Given the US macroeconomic indicators and the latest data, we can analyze the overall macroeconomic sentiment on the U.S. dollar (USD). Each indicator tells a different part of the economic story, which together can paint a broader picture of the economic health of the United States and its implications for the USD.

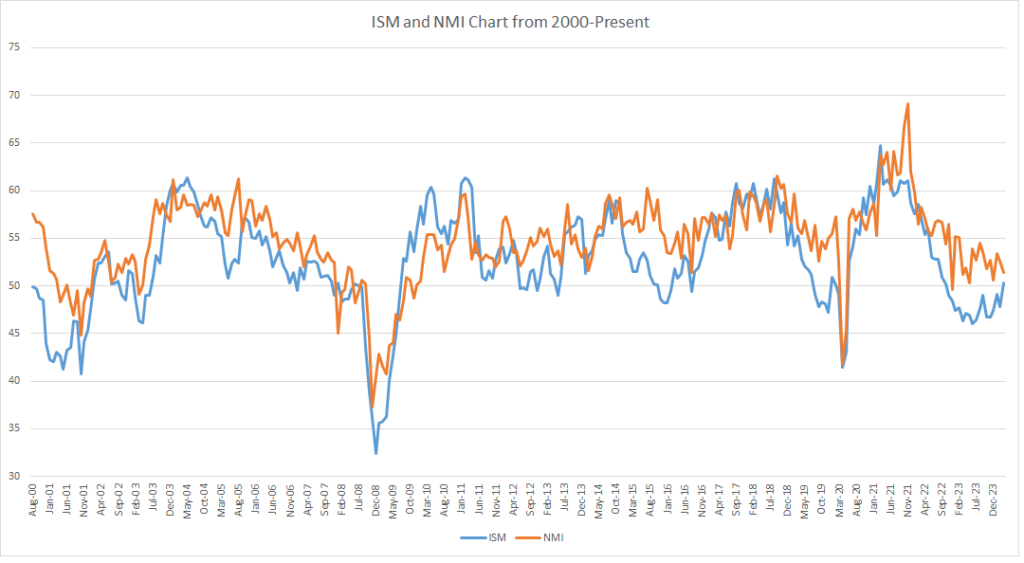

ISM (Institute for Supply Management) Index

- June Reading: 48.5

- July Reading: 46.8

The ISM Index, which tracks manufacturing activity, has been contracting for two consecutive months, with a further decline in July. Readings below 50 indicate a contraction in manufacturing, which signals weaker industrial activity. The drop from 48.5 to 46.8 suggests that manufacturing is facing headwinds, possibly due to weakened demand or supply chain disruptions. This decline in manufacturing could put downward pressure on the USD, as it suggests a slowing economy.

NMI (Non-Manufacturing Index)

- June Reading: 48.8

- July Reading: 51.4

The NMI, which tracks the non-manufacturing sector (services), showed a positive turnaround, moving from contraction (48.8) in June to expansion (51.4) in July. This improvement in the services sector is a positive sign for the broader economy and could lend some support to the USD, particularly as services represent a large part of the U.S. economy.

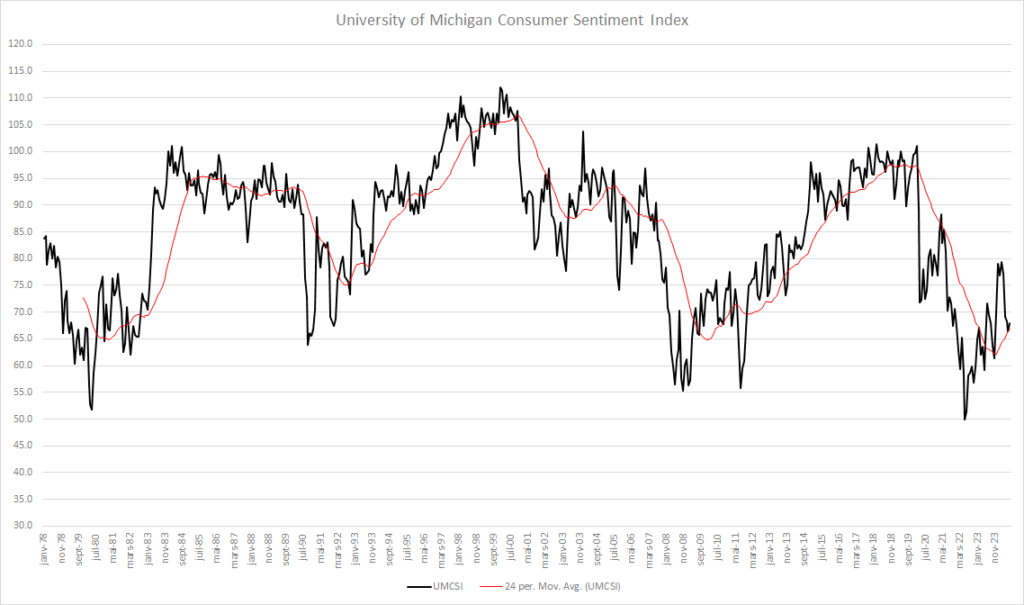

Michigan Consumer Sentiment Index (UMCSI)

- July Reading: 66.4

- August Reading: 67.9

Consumer sentiment has improved slightly from July to August, indicating that consumers are feeling more confident about the economy. This increase, while modest, suggests that consumer spending might remain steady or even improve, which is a positive sign for economic growth. A stronger consumer sentiment could support the USD, as it may lead to sustained or increased consumer spending, which drives economic growth.

Building Permits

- June Reading: 1,454

- July Reading: 1,406

Building permits have declined from June to July, which could indicate a slowdown in the housing market. A decrease in building permits often signals future declines in construction activity, which can negatively impact GDP growth. This reduction could be a headwind for the USD, especially if it suggests broader economic weakness in housing, a key sector of the U.S. economy.

M2 Money Supply

- Average 3-Month Reading Increase: 15.99% (May to July)

A sharp increase in the M2 money supply indicates that there is more money circulating in the economy. While this can stimulate economic activity, it can also lead to inflationary pressures if not accompanied by corresponding growth in output. The significant increase could be a sign of potential inflationary pressures down the line, which could erode the USD’s value if inflation picks up beyond the Fed’s target.

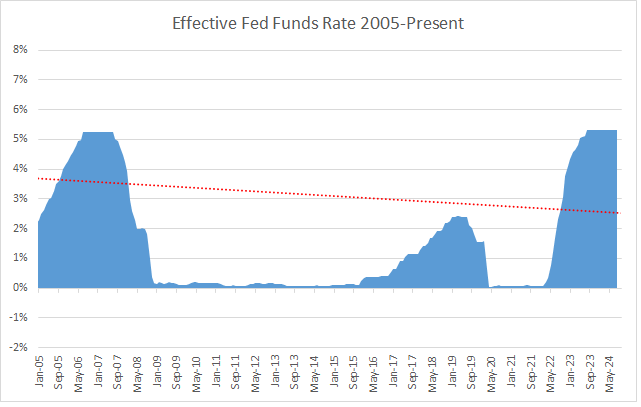

Interest Rates

- Current Rate: 5.33% (Stable for 13 months)

The stability of interest rates at 5.33% for 13 months indicates that the Federal Reserve is maintaining a tight monetary policy stance. This higher rate environment is generally supportive of the USD, as higher interest rates attract foreign capital looking for better returns. However, the prolonged high rates could also dampen economic growth by making borrowing more expensive.

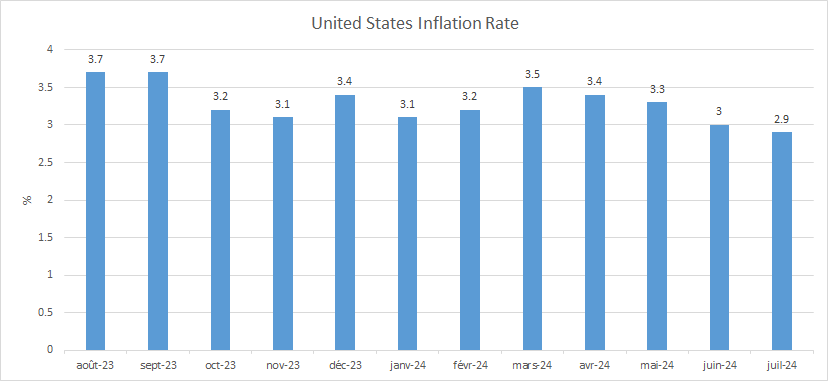

Consumer Price Index (CPI)

- Current Rate: 2.9% (Down from 3%)

The slight decrease in the CPI indicates a minor reduction in inflationary pressures. While inflation remains relatively low, the reduction might be seen as a positive development, suggesting that inflation is under control. This could support the USD by alleviating concerns about runaway inflation. However, it also means that the Fed might not feel pressured to increase rates further, which could cap the upside potential for the USD.

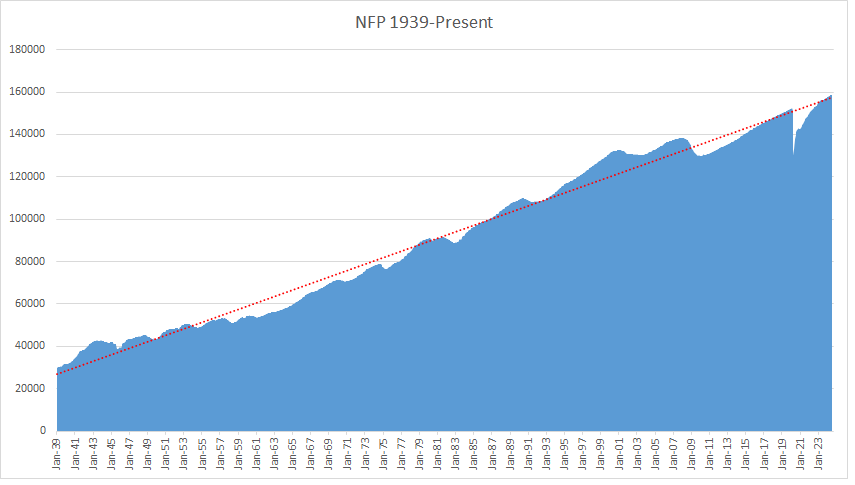

Non-Farm Payrolls (NFP)

12-Month Average Increase: 0.126% (from 156,419 to 158,723 in July)

Analysis: The slow growth in non-farm payrolls suggests that while jobs are still being added, the pace is modest. This indicates a labor market that is growing but not at a robust pace. A slowly growing labor market might not be enough to significantly boost the USD, especially if other economic indicators are pointing to weakness.

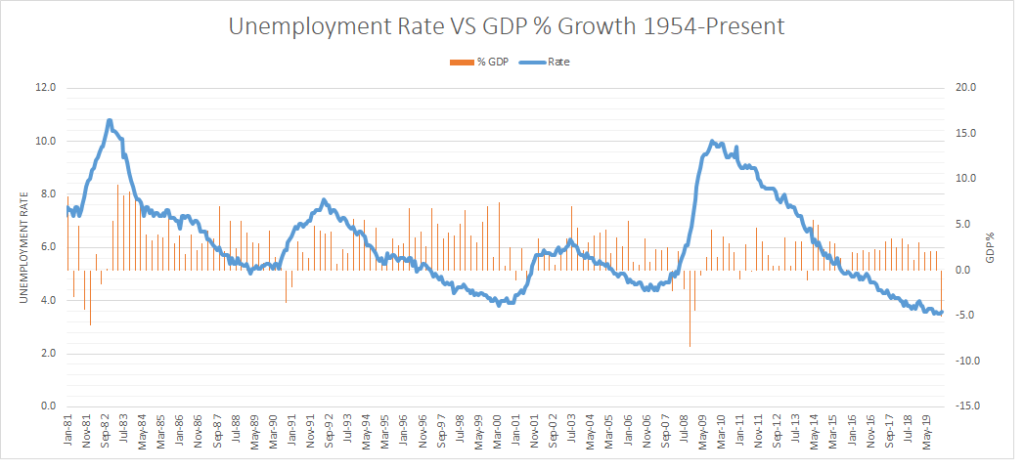

Unemployment Rate

- March Rate: 3.8%

- July Rate: 4.3% (12-Month Average Increase of 1.791%)

The rise in the unemployment rate from 3.8% to 4.3% signals a weakening labor market. A rising unemployment rate typically suggests that the economy is slowing, which could weigh on the USD. This is a negative indicator, as it might lead to reduced consumer spending and slower economic growth.

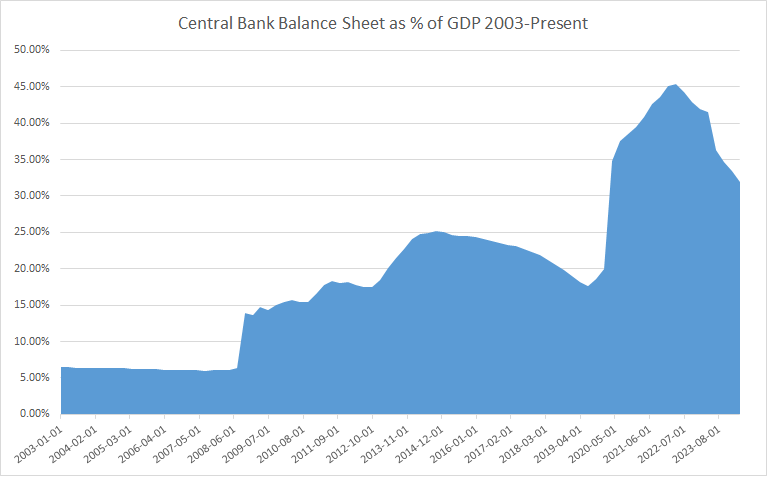

Central Bank Balance Sheet

- Decrease: From 45.40% (April 2022) to 31.97% (April 2024)

The reduction in the central bank’s balance sheet indicates a period of quantitative tightening (QT), which usually involves selling off assets to reduce the money supply. This can lead to higher interest rates and is generally supportive of the USD, as it reduces liquidity in the market, potentially leading to a stronger currency.

Government Debt

- Debt to GDP Ratio: 122.34% (Q1 2024)

A high and increasing debt-to-GDP ratio suggests that the U.S. is carrying a significant debt burden. While this is sustainable in the short term, it could pose long-term risks to the USD if investors start to worry about the U.S.’s ability to manage its debt. High debt levels can lead to concerns about potential inflation or the need for higher taxes, which could weigh on the USD.

Government Surplus to Deficit

- Deficit: -7.53%

A government running a deficit of -7.53% indicates that spending is significantly outpacing revenue. Persistent deficits can lead to an increase in government borrowing, which might eventually pressure interest rates upward. While this might support the USD in the short term, over the long term, continuous deficits can weaken the currency by increasing the debt burden.

Government Liquidity Cover

- Liquidity Cover: 6.75

A liquidity cover ratio of 6.75 suggests that the government has a reasonable buffer to cover its short-term liabilities. This indicates relative financial stability in the short term, which can be supportive of the USD. However, this must be balanced against the broader context of rising debt and deficits.

Overall Macroeconomic Sentiment on the U.S. Dollar

Mixed Sentiment with Potential Downside Risks: The overall sentiment on the U.S. dollar is mixed, with several indicators pointing to economic weaknesses that could weigh on the USD:

- The decline in the ISM index and the rise in unemployment suggest economic slowdown, which could weaken the USD.

- However, the NMI and consumer sentiment improvements provide some support, indicating resilience in the services sector and consumer confidence.

- The stable interest rates at a relatively high level are supportive of the USD in the short term, but the rising debt-to-GDP ratio and increasing deficit pose longer-term risks.

- The slight reduction in CPI is positive for controlling inflation, but the substantial increase in the money supply could reignite inflationary pressures.

In conclusion, while the USD may receive some short-term support from high interest rates and an improving services sector, the broader economic indicators suggest potential downside risks, particularly if manufacturing continues to contract and unemployment rises further. The long-term sustainability of the U.S. fiscal position also raises concerns, which could weigh on the USD if these issues are not addressed.