In the ever-interconnected world of global finance, sanctions and trade wars don’t just shake political headlines—they rattle currency markets. Behind every diplomatic standoff or tariff war lies a chain reaction of economic consequences, and one of the most immediate victims or victors is a nation’s currency.

This lesson unpacks how sanctions and trade wars influence currency strength, using real-world examples, economic theory, and empirical studies to explain the often-counterintuitive mechanics at play.

Understanding the Basics: Currency Strength and What Drives It

Before diving into sanctions and trade wars, it’s essential to understand how currencies gain or lose strength. Currency value is determined by supply and demand—just like any other asset. Factors like:

- Trade balances

- Capital flows

- Interest rate differentials

- Investor sentiment

- Political and economic stability

…all influence whether a currency strengthens or weakens. Sanctions and trade wars alter many of these forces at once, making them potent and complex tools with global implications.

How Sanctions Affect Currency Strength

Sanctions are policy tools used by governments or international bodies to restrict economic transactions with a targeted country. These restrictions may target exports, imports, financial assets, or individual entities. Here’s how different types of sanctions influence currency strength:

Export Sanctions & Asset Freezes — Depreciating Pressure

When a country is banned from selling its goods abroad or its foreign reserves are frozen, it loses access to foreign currency. This restricts the supply of foreign exchange, making it harder to support its own currency in the FX market. The result? Currency depreciation.

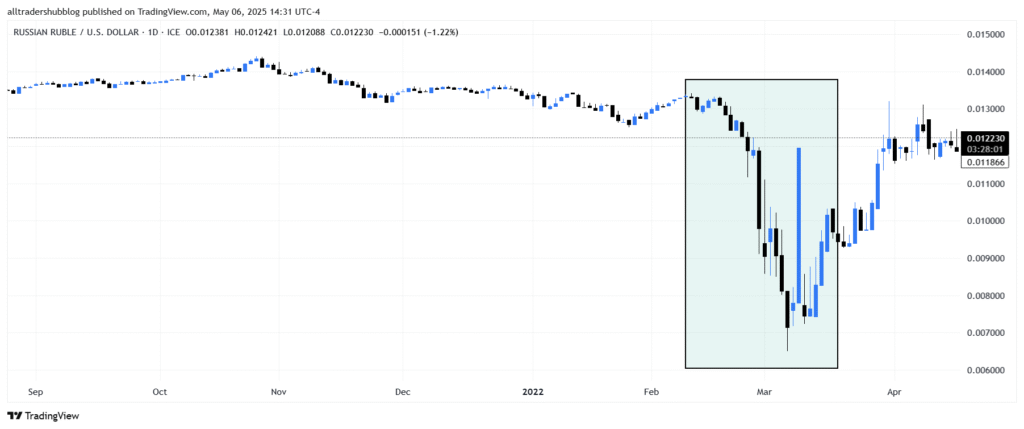

📉 Case in Point: After Russia’s invasion of Ukraine in 2022, Western sanctions froze hundreds of billions of dollars in Russian foreign assets and limited energy exports. The ruble initially plunged over 60% in a matter of weeks.

Import Sanctions — Appreciating Pressure

On the flip side, if a country is restricted from importing foreign goods, it doesn’t need as much foreign currency to pay for those goods. This reduces demand for foreign exchange, which can cause the local currency to appreciate.

This counterintuitive result often confuses people: sanctions are “bad,” so why would the currency strengthen? Because currency value isn’t about morality—it’s about demand and supply math.

💡 Example: Russia’s ruble later rebounded after tough import restrictions and capital controls were imposed. The combination reduced demand for foreign currency and kept rubles circulating within the domestic economy, propping up its value.

3. Trade Embargoes (Both Exports & Imports) — Neutral Impact

When both exports and imports are restricted, their effects often offset each other. Export limits reduce foreign currency supply (depreciation), while import restrictions reduce demand for foreign currency (appreciation). The net effect? Often neutral or muted currency movement.

4. Precautionary Demand for Foreign Currency — Hidden Depreciation Risk

Sanctions also trigger fear. Households and businesses might rush to convert local currency into dollars, euros, or gold. This precautionary hoarding increases demand for foreign exchange, pushing the local currency lower.

To fight this, governments might impose:

- Capital controls (limiting foreign exchange purchases)

- Currency pegs or dual exchange rates

- Financial repression (forcing banks to lend cheaply to governments)

📉 Example: In 2022, Russia introduced strict capital controls and interest rate hikes to prevent ruble freefall. These government interventions helped restore confidence, stabilizing the ruble despite ongoing sanctions.

How Trade Wars Affect Currency Strength

Trade wars are economic conflicts where countries impose tariffs or other trade barriers against each other. While less dramatic than sanctions, trade wars influence currency strength in subtle yet powerful ways.

Safe-Haven Demand Boosts the Tariff-Imposing Country’s Currency

Trade policy uncertainty drives global investors toward “safe haven” currencies like the US dollar, Swiss franc, or Japanese yen. Ironically, the country starting the trade war often sees currency appreciation—at least in the short term.

📈 Example: During the 2018–2019 US-China trade war, each tariff announcement triggered a surge in the U.S. Dollar Index (DXY), which rose as much as 10%, as global investors flocked to dollar-denominated assets.

Currency Depreciation in Targeted Countries

The targeted country often experiences currency devaluation—either naturally or through central bank intervention. By weakening the currency, the targeted nation makes its exports cheaper and offsets the cost of tariffs.

📉 Example: The Chinese yuan (CNY) fell by 10% in 2018 and another 5% in 2019. Analysts believe this was partly due to China allowing a controlled depreciation to absorb tariff impacts without losing export competitiveness.

Global Spillover: Other Currencies Also React

Trade wars don’t exist in a vacuum. Global markets respond with volatility, affecting:

- Commodity currencies (like AUD, CAD, ZAR)

- Export-heavy economies (like Germany and South Korea)

- Emerging markets with trade-dependent growth

📉 Example: During the US-China dispute, currencies like the euro and Brazilian real weakened as global growth projections dimmed.

Interest Rates Still Matter—Trade Isn’t Everything

While trade policies move currencies, they don’t override monetary policy fundamentals. If a country has rising interest rates and solid economic data, its currency may remain strong even during a trade war.

💡 Insight: Despite aggressive US tariffs on China, the dollar stayed strong largely due to Fed rate hikes, robust GDP growth, and low unemployment during the same period.

Key Takeaways: What Traders & Investors Should Watch

- Sanctions targeting exports or freezing assets tend to depreciate the sanctioned currency by reducing foreign currency inflows.

- Sanctions restricting imports tend to appreciate the currency by decreasing demand for foreign exchange.

- Trade wars often strengthen the initiating country’s currency and weaken the target’s, especially if markets view the initiator as a safe haven.

- Capital controls, financial repression, and central bank interventions can moderate these effects, influencing both real and nominal exchange rates.

- Investor sentiment, risk aversion, and interest rate differentials remain critical to understanding currency strength amid geopolitical tension.

Final Thoughts: Why This Matters in Forex Trading

For forex traders, understanding sanctions and trade wars isn’t optional—it’s essential. These events can cause sudden volatility, shift long-term trends, or even distort normal technical patterns. A news headline, policy announcement, or tariff tweet can send a currency soaring or crashing in minutes.

By tracking not only the events but also how they affect capital flows, trade balances, and policy responses, you can better predict currency moves—and avoid being blindsided by geopolitics.

Further Reading & Resources

- Economic Policy Panel: Sanctions and Exchange Rates

- JPMorgan AM: Trade Wars and Currency Impact

- Itskhoki & Mukhin: Sanctions and Exchange Rate Dynamics

- LSE CFM Discussion Papers: Sanctions and Financial Repression

- Eichengreen et al.: Historical Sanction Episodes and FX Effects