Trading forex can feel like a thrilling ride—the opportunity to make money by predicting currency moves is exhilarating. But beneath that excitement lies a harsh reality: without proper risk management, even the best trading strategies can lead to ruin.

Forex isn’t just about spotting opportunities—it’s about surviving the inevitable setbacks.

In this lesson, we’ll break down what forex risk management really means, why it’s absolutely critical for your success, and the practical steps you must take to protect your capital and your future as a trader.

What is Risk Management in Forex Trading?

Risk management in forex trading refers to the systematic process of identifying, assessing, and controlling potential losses that come from the inherent volatility of the currency markets. It’s the invisible armor that shields your trading account from catastrophic damage when the market turns against you.

It’s not about eliminating risk—you can’t do that—but about managing it intelligently, so no single loss can take you out of the game.

Risk management strategies typically include:

- Setting stop-loss orders to automatically exit losing trades at predefined levels.

- Position sizing properly so one bad trade won’t cripple your account.

- Diversifying trades across different currency pairs instead of betting everything on one idea.

- Using leverage cautiously to prevent small market moves from becoming devastating.

- Sticking to a trading plan with clearly defined risk limits and entry/exit criteria.

In short: risk management is about planning for what could go wrong—before it happens.

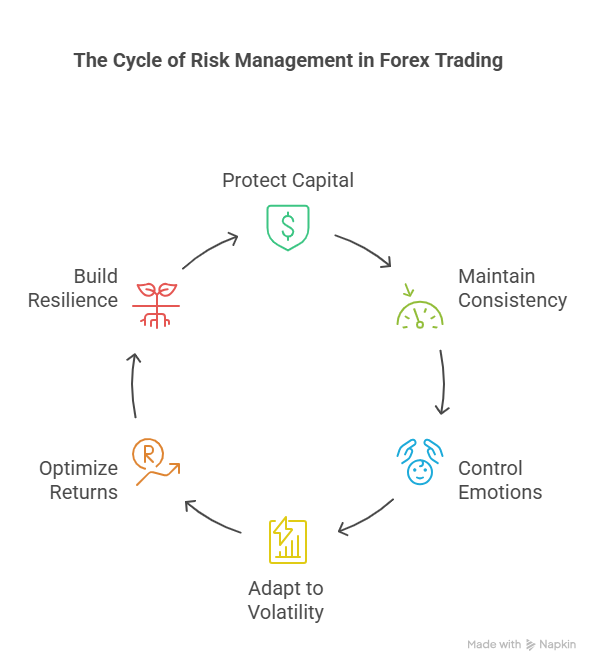

Why Risk Management is Critical for Forex Traders

Without exaggeration, risk management is the difference between a professional trader and a gambler. Here’s why it should be at the very core of your trading strategy:

1. Capital Protection

Your trading capital is your lifeblood. Once it’s gone, the game is over.

Forex markets are volatile, and a single poorly managed trade—especially when using high leverage—can wipe out months or even years of hard work. Setting stop-loss orders and controlling the size of your positions ensures that no single trade can destroy your account.

In trading, preserving capital is more important than making profits, because you can’t make profits if you don’t survive.

2. Long-Term Survival and Consistency

Forex trading is not about winning the next trade—it’s about staying in the market long enough to allow your edge to work out over time.

Even the best traders suffer losing streaks. Proper risk management lets you survive these periods without blowing up your account.

Without survival, consistency is impossible. With it, you give yourself the chance to be profitable over the long term.

3. Emotional Control and Discipline

Losing money hurts. It triggers fear, frustration, and sometimes panic. Without a risk management plan, you’re at the mercy of these emotions.

You might start revenge trading. Overleveraging. Doubling down on losing trades. All recipes for disaster.

But with predefined risk rules, you remove emotion from your decisions. You accept losses as part of the business and move forward, calmly and rationally.

4. Adapting to Market Volatility

Forex markets are influenced by countless unpredictable factors—central bank announcements, geopolitical tensions, unexpected economic data.

Sudden volatility is inevitable.

Good risk management isn’t just about “normal conditions”—it’s about preparing for the shocks you can’t predict.

When volatility strikes, your stop-losses, proper leverage use, and disciplined position sizing can be the difference between a manageable drawdown and a complete wipeout.

5. Optimizing Returns

Risk management isn’t about being defensive all the time. It’s about maximizing returns relative to the risks you take.

By carefully assessing risk-reward ratios—only taking trades where the potential reward justifies the risk—you ensure that even if you lose more often than you win, your winners outweigh your losers.

This is how smart traders stay profitable even with a 40% or 50% win rate.

6. Sustainable Trading Mindset

One of the most underrated benefits of risk management is psychological: it builds resilience.

It trains you to view losses as just part of the game—not as personal failures.

This mindset is critical. If you internalize every loss, your confidence will collapse. But if you understand that small, controlled losses are inevitable and acceptable, you’ll maintain your discipline, focus, and emotional stability over the long term.

Common Forex Risks That Traders Must Manage

Forex risk management isn’t just about “one big risk”—there are several types that need to be managed simultaneously:

| Risk Type | Description |

|---|---|

| Market Risk | Losses from currency movements going against your trade. |

| Leverage Risk | Losses amplified due to trading with borrowed money (high leverage). |

| Liquidity Risk | Trouble entering or exiting trades at desired prices during low market activity. |

| Political/Economic Risk | Unexpected geopolitical events or economic instability impacting currencies. |

| Interest Rate Risk | Changes in central bank policies moving currency values rapidly. |

| Risk of Ruin | Losing so much capital that recovery becomes mathematically impossible. |

Being aware of these risks—and having systems in place to mitigate them—is at the heart of professional forex trading.

Conclusion

Risk management isn’t just important in forex trading—it’s everything.

No matter how smart you are, no matter how good your analysis is, no matter how lucky you get—without a disciplined approach to risk, it’s only a matter of time before the market humbles you.

Proper risk management:

- Protects your capital,

- Helps you survive rough patches,

- Keeps your emotions in check,

- Allows you to adapt to a constantly changing market,

- Optimizes your risk-to-reward outcomes,

- And builds the sustainable, professional mindset you need for long-term success.

In forex, profits come and go. But if you protect your capital, you live to fight another day. And in the end, that’s what truly separates winners from losers.

Resources for Further Reading

- Vantage Markets: Mastering Forex Risk Management

- Traders Union: What is Risk Management in Forex?

- LinkedIn: Risk Management in Forex Trading – Overview

- Bravo Trade Academy: The Importance of Risk Management in Forex Trading

- LinkedIn: Risk Management in Forex Trading – The Pillar of Sustainable Success