If you’ve ever stared at a chart and wondered, “Why did price reverse here?” or “Is this the start of a trend?” — then you’re already brushing up against one of the most important concepts in trading: market structure.

Understanding market structure is like learning the grammar of price action. It tells you how to interpret movements, spot opportunities, and—most importantly—avoid traps that snare most retail traders. In this lesson, we’ll break down market structure, explain how it forms, why it matters, and how you can use it to elevate your trading—without a single indicator.

What is Market Structure?

Market structure refers to the repeating patterns in price movement that reveal the ongoing battle between buyers and sellers. These patterns form the foundation of price action analysis. By observing how highs and lows form and interact on a chart, traders can decode whether the market is trending, ranging, or preparing to break out.

Think of market structure as the “skeleton” of the market. It reveals the intentions of institutional players, the balance (or imbalance) of supply and demand, and the likely path of least resistance. It’s not a system; it’s a framework for reading what price is telling you.

The 3 Key Elements of Market Structure

1. Trends: The Path of Least Resistance

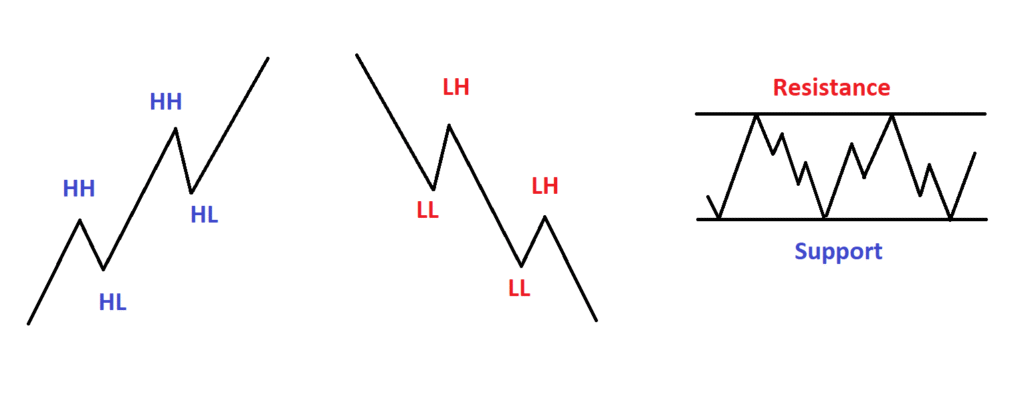

Market structure is most visible in trends. There are three basic types:

- Uptrend: A series of higher highs (HH) and higher lows (HL). Buyers are in control, and each pullback is met with renewed buying.

- Downtrend: A series of lower lows (LL) and lower highs (LH). Sellers dominate, and every rally gets sold into.

- Range-bound (Sideways): The market oscillates between horizontal support and resistance, with no clear directional bias.

These structures aren’t just visual cues—they’re a reflection of underlying sentiment. An uptrend shows consistent optimism. A downtrend signals persistent pessimism. A range reflects indecision or accumulation/distribution by larger players.

2. Support and Resistance: Where Price Pauses or Turns

Support and resistance are key zones that shape market structure.

- Support: A price level where buying interest tends to outweigh selling pressure. It’s where higher lows often form in an uptrend.

- Resistance: A level where selling pressure overcomes buyers. You’ll often see lower highs form here in a downtrend.

These levels aren’t magical. They exist because price remembers. Traders remember. Institutions remember. Rejections at these zones leave footprints.

3. Phases of Market Structure

Markets move in cycles. Understanding the phases of these cycles is crucial:

- Accumulation: Price moves sideways after a decline. Smart money starts buying.

- Markup: An uptrend begins. Market structure shows HHs and HLs.

- Distribution: Price stalls after an uptrend. Smart money offloads positions.

- Markdown: A downtrend begins. LLs and LHs appear.

Traders who can identify these phases early position themselves ahead of the crowd.

Understanding Highs and Lows: The Language of Price

Price action speaks in highs and lows. Learn to recognize them, and you’ll start to read the market rather than guess.

- Higher High (HH): New swing high breaks above the previous. Bullish strength.

- Higher Low (HL): Retracement low holds above the previous low. Continuation signal in an uptrend.

- Lower Low (LL): New swing low undercuts the last. Bearish pressure.

- Lower High (LH): Price fails to make a new high, then drops. Often a warning of trend reversal or continuation down.

A simple shift from HH–HL to LH–LL is often the first clue a trend is changing.

Why Market Structure Matters (More Than Indicators)

Many traders clutter their charts with indicators and lagging signals. But market structure? It’s raw, real-time information. Here’s why it matters:

1. It Creates a Framework for Decision-Making

Market structure gives you a map. You can quickly determine: Are we trending? Are we reversing? Are we ranging? This shapes your strategy.

2. It Enhances Risk Management

Support and resistance zones allow you to place stops and targets more logically—no guessing. This improves your risk-to-reward ratios.

3. It Works Without Indicators

You don’t need RSI, MACD, or fancy overlays. Just clean, “naked” charts. That’s the beauty: simplicity with precision.

How to Use Market Structure in Your Trading

Here’s how to apply this in the real world:

✅ Step 1: Identify the Trend

Zoom out. Are you seeing HHs and HLs (uptrend)? Or LLs and LHs (downtrend)? Or a flat range? Start from higher timeframes (like daily) and drill down.

✅ Step 2: Mark Key Levels

Highlight areas where price has previously bounced or reversed. These are your support and resistance zones.

✅ Step 3: Draw Trend Lines

Use swing highs/lows to draw diagonal trend lines. They help you visualize the directional flow and spot breaks in structure.

✅ Step 4: Watch for Breakouts or Breaks in Structure

A break above resistance or below support can signal a new trend forming—especially if accompanied by volume or strong momentum.

✅ Step 5: Combine with Candlestick Signals

Use reversal patterns (like pin bars, engulfing candles) or continuation patterns to refine your entries within the broader structure.

Market Structure Doesn’t Predict—It Reacts

Here’s the truth: market structure is reactive, not predictive. It doesn’t forecast the future—but it tells you what the market is doing now. And in trading, reacting to what’s in front of you is far more powerful than guessing.

That said, when you combine structure with context—like fundamentals, COT data, or institutional order flow—it becomes a potent edge.

Final Thoughts: Mastering Market Structure is a Trader’s Superpower

Understanding market structure is the first step to mastering price action. It strips away the noise and shows you the real story unfolding on your charts. If you’re tired of lagging signals and indicator whiplash, market structure offers clarity, consistency, and confidence.

Start simple. Watch the swings. Mark the highs and lows. Observe how price behaves at support and resistance. Practice reading the chart like a language.

Over time, you’ll stop reacting emotionally—and start responding strategically.