Market Sentiment Overview

Last week saw mixed sentiment across global markets, driven by divergent economic data. The U.S. dollar gained traction as robust labor market data and strong ISM readings boosted confidence in the resilience of the U.S. economy. The euro weakened amid deteriorating PMI readings, while the British pound experienced bearish pressure due to lackluster economic activity. Meanwhile, commodity currencies like the CAD and AUD showed resilience due to positive trade and labor data, whereas the yen remained underwhelming.

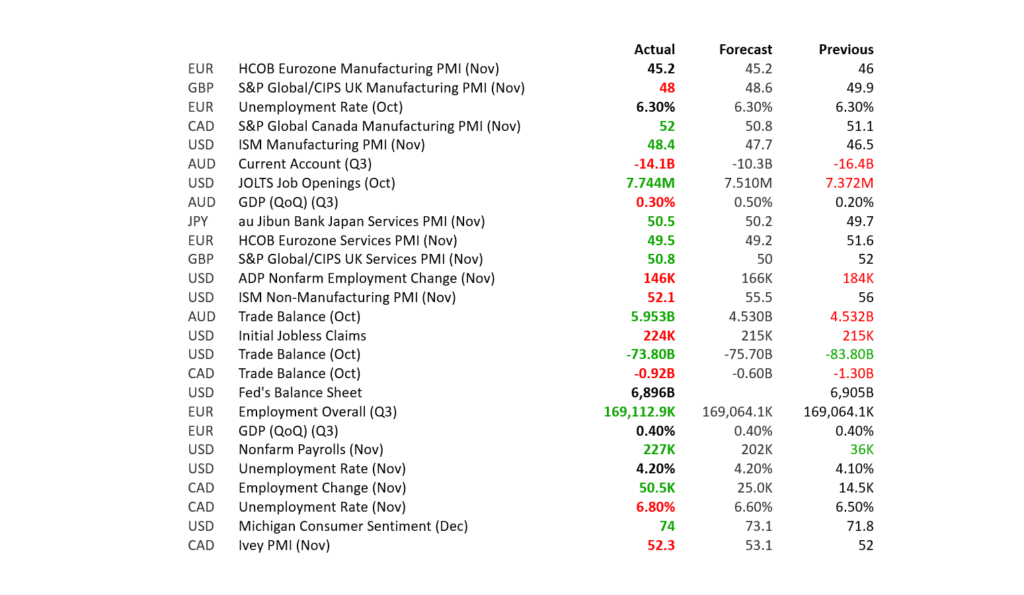

Key Macroeconomic Events and Forex Impact

Eurozone (EUR)

- HCOB Manufacturing PMI: 45.2 (Prev: 46, Est: 45.2)

Manufacturing activity contracted further, signaling ongoing weakness in the industrial sector. The data reinforced bearish sentiment around the euro. - HCOB Services PMI: 49.5 (Prev: 51.6, Est: 49.2)

Services activity dipped below the neutral mark, confirming a slowdown in economic momentum and contributing to a weaker EUR/USD. - Unemployment Rate: Unchanged at 6.3%, in line with expectations.

Stable labor market data had minimal impact on the currency. - GDP Growth (Q3): 0.4% QoQ

While GDP growth was positive, other data overshadowed the news, maintaining a bearish bias for the euro.

Impact: EUR/USD fell as weak PMIs pointed to economic fragility, raising concerns over ECB policy flexibility.

United States (USD)

- ISM Manufacturing PMI: 48.4 (Prev: 46.5, Est: 47.7)

Better-than-expected improvement in manufacturing underscored resilience in the industrial sector. - Non-Farm Payrolls (NFP): 227K (Prev: 36K, Est: 202K)

The labor market showed strength, reinforcing the Fed’s higher-for-longer narrative. - ISM Non-Manufacturing PMI: 52.1 (Prev: 56, Est: 55.5)

Despite a decline, the services sector remained expansionary, bolstering USD demand. - Trade Balance: -$73.8B (Prev: -$83.8B, Est: -$75.7B)

A narrower deficit supported the dollar amid expectations of economic stability.

Impact: USD rallied against major peers, particularly EUR and GBP, supported by strong labor and trade data.

United Kingdom (GBP)

- Manufacturing PMI: 48 (Prev: 49.9, Est: 48.6)

Persistent contraction in manufacturing dampened optimism. - Services PMI: 50.8 (Prev: 52, Est: 50)

Services barely expanded, highlighting economic stagnation.

Impact: GBP/USD saw selling pressure as weak PMIs suggested challenges for the Bank of England’s policy trajectory.

Australia (AUD)

- Current Account (Q3): -14.1B (Prev: -16.4B, Est: -10.3B)

A larger deficit weighed on the AUD initially. - GDP Growth (QoQ): 0.3% (Prev: 0.2%, Est: 0.5%)

Growth missed expectations but still marked an improvement, cushioning losses. - Trade Balance: 5.953B (Prev: 4.532B, Est: 4.53B)

Strong trade data lent late-week support to the AUD.

Impact: AUD/USD was mixed, with weakness early in the week followed by a recovery due to trade data.

Canada (CAD)

- Employment Change: 50.5K (Prev: 14.5K, Est: 25K)

Job gains exceeded expectations, bolstering sentiment. - Unemployment Rate: 6.8% (Prev: 6.5%, Est: 6.6%)

A higher unemployment rate tempered enthusiasm slightly. - Ivey PMI: 52.3 (Prev: 52, Est: 53.1)

The PMI showed modest expansion, supporting stability.

Impact: CAD outperformed peers, particularly against EUR, due to strong labor market performance.

Japan (JPY)

- Services PMI: 50.5 (Prev: 49.7, Est: 50.2)

Marginal growth in services provided limited support for the yen.

Impact: USD/JPY edged higher as risk-on sentiment and rising U.S. yields reduced demand for safe-haven JPY.

Key Takeaways

- USD Strength: Strong U.S. labor market data and resilient manufacturing drove the greenback higher across the board.

- EUR Weakness: Deteriorating PMIs underscored economic challenges in the Eurozone.

- GBP Pressure: Stagnant services and manufacturing data weighed on the pound.

- Commodity Currencies Resilience: CAD and AUD gained on robust trade and labor data, respectively.

Currency Performance Ranking:

- USD (Strong labor market and data outperformance)

- CAD (Surprising job gains)

- AUD (Trade surplus support)

- NZD (Positive terms of trade)

- JPY (Lack of catalysts)

- GBP (Economic stagnation)

- EUR (Weak PMI readings)

This analysis highlights the importance of aligning fundamental insights with forex trading strategies for identifying profitable opportunities.

Overall Conclusion

Last week’s macroeconomic data painted a picture of divergence across global economies, with the U.S. standing out as the strongest performer. Robust labor market figures, solid ISM readings, and a narrowing trade deficit reinforced the U.S. dollar’s dominance, supported by the Federal Reserve’s “higher-for-longer” interest rate narrative.

In contrast, the Eurozone grappled with weakening economic activity, as reflected in deteriorating PMI readings, signaling that growth headwinds persist. Similarly, the UK struggled with contraction in manufacturing and stagnation in services, highlighting challenges for the British economy and pressuring the pound.

Commodity-linked currencies like the Canadian and Australian dollars found support from stronger labor and trade data, showcasing resilience despite global economic uncertainties. Meanwhile, the Japanese yen continued to face challenges, weighed down by a lack of positive catalysts and persistent U.S. dollar strength.

Key Takeaway:

The macroeconomic data solidified the U.S. dollar’s position as the preferred safe-haven currency, while weaker data in Europe and the UK raised concerns over their economic outlooks. Commodity currencies showed potential for near-term strength, while the yen remains vulnerable as global risk appetite increases. For traders, this divergence creates clear opportunities to capitalize on dollar strength while selectively positioning in resilient commodity currencies.