bretton Woods, New Hampshire, in 1944. The result was the Bretton Woods Agreement, a landmark accord that redefined global monetary policy:

- Currencies were pegged to the U.S. dollar, which was itself backed by gold at a fixed rate of $35 per ounce.

- The International Monetary Fund (IMF) was established to monitor exchange rates and assist countries in economic distress.

- This arrangement created a system of fixed but adjustable exchange rates, balancing flexibility with stability.

While Bretton Woods ushered in two decades of economic growth, it began to unravel in the late 1960s. Persistent U.S. trade deficits, rising inflation, and the cost of the Vietnam War put immense pressure on the dollar’s convertibility. In 1971, President Richard Nixon officially suspended the dollar’s link to gold, effectively ending the Bretton Woods system and paving the way for a new era.

The Era of Floating Exchange Rates (1973–Present): Markets Take Control

Following the collapse of Bretton Woods, the world moved to a floating exchange rate system, where the value of currencies was determined by supply and demand in the open market rather than being pegged to a commodity like gold.

This transition marked the beginning of modern forex trading:

- Exchange rates became more volatile, creating both opportunities and risks for traders and policymakers.

- The interbank market—a network of large financial institutions trading currencies among themselves—emerged as the dominant force in forex transactions.

- The 1980s saw the introduction of new financial instruments, including forex swaps, forwards, and options, allowing institutions to hedge and speculate more efficiently.

Floating rates also democratized currency valuation, making it a reflection of a country’s economic fundamentals, political stability, and investor sentiment.

Technological Advancements (1990s–Present): Forex Goes Digital

Technology has played a transformative role in making forex what it is today.

The first major innovation came in 1973, when Reuters introduced computer monitors to display live currency quotes, replacing the phone-based systems that had dominated the interbank market. But it wasn’t until the 1990s that forex experienced a full digital revolution.

Key developments during this period include:

- Electronic trading platforms such as MetaTrader and Bloomberg Terminal revolutionized access, transparency, and execution speed.

- The rise of the internet allowed retail traders—previously excluded from the market—to participate directly. By 1996, online forex brokers began offering platforms that enabled individuals to trade currencies from their own homes.

- Algorithmic trading and electronic communication networks (ECNs) emerged, automating transactions and enhancing market liquidity.

Today’s forex market is driven by high-frequency trading algorithms and AI-based systems that can execute millions of trades per second based on real-time data.

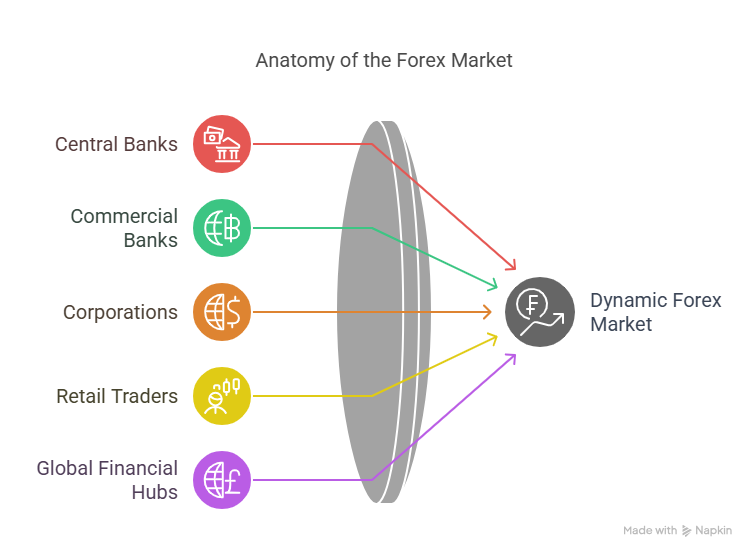

Anatomy of the Modern Forex Market

Today’s foreign exchange market is a 24-hour, decentralized ecosystem involving a wide array of participants:

- Central banks intervene to stabilize currencies or control inflation.

- Commercial banks and financial institutions conduct the majority of volume, trading for clients or their own accounts.

- Corporations use forex to hedge currency exposure from international business.

- Retail traders, now numbering in the millions, speculate on price movements using online platforms.

Unlike stock markets, the forex market operates without a centralized exchange. Trading occurs over-the-counter (OTC) through global financial hubs in London, New York, Tokyo, and Sydney, ensuring that at least one market is always open.

The value of a currency is now determined by a mix of economic indicators, geopolitical developments, central bank policy, and market sentiment—making forex one of the most dynamic and complex financial arenas in existence.

Key Milestones in Forex History

| Year | Event |

| 6th century BC | First gold coins minted in ancient Lydia |

| 1819 | England adopts the gold standard |

| 1944 | Bretton Woods Agreement signed |

| 1971 | End of Bretton Woods; U.S. ends gold convertibility |

| 1996 | Online forex trading becomes available to retail traders |

| Today | Forex market exceeds $6.6 trillion in daily trading volume |

Conclusion

The evolution of the foreign exchange market mirrors the story of global economic development. From bartering and gold coins to Bretton Woods and digital trading platforms, each chapter of forex history reflects broader changes in trade, technology, and geopolitics.

Understanding this history is more than an academic exercise—it’s essential for modern traders looking to grasp the forces that shape currency markets today. As algorithmic systems and artificial intelligence continue to evolve, the forex market remains a dynamic space where history, innovation, and strategy intersect.