As we wrapped up April 2025, the Forex market delivered a powerful reminder that fundamentals still reign supreme. Between intensifying US-China trade tensions, sharp swings in equity markets, and safe-haven demand skyrocketing, traders navigated a rollercoaster of volatility.

This week’s recap breaks down the major currency moves, the underlying drivers behind them, and what to watch as we head into May. Whether you traded it profitably or found yourself whipsawed, there’s a lot we can learn from this week’s action.

1. Market Overview

Risk sentiment dominated the landscape over the past two weeks. The escalation of US tariffs on Chinese exports and new restrictions on technology transfers sent shockwaves through global markets. This uncertainty fueled a broad risk-off environment early in the week, favoring safe-haven assets, before temporary optimism around tariff exemptions pulled risk appetite back in midweek — only to fade again by Friday.

Currency markets, equity indexes, commodities, and even bond yields were all heavily influenced by these geopolitical crosswinds. Traders who stayed flexible and attentive to fundamentals had the edge.

2. Key Highlights

2.1 Currency Movements

The US dollar (USD) was under heavy selling pressure for most of the week. Risk aversion and falling US Treasury yields made the dollar less attractive, especially against traditional safe havens:

- EUR/USD surged above 1.1400 midweek, fueled by USD weakness and hopes that European exporters might benefit from new tariff exemptions.

- USD/JPY plunged below 143.00 as investors piled into the Japanese Yen, a classic risk-off currency.

- USD/CHF fell sharply, with the pair nearing recent cycle lows around 0.8150, reflecting broad-based weakness in the greenback.

Meanwhile, the Australian Dollar (AUD) defied the usual risk-off script, posting relative strength. Strong Australian employment data and hopes for improved commodity demand kept the AUD buoyant. On the flip side, the Swiss Franc (CHF), while still strong, underperformed slightly compared to JPY, highlighting nuances within safe-haven flows.

2.2 Impact of Equities and Volatility on Forex

Stock market volatility had a significant spillover effect on currencies this week. The Nasdaq experienced wild swings — surging over 12% midweek on optimism around possible tariff exemptions, only to retreat again as new trade restrictions reignited fears.

The VIX volatility index mirrored this pattern, spiking midweek before easing about 18% by April 15th. When the VIX eased, risk currencies like AUD and EUR got a temporary boost. However, underlying fragility in market sentiment kept safe-havens firmly in demand overall.

2.3 Commodities and Safe-Haven Flows

Gold was the clear winner this week, with prices skyrocketing to nearly $3,300 per ounce. This surge in the yellow metal reflects deepening investor fear and the rush toward safety amid trade war worries. Historically, strong gold often correlates with USD weakness — and this week was no exception.

Oil prices were also extremely volatile. Crude briefly dipped below $60 a barrel as recession fears gained ground. This turbulence weighed on commodity-linked currencies like the Canadian Dollar (CAD) and the Norwegian Krone (NOK), although the broader focus remained squarely on risk sentiment rather than oil supply fundamentals.

2.4 Fixed Income and Yield Movements

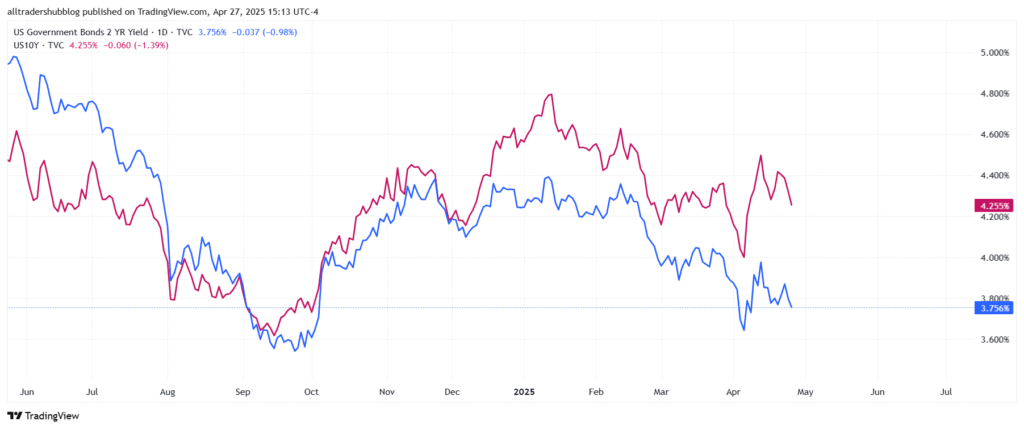

Treasury markets painted a clear picture of risk aversion:

- The 10-year US Treasury yield dropped sharply from around 4.48% to 4.32%.

- Short-term rates also fell, with the 2-year yield tumbling after the US announced new export restrictions.

Falling yields weaken the USD by reducing returns on dollar-denominated assets. It’s no surprise then that currency markets moved hand-in-hand with bond markets this week. Traders should note: in environments like these, monitoring Treasury yields can offer crucial early signals for Forex positioning.

3. Fundamental Drivers and Upcoming Events

3.1 Ongoing Macro Drivers

The 90-day tariff review period between the US and China has now extended into early July 2025. This ongoing uncertainty remains the dominant fundamental theme. Every headline around negotiations — whether positive or negative — is moving markets sharply.

For now, traders should expect continued headline-driven volatility, particularly during thin liquidity periods.

3.2 Key Economic Data to Watch

The upcoming week will be packed with major US data releases:

- Core PCE Price Index — the Fed’s preferred inflation gauge. Strong data could revive USD strength.

- Non-Farm Payrolls (NFP) — always a major market mover, particularly in an environment where economic health is in focus.

- ISM Manufacturing PMI — providing insight into economic momentum amid trade disruptions.

Positive surprises could give the USD a much-needed bounce, while disappointing numbers might accelerate the dollar’s recent decline.

3.3 Central Bank Events

The Bank of Japan (BoJ) will hold a critical policy meeting. While no major changes are expected, any shift in tone regarding inflation or stimulus measures could move the JPY sharply — especially given the currency’s sensitivity to global risk conditions right now.

3.4 Corporate Earnings Impact

Finally, earnings reports from giants like Alphabet, Intel, and Goldman Sachs will feed into broader market sentiment. Strong earnings could temper fears of a global slowdown, lifting equities and risk currencies. Weak earnings, however, could reinforce recession worries and boost safe-havens like the JPY, CHF, and gold.

4. Technical and Sentiment Insights

4.1 Market Structure and Liquidity

Technical traders found a rich environment this week. Liquidity hunts and market structure shifts were plentiful, especially around major news events. Watching how price reacted at key support and resistance zones often gave traders valuable clues about the next big move.

For example, clean sweeps of previous swing lows in EUR/USD and USD/JPY offered textbook liquidity grabs before reversals.

4.2 Fair Value Gaps and Balanced Price Ranges

More traders are leaning into ICT concepts like Fair Value Gaps (FVGs) and Balanced Price Ranges (BPRs) to navigate this volatility. These technical models help identify inefficiencies where price is likely to revisit — crucial information in a whipsawing market like this one.

In particular, watching FVGs on the 4-hour and daily charts provided excellent setups for traders looking to fade extremes in USD pairs.

Conclusion: What This Week Taught Us

This week was a powerful demonstration of how quickly fundamentals can overwhelm technical patterns in the Forex market. Trade tensions, risk sentiment, and Treasury yields were the true puppeteers behind currency moves.

At the same time, savvy technical traders who stayed flexible — focusing on liquidity sweeps, fair value gaps, and market structure shifts — found plenty of opportunities.

Looking ahead, traders should stay laser-focused on US economic data, central bank commentary, and any developments in the US-China saga. In a market this reactive, preparation and adaptability are the keys to success.