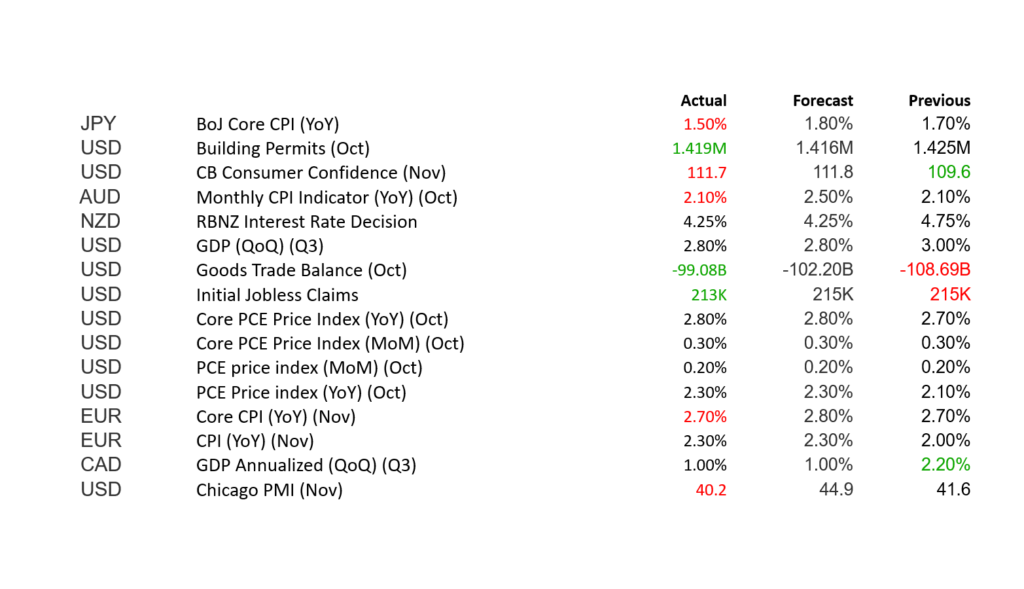

Welcome to this weekly market recap for the past week, where we break down the latest macroeconomic events and what they mean for the global economy and markets. This week’s macroeconomic data provides valuable insights into the global economic landscape, with notable updates from major economies like the US, Japan, the Eurozone, Australia, New Zealand, and Canada. Here’s a detailed breakdown:

Inflation Trends

- Japan Core CPI:

- Declined to 1.5% from 1.7%, missing the forecast of 1.8%.

- This softening inflation reflects subdued demand-side pressures, suggesting that Japan’s central bank is unlikely to tighten monetary policy further in the near term.

- Australia CPI:

- Held steady at 2.1%, below the forecast of 2.5%.

- Weak inflation could ease pressure on the Reserve Bank of Australia (RBA), supporting a more dovish monetary stance.

- Eurozone CPI:

- Headline CPI rose to 2.3%, matching the forecast, up from 2.0%.

- Core CPI remained unchanged at 2.7%, slightly below the forecast of 2.8%.

- While inflation remains elevated, the lack of acceleration in core CPI might signal easing price pressures ahead, reducing the likelihood of aggressive monetary tightening by the ECB.

- US Core PCE & PCE:

- Core PCE inflation came in at 2.8%, matching expectations, up from 2.7%.

- Headline PCE inflation rose to 2.3%, in line with forecasts.

- This confirms that inflationary pressures in the US remain steady but manageable, which could influence the Federal Reserve’s rate decision-making process, keeping policy stable for now.

Monetary Policy Decisions

- New Zealand Interest Rate:

- Surprised markets by decreasing to 4.25% from 4.75%, against expectations of a hold at 4.25%.

- The unexpected cut indicates concerns about slowing economic growth or inflationary moderation, potentially signaling a dovish turn in the Reserve Bank of New Zealand’s policy.

Growth Indicators

- US GDP (QoQ):

- Came in at 2.8%, matching forecasts but lower than the previous 3.0%.

- The slight moderation indicates a steady but slowing growth trajectory in the US economy, consistent with the Federal Reserve’s efforts to engineer a soft landing.

- Canada GDP (QoQ):

- Reported at 1%, matching forecasts, but significantly lower than the previous 2.2%.

- This sharp deceleration highlights potential vulnerabilities in Canada’s economy, raising concerns about consumer spending and investment trends.

Trade and Labor Market Insights

- US Trade Balance:

- Narrowed significantly to -99.08B from -108.69B, beating the forecast of -102.2B.

- The improvement suggests stronger export activity or weaker imports, signaling resilience in external trade dynamics despite global headwinds.

- US Initial Jobless Claims:

- Declined to 213K, slightly better than the forecast of 215K, down from 215K.

- This indicates continued strength in the labor market, contributing to the overall resilience of the US economy.

Consumer and Business Sentiment

- US Consumer Confidence:

- Improved to 111.7, marginally below the forecast of 111.8, but up from 109.6.

- Higher confidence levels point to optimism among US consumers, which may support spending in the coming months.

- US Chicago PMI:

- Dropped to 40.2 from 41.6, significantly missing the forecast of 44.9.

- This deep contraction reflects ongoing challenges in the manufacturing sector, which remains a weak spot in the US economy.

Key Themes and Risk Sentiment

- Risk-On Drivers:

- Resilient US GDP and improved consumer confidence support a positive outlook for the US economy, bolstering global risk appetite.

- Narrowing US trade deficit suggests strength in external sectors, which could favor risk-sensitive assets like equities.

- Risk-Off Drivers:

- Weak GDP growth in Canada, slowing inflation in Japan and Australia, and the Eurozone’s stagnant core CPI raise concerns about global economic deceleration.

- The steep drop in US Chicago PMI signals industrial weakness, adding to growth worries.

Market Implications

- Currencies:

- USD: Steady growth and resilient inflation keep the US dollar attractive.

- NZD: The surprise rate cut is bearish for the New Zealand dollar, likely leading to downside pressure.

- EUR: Lackluster core inflation and moderate GDP may cap euro strength.

- Equities:

- US Stocks: Likely supported by strong consumer confidence and GDP growth.

- Global Markets: Weak data from Canada, Japan, and Australia may temper risk-on sentiment.

- Bonds:

- Safe-haven flows into bonds are likely to persist, particularly in economies showing weak growth signals like Japan and Canada.

- Commodities:

- Gold: May see mixed demand, balancing between a strong US dollar and safe-haven flows.

- Oil: Could face pressure as growth concerns in non-US markets weigh on demand expectations.

Conclusion

This week’s macroeconomic data highlights a mixed global economic environment. While the US remains a source of stability with resilient growth and consumer confidence, concerns about slowing growth in Canada, Japan, and parts of Europe suggest caution. Inflation trends indicate moderation in several regions, reducing the likelihood of aggressive tightening, but the divergence in growth trajectories adds complexity to market sentiment.

Overall Risk Sentiment: Cautiously Risk-Off, as global growth concerns overshadow the US’s relative resilience.